Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q4 2025 edition covers Market Review up to Q3 of 2025, the Artificial Intelligence (AI) boom and gold’s surge. Shiuman’s Corner is a about my cycling adventures for fund raising.

Markets

Market scorecard as of close on Friday November 7, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 29,847 | -1.4% | 20.7% |

| U.S. | S&P 500 | 6,719 | -1.8% | 14.2% |

| U.S. | NASDAQ | 22,963 | -3.2% | 18.9% |

| Europe/Asia | MSCI EAFE | 2,784 | -0.5% | 23.1% |

Source: FactSet

- TSX finished slightly higher in Friday afternoon trading after spending majority of the session in negative territory. Most sectors higher. Canadian equities (TSX) slipped below 30,000, ended with a 1.4% weekly decline in volatile week.

- US equities were mostly higher in Friday trading. Stocks ended near best levels after erasing sizable midday declines. Breadth positive as equal weight S&P 500 outperformed cap-weighted index by ~70 bp. However, S&P 500 and Nasdaq still lower for the week, snapped three-straight weekly gains.

Economy

Canada

- Prime Minister Mark Carney’s inaugural federal budget proposes roughly CA$280 billion in new investments over five years, focused on infrastructure (CA$115 billion), productivity and competitiveness (CA$110 billion), defence and security (CA$30 billion), and housing (CA$25 billion).

- To partially offset higher spending, the government plans CA$60 billion in savings through fiscal year 2028–2029, including a 10% cut to the federal workforce and enhanced tax-enforcement measures.

- The deficit for the current fiscal year (FY2025–2026) is projected at CA$78 billion or 2.5% of GDP, roughly in the range of many pre-budget estimates but not quite as high as some projections. Still, that amount is more than twice the size of the previous year’s $36 billion deficit and well above the CA$42 billion shortfall previously projected.

U.S.

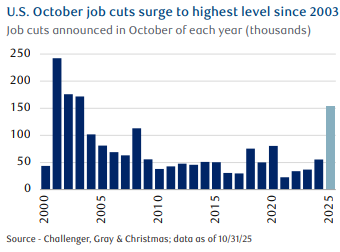

- According to a report by outplacement firm Challenger, Gray & Christmas Friday morning, U.S. companies announced over 150,000 job cuts last month, the most for any October since 2003, as rising costs, softer consumer spending, and the adoption of AI lead more companies to reduce headcount.

- Job cuts for all of 2025 have now exceeded one million, the largest total since the pandemic. U.S. employers are also pulling back on hiring plans, which fell in October to the lowest level since 2011.

- Further Afield

- The Bank of England (BoE) kept the Bank Rate unchanged at 4%. The narrow 5-4 vote was more dovish than consensus and our expectations.

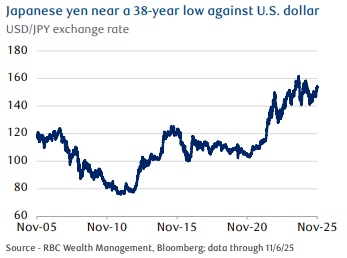

- Investors have been closely monitoring the movement of the Japanese yen, which has recently retreated to the 154 level against the U.S. dollar, near the 38-year low seen last year.

-

Notes About Companies in Model Portfolio

- Brookfield Infrastructure Partners L.P. (BIP.UN) Friday announced its results for Q3 ended September 30, 2025. BIP’s funds flow from operations (FFO)/unit was $0.83, which compares to our (RBC Capital Market’s) forecast of $0.83. BIP highlighted its six new investments totalling over $1.5 billion including a framework agreement with Bloom Energy to install up to 1 GW of behind the meter power solutions for data centers and AI factories.

- Fortis (FTS) released on Tuesday Q3 2025 results. Q3 net earnings of $409 million was a decrease of $11 million compared to Q3 2024. The decrease was due to income taxes and closing costs totalling $32 million associated with the disposition of FortisTCI. The company increased Q4 common share dividend by 4.1%.

- Intact Financial (IFC) reported Tuesday Q3 2025 results. Operating direct premium written (DPW) growth increased to 6%, driven by momentum in Commercial lines and continued strength in Personal line. Combined ratio (losses divided by premiums collected) was strong at 89.8%, a 14-point improvement from last year. Net operating income per share1 was solid at $4.46.

- Pembina Pipeline Corporation (PPL) announced Thursday its financial and operating results for Q3 2025. PPL reported Q3 earnings of $286 million compared with $385 million same period last year. Q3/25 results were largely in line with our (RBC Capital Markets) estimate and consensus. In Q3/25, Pembina's EBITDA was $1.034 billion versus our forecast of $1.027 billion and consensus of $1.011 billion.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.