DIARY OF A PORTFOLIO MANAGER

June 28, 2024

HAPPY CANADA DAY!

Good day,

It's hard to believe, but we have reached the year’s midway point.

Let’s reflect on this year’s developments and share some thoughts on the outlook. I also want to highlight the Global Insight Mid-Year Outlook, published by some of the thought leaders across our firm. The special report on U.S. debt is particularly thought-provoking. If you are having trouble sleeping this weekend, perhaps you can peruse the whole piece.

There has been encouraging progress on inflation this year, albeit with different regions seeing different rates of decline. Yet, services inflation has remained sticky throughout most of the developed world thanks to wage growth, resilient demand, and shelter-related costs. Even so, fading pressures have allowed a few central banks to begin cutting rates, while others, like the U.S. Federal Reserve, suggest cuts remain a possibility later this year.

On the growth front, things have been arguably better than anticipated, given many investors were expecting a recession to have already begun in various jurisdictions. The manufacturing sector has been generally weak, offset to a large degree by the services side of the economy. The consensus view is that a soft landing, where the economy slows but avoids a material deterioration in employment, is now more likely for many economies.

The backdrop above has driven global equity markets higher this year, with the U.S. leading the way. But, as has been the case for some time, U.S. gains have been heavily influenced by large-cap technology. More specifically, anything related to artificial intelligence. This momentum may continue for some time, but a few things warrant attention.

The U.S. market has become more expensive over the past year. While valuations are more reasonable if one excludes the large “tech” stocks that have led markets, they still sit above historical averages. That may have bigger implications over the longer-term than it does for the rest of the year. Meanwhile, my confidence in the sustainability of a bull market is usually highest when gains are driven by a broad range of stocks and sectors. That hasn’t exactly been the case this year, though there is always the possibility that market leadership could broaden and shift to other sectors. Investor sentiment isn’t overly optimistic yet, which can often be the case near market peaks, but it is more positive than it was a year ago. This suggests that there is a growing risk of some investor complacency. Most importantly, the risk of recession remains above average based on various factors. As a result, the range of possibilities for equities is wider than normal despite the market strength to date.

Outside the U.S., and “tech” in particular, equity markets sit at valuation levels that are more balanced, reflecting some of the economic headwinds that exist in parts of the world. On the fixed income front, yields remain attractive, and higher quality bond exposure can act as a stabilizer in portfolios in the event equity market volatility returns. Overall, our approach to managing portfolios remains a bit more cautious at this time given the range of potential outcomes. We remain committed to regular rebalancing to mitigate the risk of overexposure to any one market or sector’s idiosyncrasies. I also want to be aware of the danger of chasing the hot sector as that usually leads to less than desirable outcomes.

Here is a piece from our strategy group on Canadian productivity (if I haven’t lost you already)…

Challenges facing slowing Canadian GDP growth

The global economic growth backdrop has shown signs of improvement, though growth remains modest and developments continue to diverge across countries. In Canada, economic growth resumed in Q1 after stalling in the second half of 2023, albeit slower than expected at a 1.7% q/q annualized pace. Accounting for a rapidly growing population, per-capita GDP has declined in six of the past seven quarters to levels last seen in 2016. We highlight some of the challenges facing Canada’s slowing GDP growth and discuss why BoC rate cuts may not immediately spur a rebound in Canadian economic activity.

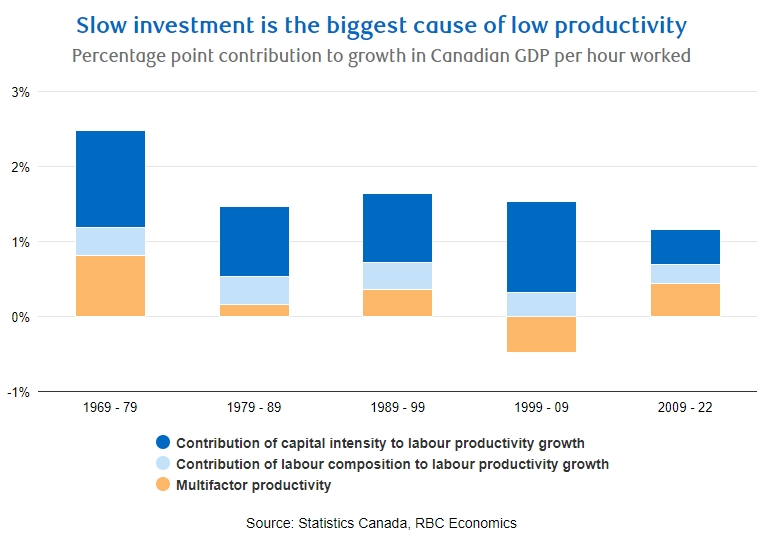

Slow investment a root cause of low productivity in Canada.

