Economic growth continues to downshift

Global growth slowed in the past quarter, extending a trend that began at the start of 2018. Manufacturing weakness has been the main cause of the slowdown as services have experienced only a minor deceleration and consumption has held up reasonably well. Other factors hindering economic growth have been the elevated uncertainty from protectionism and Brexit, fading fiscal stimulus and the slowing Chinese economy. Although central banks are attempting to offset some of these negatives by cutting interest rates, we note that the economic boost from each individual rate cut is fairly small. Weighing the positives and negatives, we look for slower growth in 2019 versus 2018, and for a further deceleration in 2020 in both developed and emerging markets. Our forecasts were downgraded modestly from last quarter and they are now in line with the consensus for 2019 and modestly lower for 2020.

Where do we go from Here?

Downside risks are mounting, but we should also consider the possibility of upside surprises

On the trade front, several new rounds of U.S.-China tariffs have been announced and there are a number of ways the trade war could unfold. While the U.S. election in 2020 could encourage a resolution, the most likely scenario is that the tariffs announced so far are fully implemented and that the U.S-China relationship does not improve. Such a negative scenario would subtract a cumulative 0.60% to 0.80% from U.S. GDP and 0.75% to 0.95% from Chinese GDP over the next several years. Other downside risks include the deteriorating geopolitical environment, Brexit and various debt hot spots. Offsetting these are the potential for fiscal stimulus and improved productivity growth, which could represent sources of upside for economies.

U.S. business cycle is late and advancing

The economic expansion is mature and is now officially the longest on record. While business cycles don’t die of old age, we should recognize that the longer an expansion lasts the more likely it is to stumble. Other signs suggesting that we are in the later stages of the business cycle are an extremely low unemployment rate and yield curves that are inverted. While yield-curve inversions don’t by themselves guarantee that a recession is coming, they tend to coincide with an increased risk of an economic downturn six months to two years into the future.

U.S. dollar buoyed in the near term, but we expect a weaker greenback to emerge

Most policymakers today prefer weaker currencies to stimulate their domestic economies and President Trump has been quite vocal in expressing this view for the U.S. dollar. However, tariffs have been relatively more damaging for non-U.S. markets, weakening global currencies and pushing the U.S. dollar higher against Trump’s wishes. While trade tensions act to temporarily extend the U.S. dollar’s topping process, we do think the greenback will eventually be weighed down by longer-term factors such as twin deficits and narrowing yield differentials. Over the next 12 months, we expect an environment of higher volatility, where the euro and yen outperform the loonie and pound.

A monetary easing cycle gets underway

Central banks have now pivoted to monetary stimulus in a synchronized fashion, with some having already delivered rate cuts and others hinting at easing measures to come. The U.S. Federal Reserve cut interest rates by 25 basis points in July, China and India have also eased, and the European Central Bank has indicated action is imminent. This monetary stimulus should be seen as supportive for economies and risk assets, but we recognize that the capacity for easing is limited. The futures market suggests that the Fed may cut as many as four more times over the next year, while our own forecast is for three.

IMPLICTATIONS

Economy/Markets Face meaningful challenges. Trimming equity overwEight/increasing cash reserve

- Leading indicators of global growth have extended their decline and the majority of the world’s PMIs are now below 50 suggesting a broad-based deceleration in economic activity. Escalating trade tensions, slowing Chinese growth and uncertainty related to Brexit are all factors weighing on economies, but central banks are offering support in the form of monetary stimulus. We have lowered our economic growth forecasts slightly and, while we don’t see a recession over our one-year forecast horizon, we recognize that downside risks have increased.

- The longest streak of uninterrupted U.S. growth is showing its age. Diminished economic slack and low unemployment rates suggest little room for upside surprise. Moreover, the U.S. yield curve, a reliable indicator of past recessions, is inverted and financial market volatility has appropriately increased against this backdrop. Overall, our assessment is that the U.S. expansion is in its later stages with an increasing possibility that the end of the cycle is near, although we still weight the probability below 50% for the year ahead.

