As part of the estate planning process, individuals will often consider establishing a joint account with their spouse, adult children or other family members. Sometimes, this is done as a tool for expediency so that a joint account holder can help to manage the account, or to make the assets immediately available to the surviving account holder(s) upon the death of the first joint account holder. In other cases, a joint account is a planning technique used as part of a strategy recommended by an individual’s legal and tax advisors to seek to minimize probate tax.

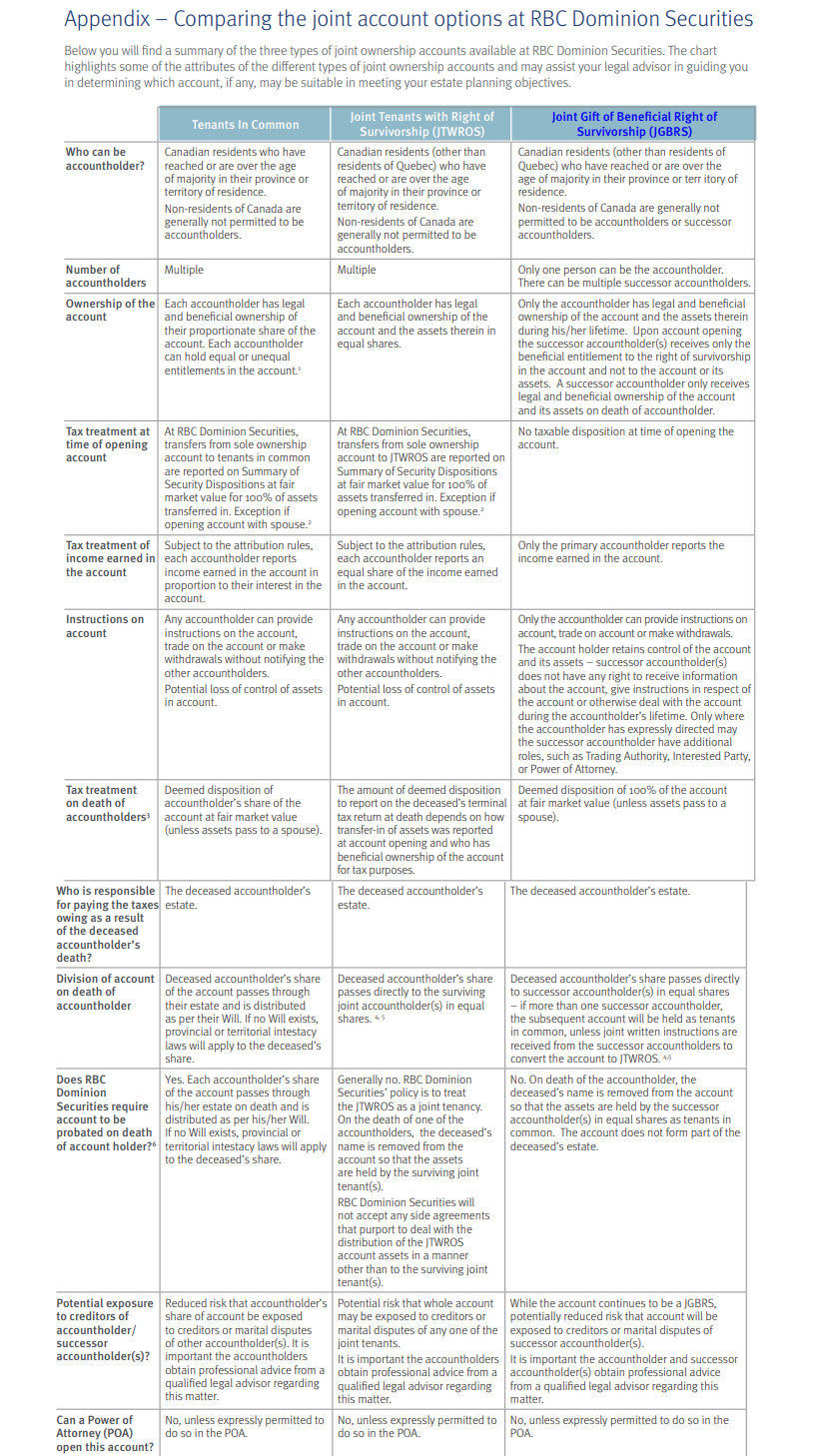

Whatever the motivation behind the account, before you open a joint account, it is important to be aware of the different joint account types available at RBC Dominion Securities Inc., how these different joint account types operate, and the resulting potential benefits and considerations for each joint account type.

In addition to the typical joint accounts, we offer the Joint Gift of Beneficial Right of Survivorship (JGBRS Account).

Where our clients have seen the most benefit:

- No deemed disposition upon opening

- Transfer to successor(s) only happens upon death

- Control and privacy is maintained during the lifetime, if chosen

- Saves time, cost and the intended future recipients receive the proceeds quickly and efficiently

- Helps start future wealth transfer conversations early with their loved ones

- No probate so the client(s) can maintain their privacy

- Great option for widowers, common-law or divorcees

Click the link below for a printable summary:

Joint Ownership Accounts at RBCDS

To learn more, reach out to Stephanie Woo at 604.257.3234 or stephanie.woo@rbc.com and

she will provide you with personalized advice and review these options with you.