Canadian businesses invest substantially less compared to those in the U.S. – about half as much per worker in aggregate. Part of the slowing in investment has been from a pullback in the Canadian oil and gas sector that is tied to the ongoing energy transition away from fossil fuels. Moreover, Government policies tend to favor small businesses over growth of large enterprises, which has limited Canada’s overall economic activity. (see exhibit below)

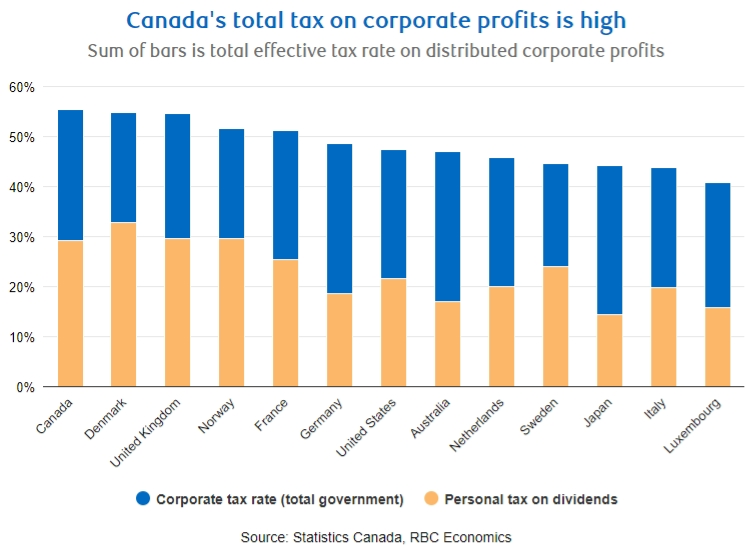

Canada’s corporate taxes are highest among developed nations

Canadian corporate tax rates are comparable to other developed economies, but after accounting for the tax on company dividends at the personal income tax level, the total tax on distributed profits from Canadian companies is the highest in the G7, according to the OECD (see exhibit below). Moreover, governments in Canada have been running larger budget deficits which raises the risk of further tax hikes in the future. Accordingly, this increases uncertainty for businesses thinking about expanding into Canada.

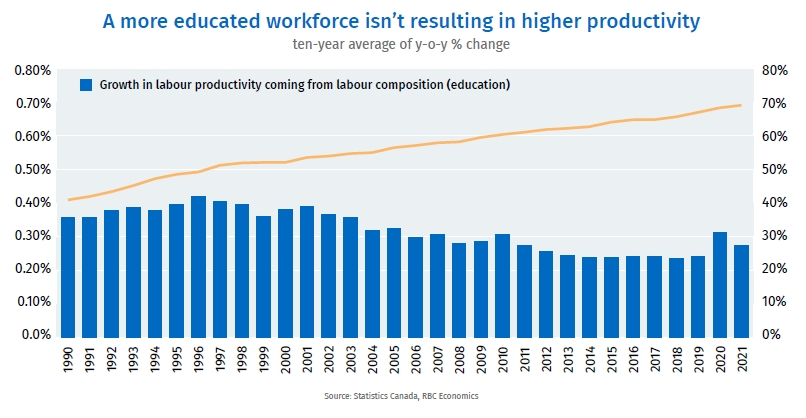

Higher education hasn’t yet to translated into higher productivity

The share of the Canadian workforce with completed post-secondary education has increased from 41% in 1990 to 70% in 2023. However, Canada’s high investments in human capital has yet to translate into an acceleration in productivity growth from the quality of labour, which raises questions on whether Canadian businesses are capitalizing on its highly educated workforce (see exhibit below).

Canada’s per-capita GDP continues to underperform the U.S.