- Consistent with an end-of-cycle narrative is the fact that many global central banks are now actively cutting interest rates and/or have hinted that further monetary easing is forthcoming. The U.S. Federal Reserve cut interest rates by 25 basis points at the end of July as insurance against mounting trade tensions and slowing growth outside the U.S. We expect the Fed will deliver several more rate cuts over the year ahead. In Europe, the central bank hinted at pushing interest rates further into negative territory and possibility resuming quantitative easing. All this monetary stimulus should ultimately provide a boost to growth, but history suggests it could take some time before the impact from rate cuts is felt by the economy.

For Equities Markets:

- Equity markets encountered volatility following a strong start to the year and performance has been much more varied over the summer. Developed market equities have declined slightly but still feature double digit gains year to date. Increasing trade tensions appear to be taking a larger toll on emerging markets, however, with EM equities having erased year-to-date gains and are trading near their 2018 lows. According to our models, U.S. equities are hovering close to fair value but non-U.S. markets offer relatively attractive risk premiums.

- Shifting investor sentiment has been the main source of market volatility and renewed earnings growth is a pre-condition to higher prices. S&P 500 profits have seen little to no growth in 2019 as compared to the 20%+ gains from 2018 supported by tax cuts and stronger economic growth. Looking ahead, the consensus of analyst expectations indicates relatively flat earnings for the remainder of 2019, but a re-acceleration into 2020. In an environment of low interest rates and inflation and reasonable valuations even moderate corporate profit growth should ultimately be sufficient to push stocks higher. However, should economies enter recession and/or the trade situation escalates into a full-blown trade war, both the profit pool and valuations would likely decline and lead to materially lower prices.

For Fixed Income Markets:

- Bond yields plummeted to record levels in the past quarter, reflecting slowing growth, increasing downside risk to the economy and dovish central banks. German bund yields of all maturities up to 30 years are now below zero and more than US$16 trillion of global fixed-income assets are trading with negative yields. The U.S. 30-year yield fell below 2.00% to its lowest level on record and the 10-year Treasury yield is approaching its 2016 low. Our global sovereign-bond composite situates yields at their lowest level ever relative to our modelled estimate of equilibrium and suggests valuation risk is elevated everywhere, particularly outside North America.

For Asset Mix:

