DIARY OF A PORTFOLIO MANAGER

September 5th, 2025

“Who can it be knockin' at my door?

Make no sound, tip-toe across the floor

If he hears, he'll knock all day

I'll be trapped, and here I'll have to stay”

Who Can It Be Now – Men at Work

Good afternoon,

It’s been a big week for labour numbers so I figured I would highlight the band above.

made some reference to the degenerate economy a while ago and people seemed to understand the reference. At the same time, highlighted how the stocks that rank among the ‘bottom’ of our quantitative stock rankings have led off the lows. This is not unprecedented as usually what get beaten up the most in a downturn leads in a subsequent sharp rally. t is also not sustainable. The ‘junk’ rally have heard referenced on podcasts is visualized in two charts below.

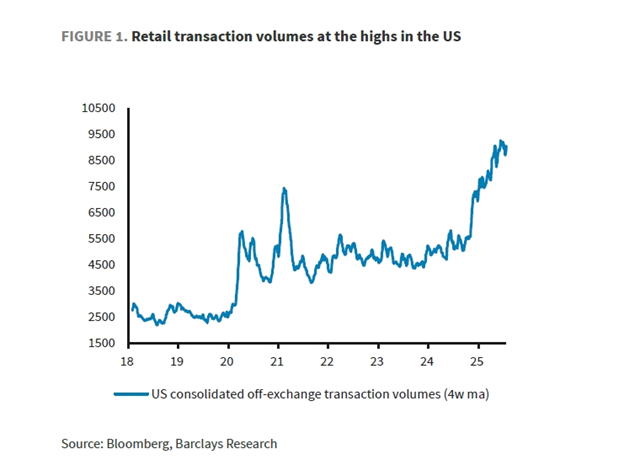

Retail investors are buying the hot stocks while institutions are staying pat.

Stocks that are not profitable are outperforming those that make money? The index buys indiscriminately but I prefer to focus on cash flow and valuation.

September seasonality

Since 1928, September has been the S&P 500’s weakest month, with an average monthly decline of 1.2%, underperforming all other months. September returns were also negative 55% of the time over this period. Similar seasonal patterns are also seen in the U.K. and Canadian markets. Given this historical seasonality and with earnings catalysts largely behind us, market participants are likely to turn their attention towards economic data, monetary policy signals, and policy developments out of the White House. Beyond short-term seasonality, however, corporate earnings fundamentals continue to look solid and remain the long-term foundation for equity markets.

Watching the U.S. data

Signs of continued softening in the U.S. labour market have pulled forward market expectations for a Federal Reserve rate cut to as early as this month. July’s underwhelming jobs report was accompanied by large downward revisions to the prior two months’ figures. At the same time, inflation remains above the Fed’s 2% target, with some indicators suggesting that price pressures could flare up again. The backdrop means Fed policymakers will need to navigate a delicate balancing act between supporting growth and price stability. Growing optimism for monetary easing has helped bolster equity markets since the Fed’s Jackson Hole symposium in late August, making upcoming jobs and inflation data crucial in shaping the outlook for interest rates.

Bond markets

While short-term Treasury yields in the U.S. have fallen on rate cut expectations, long-term yields have risen, resulting in a “steepening” of the yield curve. Several factors have likely contributed to this dynamic, including concerns around the U.S. budget deficit and the Trump administration’s rhetoric that raised questions around central bank independence.

Higher long-term bond yields have been a global phenomenon, with 30-year government bond yields in several major developed nations (U.K., Germany, France, Japan) recently reaching their highest levels in over a decade. A common thread behind the upward pressure on long-term yields is elevated budget deficits, as many governments face increasingly complex fiscal tradeoffs, balancing political priorities, defense spending, and industrial policy for strategically important industries with the need for fiscal restraint to maintain credibility in public finances and investor confidence.

Takeaways?

Resilient corporate earnings and optimism over potential Fed rate cuts have helped support global equity markets, allowing them to extend gains despite a tepid economic growth environment. But with September’s historical tendency towards weakness and valuations that appear to reflect an upbeat outlook, we believe “invested, but watchful” remains a sensible posture for portfolios as we continue to monitor economic data, earnings trends and global bond yields.

Should you have any questions, feel free to reach out.