Stock Markets Plow Ahead

Positive earnings and AI investments drive optimism

Market Review: To Q3 2025

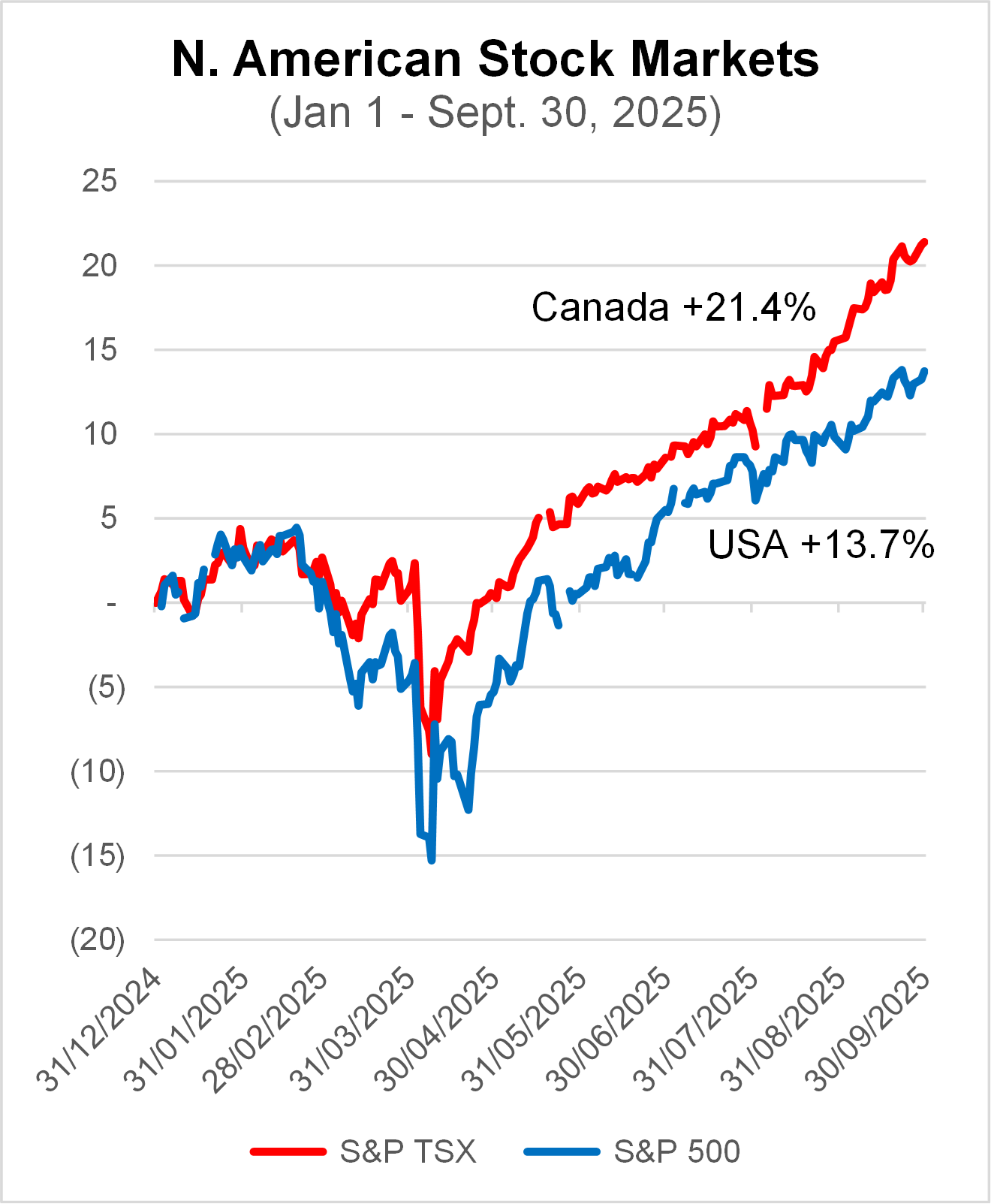

After the sudden and substantial downturn from the so-called “Liberation Day” when the U.S. government announced tariffs on every country in the world, the subsequent rebound was just as abrupt. Since then, both the U.S. and Canadian stock markets have been making steady gains, as shown in the chart below.

Source: FactSet Sep 30, 2025

The S&P/TSX Composite Index (TSX) in Canada was up 21.4% in price from the beginning of the year to September 30. The S&P 500 Index (S&P 500) in the U.S. was up 13.7% in the same period.

Bull not equally spread

By most measures, we are in a bull market. However, the gains are not equally distributed. In Canada the advance is driven by Materials which has gone up over 60% in the first nine months of the year, contrasted against negative returns in Healthcare. See article on Gold on next page.

