DIARY OF A PORTFOLIO MANAGER

May 3, 2024

Good day,

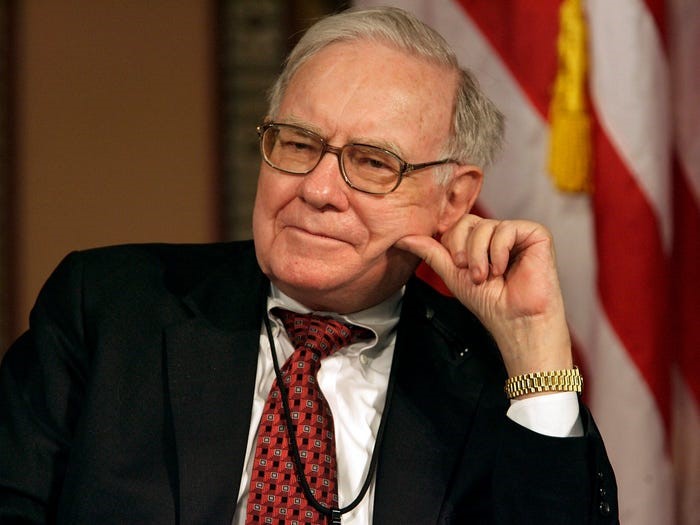

Tomorrow is the Big Day – Berkshire Hathaway Annual General Meeting in Omaha

It’s also May the 4th for all you Star Wars fans…

I highly recommend that anyone with a slight interest in wealth creation, long term planning and investing in good businesses (which, in my opinion, should be every adult) tune in to CNBC or online tomorrow to watch the live AGM. It’s about 7 hours so a bit of a haul. I plan to record it and watch a bit at a time over the weekend. I cannot sit in one place for 7 hours. Anyone in your world under 30 should also be encouraged to tune in. The material is presented in a very digestible manner. Some good life lessons. It is interesting to me that he outlines the keys to investment success in easy language (don’t try to time the market & ignore short term ‘news’ are two that come to mind) and many investors do the opposite.

In years past, I have attended in person and the whole weekend is an experience that I cannot describe in words.

I don’t have any notes on the meeting as it has not yet occurred (obviously) but found a nice preview in the Financial Post this morning and posting it below:

'Weepy for some': Berkshire devotees head to Omaha for first AGM without Munger

Warren Buffett's business partner and right-hand man, died in November, just months shy of his 100th birthday

There will be a noticeable void on stage when Berkshire Hathaway Inc. devotees gather in Omaha, Neb., on Saturday for its annual meeting.

The meeting is Berkshire’s first since Charlie Munger, Warren Buffett’s long-time business partner and right-hand man, died in November, just months shy of his 100th birthday. Munger’s appearances alongside Buffett, 93, had helped draw crowds of thousands eager to hear him opine in his blunt and witty style on investing, philosophy, human foibles, corporate excesses and more.

“Without Munger, it may be a somber start, especially for those who have owned the stock and been coming to Omaha for decades,” Jim Shanahan, an analyst at Edward D. Jones & Co. LP, said. “You could see it being kind of weepy for some people.”

Buffett and Munger transformed Berkshire from a failing textile mill into a US$862-billion behemoth spanning industries including insurance, energy and railroads — making it a closely watched proxy for U.S. economic health.

The company will report first-quarter results before the meeting kicks off on Saturday, with analysts predicting its collection of insurance businesses and a robust economy will help boost profit. Operating income may jump 10 per cent from a year earlier, when it totaled US$8.07 billion, according to Bloomberg Intelligence.

“Earnings will be strong,” Bill Smead, chief investment officer at Smead Capital Management Inc., said. “When Main Street does well, the operating businesses at Berkshire do extremely well.”

Insurance boost

This time around — and without Munger — Buffett will be joined on stage by his anointed heir apparent, Greg Abel, 61, who runs all non-insurance operations, and Ajit Jain, who oversees Berkshire’s insurance businesses.

Those businesses may post a 40 per cent jump in earnings on better underwriting results and higher yields, according to Bloomberg Intelligence. In particular, Government Employees Insurance Co.’s underwriting margins may improve substantially on earned rate increases and more favorable claims frequency, UBS Group AG analysts said in a note to clients last month.

Jain dubbed the auto insurer a “work in progress” at last year’s annual meeting after it swung to profitability following a string of consecutive losses.

“GEICO will be a candidate for some questions,” said Shanahan, noting the insurer has been losing ground to rival Progressive Corp. “The return to profitability is significant, but on the other hand, people will want to know about its outlook after it lost market share and slashed headcount — and whether it will ramp up spending.”

Wildfires, litigation

Buffett, Abel and Jain can expect to field as many as 60 questions during the meeting at the CHI Health Center Arena in downtown Omaha. Among them will probably be queries about climate risks and wildfire exposure, as Berkshire’s PacifiCorp utility faces liability claims from Oregon blazes in 2020 that could run into the billions of dollars.

In Buffett’s most recent letter to shareholders, he warned that he no longer views investments in western utilities as safe given their exposure to wildfire liability claims and acknowledged making a “costly mistake” by not anticipating the surge in these expenses.

Other units have also faced litigation that may invite questions: Berkshire’s real estate brokerage HomeServices of America Inc. recently struck a US$250-million settlement agreement in a lawsuit taking aim at agent commissions industrywide. Just this week, it was hit with a fresh complaint from a group of homebuyers accusing the brokerage of inflating compensation to agents.

Economic barometer

Buffett has long identified his vast business empire as a barometer for U.S. economic health — and investors will look for forecasts for the economy this time. Last year, he predicted the majority of Berkshire’s businesses would report lower earnings as an “incredible period” for the U.S. economy draws to an end. The company then went on to report fourth-quarter operating earnings of US$8.48 billion, up from US$6.63 billion a year earlier.

“Though that largely didn’t come to pass, we’d expect a similar message this year,” Bloomberg Intelligence analysts Matthew Palazola and Eric Bedell said.

BNSF Railway Co. may post flat revenue growth as lower fuel surcharges offset a rebound in carload volume and wage inflation bites, they said. Inflation and higher rates may also weigh on Berkshire’s manufacturing, service and retailing businesses, though those operations have proven resilient.

In recent years, the conglomerate has struggled with a high-class problem: a surplus of cash and nothing to spend it on as elevated public-market valuations deprived the billionaire investor of acquisition targets. Higher interest rates will have taken some pressure off holding that cash, according to Shanahan.

The firm’s cash pile jumped to a record US$167.6 billion at year-end, and analysts predict it could be even higher when Berkshire reports results on Saturday.

“There’s so much money sloshing around out there because of the money the Fed has pumped into the system, making valuations even tougher,” Smead said. “Buffett is going to hold that cash position until people get negative about stocks.”

Munger tribute

The Omaha event — dubbed the “Woodstock for Capitalists” — distinguishes Berkshire’s gathering from most other companies’ annual meetings. The day is typically a showcase for Berkshire’s many holdings — booths handing out See’s Candies, toy trains mimicking Berkshire’s railroad — as well as hours of commentary.

Buffett will likely again pay tribute to Munger’s role in creating the sprawling company. In his February annual letter, he called him the “architect” of the company and referred to himself as the person “in charge of the construction crew.”

Things won’t be the same without Munger.

“It will be way less fun,” Smead said. “Munger’s sense of humor and wisdom were always the highlights of the meeting.”

If you do watch the AGM and want to compare thoughts next week, please reach out.

Have yourself a great weekend,