DIARY OF A PORTFOLIO MANAGER

July 26, 2024

Good day,

As a kid, I spent a lot of time in Alberta and always felt a connection there. The reason is my Dad’s family is there and that’s where he was born and raised. Jasper was always a special place. With that in mind, our thoughts go out to those that have been impacted by recent wildfires, in particular those in Jasper National Park. What else is on my mind this week?

SECTOR ROTATION

On the investing front, it has been an eventful few weeks. The Bank of Canada cut interest rates for the second consecutive time. Meanwhile, global equities have been weaker, driven by a classic sector rotation rather than broad market weakness. More specifically, large-cap technology stocks have sold off, while other sectors and smaller stocks have seen gains. In some ways, this development has been overdue and may be a healthy shift as “tech” has dominated market returns for a long period of time.

There are a few catalysts driving the rotation. First, the increasing probability of a U.S. Federal Reserve rate cut in September, which may benefit rate-sensitive and cyclical sectors, such as housing and construction. Additionally, the second-quarter earnings season is also well underway, and expectations for “tech” have left little room for disappointment. Unfortunately, updates from a few high-profile tech companies were not well received by investors. The concern has not necessarily been the earnings reports themselves, but rather the significant sums being spent on artificial intelligence-related research and development, and growing scrutiny around the future returns on those investments.

U.S. ELECTION

Financial markets have not responded too strongly to the historic events that have unfolded in Washington over the past few weeks. However, the appointment of Vice President Kamala Harris as the Democratic nominee, set to be made official at the party’s national convention next month, has introduced new uncertainty with respect to the outcome of the November elections.

Markets tend to focus on policy and priority differences among the parties, the likelihood of meaningful legislation being passed, and any potential impact on the country’s growth and fiscal position. While the potential President-elect understandably gets the lion’s share of media attention, congressional elections are also important. The U.S. Congress is deeply involved in making new legislation and changing existing ones, and the president must sign its bills in order for something to become law. Therefore, Congress shares authority over financial and budgetary policy and national defense, among other federal government functions. It also has extensive investigative powers over government agencies that the president controls and can initiate special inquiries involving the president and other officials.

Currently, of the two chambers of Congress, the Democratic party controls the Senate, and Republicans control the House of Representatives, both with razor-thin margins. This configuration is often referred to as “gridlock” or “divided government” because passing meaningful legislation becomes more challenging, as laws must pass both chambers and be signed by the president to be enacted. Gridlock has been much more common in recent decades. Since 1953, one party has controlled both chambers of Congress and the presidency only 37% of the time, compared to 85% of the time from 1900-1952.

We will be paying close attention to the elections to get a better sense of any major policy shifts and their implications for future growth and government debts and deficits. Given the unpredictable nature of the election thus far, it is premature to make any real assessments at this juncture. Your investment team will act accordingly as we gain greater clarity. In the meantime, I continue to digest the earnings season that is taking place. That is really what counts down the road – earnings and fundamentals of owning good quality businesses.

Challenges facing slowing Canadian GDP growth

The global economic growth backdrop has shown signs of improvement, though growth remains modest, and developments continue to diverge across countries. In Canada, economic growth resumed in Q1 after stalling in the second half of 2023, albeit slower than expected at a 1.7% q/q annualized pace. Accounting for a rapidly growing population, per-capita GDP has declined in six of the past seven quarters to levels last seen in 2016. We highlight some of the challenges facing Canada’s slowing GDP growth and discuss why BoC rate cuts may not immediately spur a rebound in Canadian economic activity.

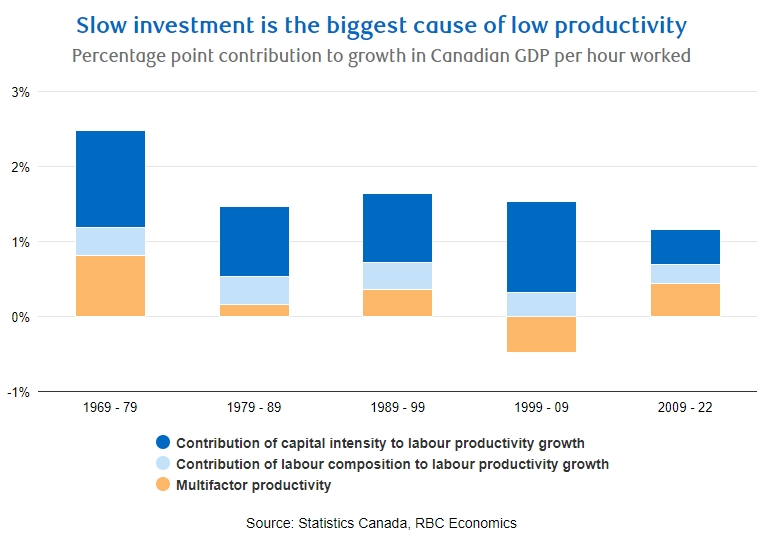

Slow investment a root cause of low productivity in Canada

Canadian businesses invest substantially less compared to those in the U.S. – about half as much per worker in aggregate. Part of the slowing in investment has been from a pullback in the Canadian oil and gas sector that is tied to the ongoing energy transition away from fossil fuels. Moreover, Government policies tend to favor small businesses over growth of large enterprises, which has limited Canada’s overall productivity gains (see exhibit below).