In the U.S. the Technology sector especially companies involved in Artificial Intelligence (AI) have been the engine of stock gains. Interestingly, the Utilities in Canada and the U.S. are both up over 20% this year. The huge investment in data centers to support AI is also driving demand for energy.

The "B" word

The search for “bubble” in Google spiked this year, peaking in August and early October. Commentators have compared the current run in stock prices in companies that are in the AI sector (such as Microsoft, Oracle and Nvidia) to be reminiscent of the “dot com” era in 2000. The one big difference is that the AI companies today are very profitable, albeit with stretched valuations. During the bubble two and a half decades ago, many of the newly listed companies barely had revenues, let alone profits. Some of the newer developers of Large Language Models (LLMs) that provide the intelligence such as Anthropic (Claude) and Open AI (ChatGPT) have growing revenues, but a long way from profitability. However, their ownership are still in private hands.

Is Artificial Intelligence for real

Since November 2022 when ChatGPT was launched, there has been a race by AI engines to win market share for users. When competition is intense, advances are rapid. In January of this year DeepSeek, a little-known AI company in China shook the world when it launched its model. It claimed that it had cost them a fraction of what the likes of Open AI had invested to develop its LLM, and that queries were more efficient and less power hungry. Competition was on.

Investing in infrastructure

Enabling the LLMs are advanced microprocessors (chips) in which U.S. based Nvidia is the world leader. China, the runner-up in the AI race is hampered by export controls on the most advanced chips made by Nvidia. This means they have to make do with less than cutting-edge hardware. But this may spur Chinese companies to step up their research and development of such chips. In anticipation of mass adoption of AI models, the likes of Meta (Facebook), Alphabet (Google) and others are investing in building data centres around the world. This is where user requests are processed. Total investment required are thought to be in the trillions by 2030. Open AI, Oracle and Softbank recently announced joint investments of $500 billion in AI infrastructure in the next four years.

Data Centers need massive amounts of power to run the banks of computers, as well as ventilation systems to keep them cool. It has been reported that Microsoft’s electricity demand is to surge by 600% by 2030, and that the company has negotiated a supply contract for nuclear power from Three-Mile Island, the site of a partial meltdown in 1979, but has recently been re-started due to the demand surge.

A question of capacity

AI companies are making big bets on future demand, hence the investments in computing power and data centres. A key question is how they would recoup their investment in the form of future revenues. Many enterprises are still in the pilot phase of testing the use of AI in the workplace. Some observers are predicting the advent of Artificial General Intelligence (with human-like ability to think for itself, rather than just recognizing patterns and recalling data). There is a risk of over investment in capacity from a delay in adoption or disappointing revenues. For now, we wait and watch.

To read “AI’s Big Leaps in 2025” article in Global Insight Monthly (October 2025), click here.

All That Glitter

What is driving gold prices higher

Since the beginning of 2024 the price of gold has soared. It is now edging closer to the $4,000 U.S. per troy ounce level.

Source: FactSet Sept. 2025

Gold is a traditional hedge against inflation and weakening of the U.S. dollar. In addition, we have seen a steady demand by central banks buying this precious metal, as a means of diversification from the U.S. dollar.

How do you buy gold

We can buy physical gold in the form of coins and store them somewhere safe. Investors can buy shares in gold mining companies and participate in their profits. Or you can buy an ETF that owns physical gold bullion. However, most bullion-based investments have a built-in cost for storage and pay no dividends or interest. It’s literally just a store of value. Devoting a small portion of your portfolio to this precious metal is a form of diversification especially in times of geopolitical uncertainty and a higher inflation environment.

Shiuman’s Corner

Cycling and Workout for Cancer

A smoky ride to Whistler

[photo: MarathonFoto]

This year I signed up for the Workout to Conquer Cancer to raise money for BC Cancer Foundation. I had to commit to a physical activity every day in May, but I modified it with a twist. To pay homage of the Tour de Cure which has been cancelled, I added two challenging bicycle rides – the Valley Granfondo and the RBC Granfondo Whistler. My training log indicates that during May I spent over 31 hours cycling, weight training and swimming. Those workouts in May were good preparation for my riding season. The Valley Granfondo was a 128km ride through the Fraser Valley on a very hot day in June. It was my first time in this event on a mostly flat route, but some punchy climbs. Then in September I gathered with thousands of riders early in the morning in Stanley Park in Vancouver at the start line, with a layer of smoke from forest fires hanging in the air. I took the precaution to wear a N95 mask most of the way of the 122km route. My goal was to beat last years’ time. It was a delicate balance between not exerting myself too much due to the poor air quality and keeping an eye on the clock. In the end I did beat my time by 27 minutes. More importantly, I raised over $11,000 for BC Cancer Foundation. I am very grateful to all donors to my campaign who have been unwavering over the years.

|

â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. (2025). All rights reserved. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. (2025). All rights reserved.

|