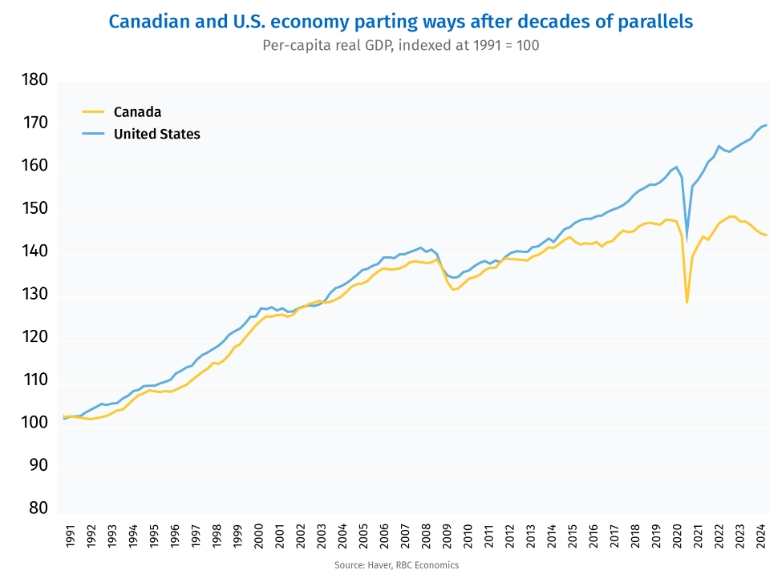

Economic performance between the U.S. and Canada has generally been in sync due in part to their close relationship. More recently however, Canada’s economy has started to persistently underperform. Compared to 2019, Canadian per-capita real GDP as of Q1 this year fell short of the U.S. by 10% - the largest gap since 1965 (see exhibit below). RBC Economics noted the divergence in domestic services demand and government spending has underpinned the growing gap in output and inflation between Canada and the U.S.

Interest rates are still elevated despite projected BoC rate cuts

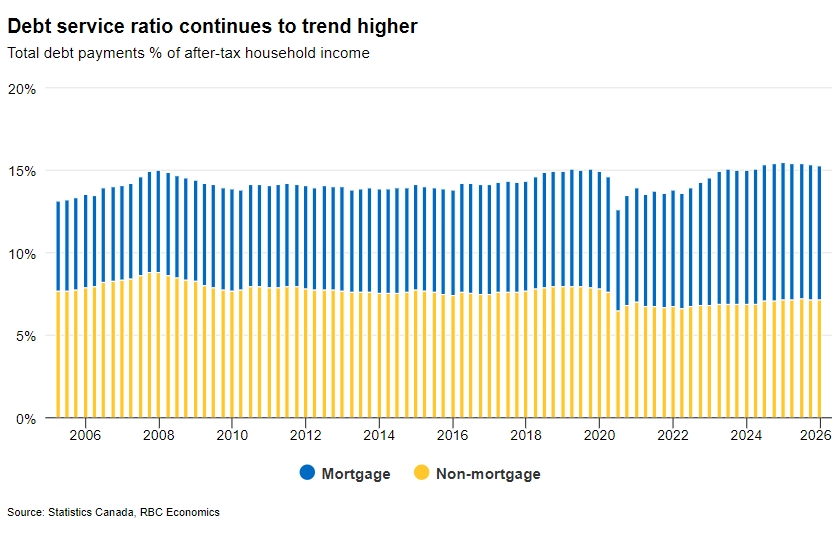

The key Canadian overnight rate is at 4.75% today, well above the 2.25% to 3.25% range that the BoC estimates would have a neutral impact on the economy. RBC Economics anticipates another 75 basis points of BoC cuts this year, but that will still leave interest rates above neutral levels and will likely subtract from economic growth. Moreover, Canada’s debt service ratio continues to trend higher (see exhibit below), which highlights Canadian households are increasingly feeling the strain of elevated borrowing costs.

Canada’s mortgage renewal payment hikes will stretch into 2025

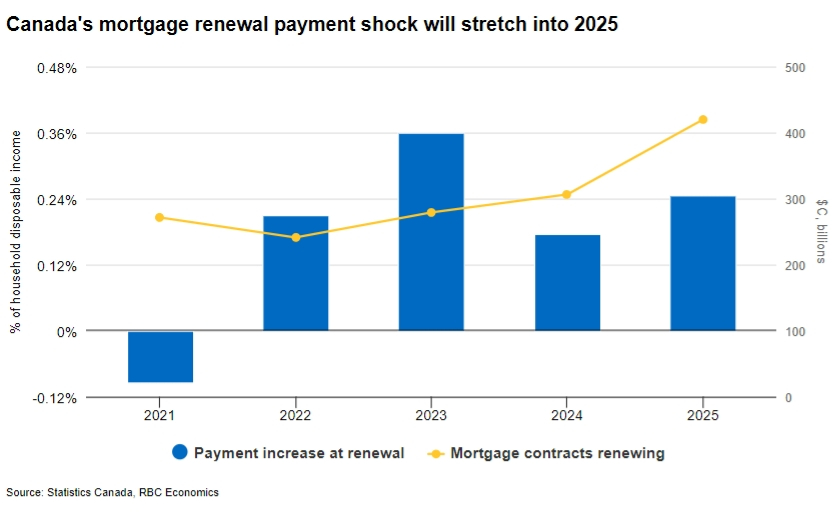

Roughly $200 billion in four and five-year fixed rate mortgages are expected to come up for renewal in 2024, with another $275 billion in 2025. Almost all of those will renew at higher interest rates which are expected to keep debt payments rising in the near term even as interest rates begin to fall. Have yourself a great long Canada Day weekend,

Have yourself a great long Canada Day weekend,