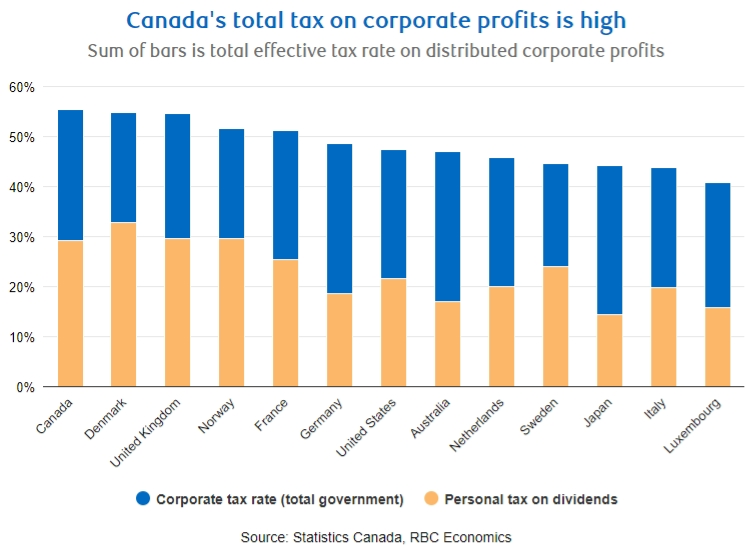

Canada’s corporate taxes are highest among developed nations

Canadian corporate tax rates are comparable to other developed economies, but after accounting for the tax on company dividends at the personal income tax level, the total tax on distributed profits from Canadian companies is the highest in the G7, according to the OECD (see exhibit below). Moreover, governments in Canada have been running larger budget deficits which raises the risk of further tax hikes in the future. Accordingly, this increases uncertainty for businesses thinking about expanding into Canada.

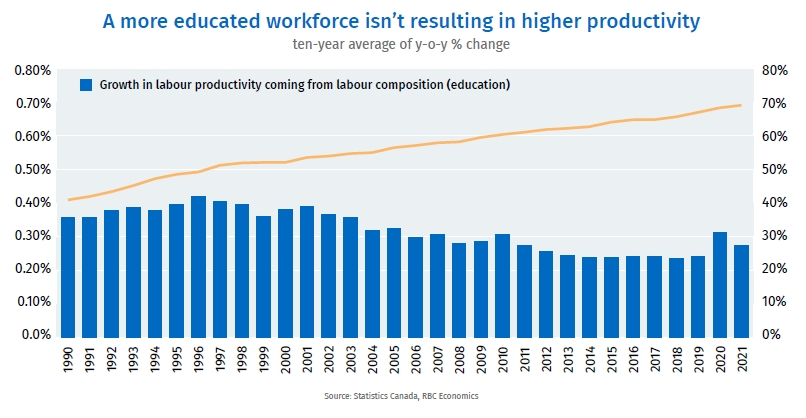

Higher education hasn’t yet to translated into higher productivity

The share of the Canadian workforce with completed post-secondary education has increased from 41% in 1990 to 70% in 2023. However, Canada’s high investments in human capital has yet to translate into an acceleration in productivity growth from the quality of labour, which raises questions on whether Canadian businesses are capitalizing on its highly educated workforce (see exhibit below).

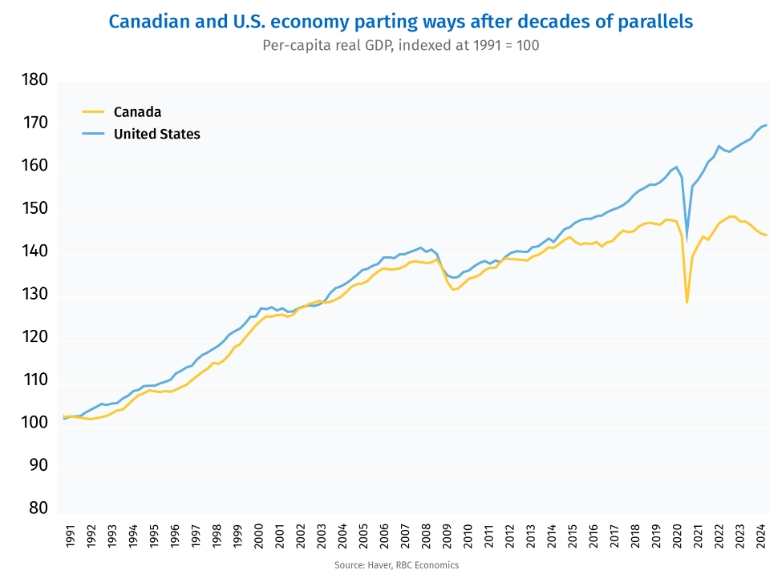

Canada’s per-capita GDP continues to underperform the U.S.