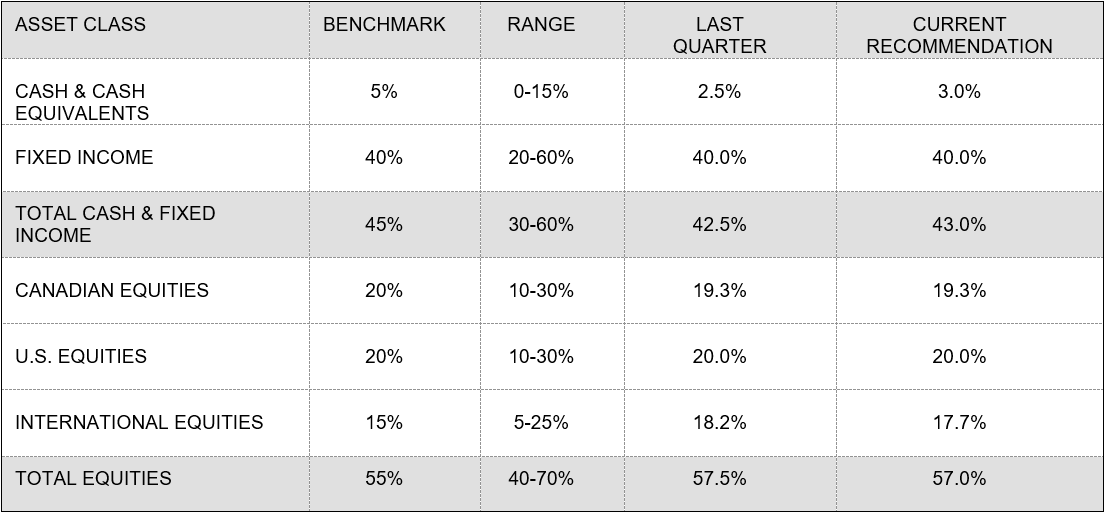

- Our base case is for the economy to continue expanding at a moderate pace but our scenario analysis places a higher-than-normal chance of recession and a bearish outcome for risk assets. We also recognize that bond yields are extremely low and that prospective returns in fixed income are quite unattractive. Equities continue to offer superior total-return potential versus bonds over the longer term and we continue to favour stocks over bonds in our asset mix. Recession odds are now higher than they have been at earlier points in the cycle, so we feel it is appropriate to move further along the path of de-risking our portfolios that we have been following as the cycle has matured. We lowered our equity weight by half a percentage point this quarter, placing the proceeds to cash. Our current recommended asset mix for a global balanced investor is 57.0% equities (strategic: “neutral”: 55%), 40.0% bonds (strategic “neutral”: 43%) and 3.0% in cash.

How We Are Positioned To Take Advantage Of This Outlook:

Global Asset Mix:

Dialing back equity overweight, raising cash reserve

The macroeconomic outlook is murky, the business cycle is aging and U.S. equity valuations are not as attractive as they have been at earlier points in the cycle. We have increased our odds of recession to approximately 40% within the next year, high by any standard, but still not our central outcome. We continue to expect stocks to outperform bonds over the longer term and remain overweight equities and underweight fixed income as a result. However, we don’t feel that this is the time to be running substantial risk positions. We have trimmed exposure to stocks again this quarter by half a percentage point, moving the proceeds to cash. To reduce our equity weight any further we would have to have a higher conviction that a recession will unfold. For a balanced, global investor, we currently recommend an asset mix of 57.0% equities (strategic neutral position: 55%) and 40% fixed income (strategic neutral position: 43%), with the balance in cash.

Geographic allocations are as follows:

- Canada 19.3%

- United States 20.0%

- International 17.7%

Risk / Reward to our Strategy

Extraordinarily low bond yields stoke valuation concerns

Global sovereign bonds have extended their rally and our valuation models are signaling caution as yields declined to record lows. German bund yields fell below zero across all maturities and the total size of negative-yielding debt across the globe has ballooned to over US$17 trillion. According to our valuation models, yields have fallen through the bottom of their equilibrium channels in all major markets including North America. Even in markets where yields remain positive, real yields (i.e. the nominal yield minus inflation) have fallen below zero indicating that investors are accepting a guaranteed loss in purchasing power should they hold their sovereign fixed-income investments to maturity. Slower economic growth and aging demographics may be depressing real interest rates, but we don’t think negative real rates are sustainable indefinitely. The pressure on real rates over time will likely be higher and, for this reason, the possibility of a bond bear market, in which returns are low or even negative as yields rise for many years, cannot be dismissed.

Earnings will be critical to sustaining higher stock prices

Global equities rallied in June and July, but stumbled in August as trade tensions escalated between the U.S. and China. The MSCI Emerging Markets Index underperformed, falling as much as 10% in August and wiping out gains from earlier in the quarter, whereas most other major markets held onto slight advances. Our models suggest that stocks are relatively attractive outside of the U.S. However, we note that the S&P 500 Index is situated slightly above fair value and is at a level that has historically been associated with lower returns and higher levels of volatility. Corporate profit growth is critical to push U.S. stocks higher. In an environment of moderate earnings growth, low interest rates and low inflation, stocks can deliver gains in the mid-single to low-double digits. In a recessionary scenario, however, the damage to profits and investor confidence would send stock prices meaningfully lower.