Economic performance between the U.S. and Canada has generally been in sync due in part to their close relationship. More recently however, Canada’s economy has started to persistently underperform. Compared to 2019, Canadian per-capita real GDP as of Q1 this year fell short of the U.S. by 10% - the largest gap since 1965 (see exhibit below). RBC Economics noted the divergence in domestic services demand and government spending has underpinned the growing gap in output and inflation between Canada and the U.S.

Interest rates are still elevated despite projected BoC rate cuts

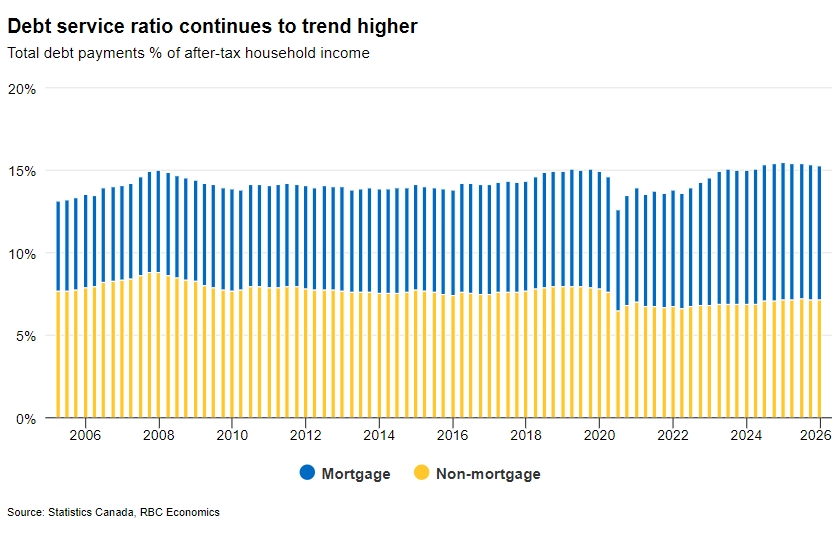

The key Canadian overnight rate is at 4.75% today, well above the 2.25% to 3.25% range that the BoC estimates would have a neutral impact on the economy. RBC Economics anticipates another 75 basis points of BoC cuts this year, but that will still leave interest rates above neutral levels and will likely subtract from economic growth. Moreover, Canada’s debt service ratio continues to trend higher (see exhibit below), which highlights Canadian households are increasingly feeling the strain of elevated borrowing costs.

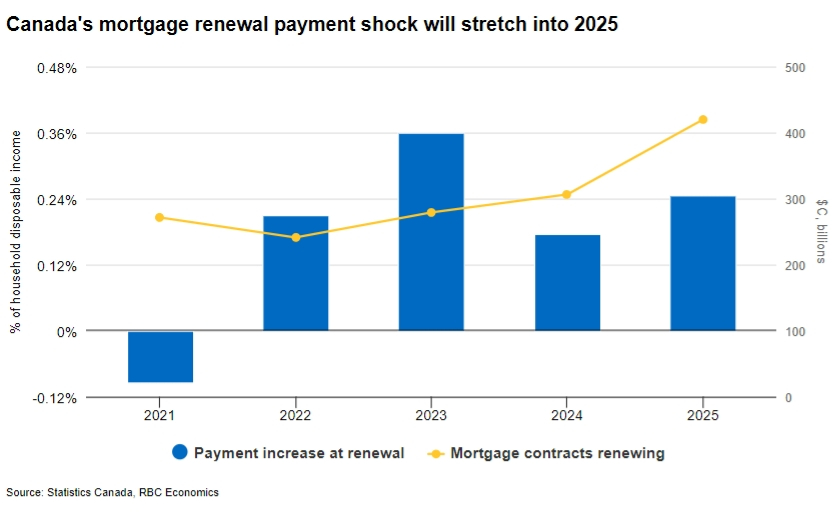

Canada’s mortgage renewal payment hikes will stretch into 2025

Roughly $200 billion in four and five-year fixed rate mortgages are expected to come up for renewal in 2024, with another $275 billion in 2025. Almost all of those will renew at higher interest rates which are expected to keep debt payments rising in the near term even as interest rates begin to fall. Have yourself a great weekend,

Have yourself a great weekend,