Conclusion:

Margin for Error

For much of the summer, investor attitudes were shaped by elevated concerns about the U.S.-China trade scrap, Brexit, sagging manufacturing activity indexes everywhere, and the persistent rumbling of commentators (who, after all, have to comment) that a U.S. recession was just around the corner.

This barrage sent U.S. investor sentiment readings to deeply pessimistic levels last seen at the bottom of last year’s August-to-December stock market rout (and not far above the panic levels at the depths of the European sovereign debt crisis in 2012 and the global financial crisis in 2009.)

This intense pessimism was stoked by some weak readings from a narrow cross-section of the economies in question. For example, manufacturing accounts for just 10% of U.S. GDP. The purchasing managers’ index (PMI) readings for the non-manufacturing 90% of the economy have remained firmly in positive territory. A similar divergence between weak manufacturing and still-strong services PMIs is apparent in China, Japan and the Euro area.

The beat goes on

This more upbeat picture seems much more in sync with the very tight labour market data. The U.S. unemployment rate at 3.7% is at a low level last seen 50 years ago. For Canada, at 5.7%, it was 45 years ago in 1974. Unemployment insurance claims in the U.S. – a good measure of the layoff rate – have trended relentlessly lower for 10 years and continue to do so. No company is voluntarily laying anyone off because replacing even an unsatisfactory employee is extremely difficult. The same dynamic is at play through much of Canada.

This tight labour market has produced a confident consumer with money to spend. Retail sales have been solidly higher in the U.S. New housing construction permits have surged recently, while home sales have climbed higher. New mortgage applications for purchase are also higher than a year ago.

In Canada, consumers are still shopping. And while the most overheated real estate markets have cooled off and retrenched in response to tighter macro-prudential rules from government, now buyers appear to have regained their composure and re-entered the market.

As good as it gets

Most importantly, in both U.S. and Canadian economies and throughout the developed world, credit conditions remain accommodative. The latest Senior Loan Officer Survey from the U.S. Federal Reserve reveals that a majority of banks continues to lower lending standards on almost all categories of loan, both commercial/industrial and consumer. Businesses report no trouble getting credit. The most recent member survey of the National Federation of Independent Business in the U.S. had just 3% of small and medium-sized businesses indicating they were unable to get all the credit they needed. And only 2% reported their most recent loan was harder to get than the one before.

Historically low interest rates, banks that are prepared to lend, confident consumers able to sustain spending, and corporations that are delivering high profitability and record levels of free cash flow: this is very close to as good as it gets. And therein lies the problem. It is usually the case that the economy looks unstoppable before it peaks. The turn most often comes when inflation – often a product of an “unstoppable” economy experiencing labour shortages – moves up to levels demanding more aggressive tightening by the central bank.

Inflation has been anything but a problem in recent years and it is the prevailing opinion of almost everyone that it is going to remain quiet and acceptably low for some considerable time. We are bothered somewhat by that unanimity. Some recent readings in both the U.S. and Canada have been higher than expected. More upside inflation surprises can’t be ruled out.

That said, the accumulating of inflationary pressures great enough to compel central banks to act and then the subsequent building of monetary tightness sufficient to produce an economic downturn will take time. For our part we expect the North American economies and corporate profits will continue to grow over the coming 12 months, perhaps beyond. Share prices should also advance from here in response to that growth.

It’s always the right time to prepare

Whether it’s a year from now, or two or three, an economic downturn will eventually arrive, ushering in a much more challenging period for equities. Bear markets usually begin some months or quarters before their associated economic recession. We think that now, while stock markets and the economy look set to move higher, is a good time to think about how to prepare portfolios for that day when an unwelcome sea change is upon us. Revisiting issues like risk appetite, portfolio balance and sector exposure is always appropriate.

An important part of portfolio construction is the building in of a margin for error were one proven wrong about the future direction of the course of the economy, share prices and interest rates. Re-assessing whether that margin is sufficient would be a useful first step.