Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2025 edition covers Market Review for first half of 2025, the impact of tariffs, and alternative investments. Shiuman's Corner is about classical music as balm.

Markets

Market scorecard as of close on Friday October 24, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 30,353 | 0.8% | 22.7% |

| U.S. | S&P 500 | 6,792 | 1.9% | 15.5% |

| U.S. | NASDAQ | 23,205 | 2.3% | 20.2% |

| Europe/Asia | MSCI EAFE | 2,811 | 1.2% | 24.3% |

Source: FactSet

- TSX finished higher in Friday afternoon trading, bit off best levels. Most sectors higher. Canadian equities ended with a 0.8% gain for the week, up 22.7% year-to-date.

- US equities were higher in Friday trading as stocks ended a bit off best levels. Major indices all posted solid gains for the week as S&P, Nasdaq Composite ended Friday with fresh record closes. S&P 500 is up 15.5% YTD.

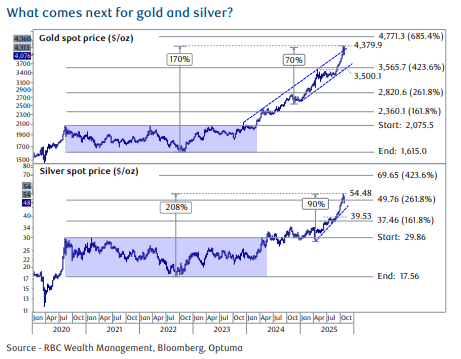

- From our Technical Strategist update on October 23: The chart below reflects the impressive rally in gold (top panel) and silver (bottom panel) that has developed in 2024 and 2025 following broad trading ranges between 2020 and 2024. Concerns regarding a declining U.S. dollar, expanding U.S. deficits, and global central banks accumulating gold have accelerated demand for both of the precious metals, with gold and silver surging 70% and 90%, respectively, in 2025.

- The bottom trend line technically is that the long-term trends for gold and silver remain intact, but we caution traders not to expect an immediate rebound to new highs. After such a dramatic rally, we project a broad consolidation to develop, which we view as a healthy pause within their longer-term uptrends.

Economy

Canada

- Headline inflation continues to run above the Bank of Canada’s (BoC) 2% target, with September’s reading coming in at 2.4% y/y, up from 1.9% in August. As we look ahead, another rate cut is on the table with a 25 basis point reduction likely at the BoC’s Oct. 29 meeting. RBC Economics believes that additional cuts beyond the October meeting will be more difficult as the central bank would be cutting into outright stimulative levels of interest rates amid sticky inflation and the likelihood of additional fiscal support to be announced as part of the federal budget in early November.

- Canadian Prime Minister Mark Carney highlighted some goals of his government’s upcoming fall budget release in a speech at the University of Ottawa. Detailing the need to diversify economic and trade relationships, Carney touted a goal for Canada to double non-U.S. exports of natural gas over the next decade, which, if realized, would represent around CA$300 billion in trade.

U.S.

- The U.S. government remains shut down pending funding legislation from Congress. There has been limited movement toward a negotiated solution, and we do not have an anticipated reopening date. For investors, the lack of economic data is a key cost, and one that we believe will complicate the Fed’s rate-setting process.

- The U.S. Supreme Court is scheduled to hear a legal challenge to the majority of the administration’s tariff programs. If the court invalidates the tariff program, we think investors will focus on the remedy. The court may require affected tariff payers to sue individually, potentially letting the U.S. keep a substantial portion of the taxes collected so far.

- Further Afield

- UK September inflation data surprised to the downside, and it seems the peak may have been reached, in our view. Headline CPI inflation was unchanged at 3.8% y/y from August, and services inflation, which is closely watched by the Bank of England (BoE), was also unchanged at 4.7% y/y.

- Washington announced sanctions on Russia’s two largest oil producers on Wednesday, sending jitters across China and India. The U.S. Treasury Department blacklisted partially state-owned oil giant Rosneft PJSC and privately held Lukoil PJSC due to “Russia’s lack of serious commitment to a peace process to end the war in Ukraine.”

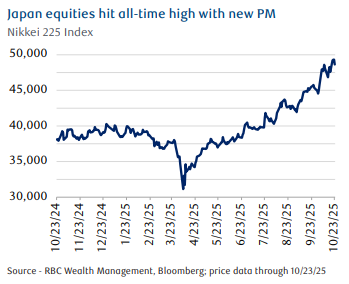

- Sanae Takaichi became Japan’s first female prime minister after winning the parliamentary vote on Tuesday. The new prime minister is known to be a fiscal expansionist and has vowed to do more for households struggling with rising costs. According to Reuters, the new administration has started working on a large stimulus package, likely to exceed last year’s US$92 billion, to help combat inflation.

Notes About Companies in Model Portfolio

- The Procter & Gamble Company (PG) reported first quarter fiscal year 2026 net sales of $22.4 billion, an increase of three percent versus the prior year. Organic sales, which excludes the impacts of foreign exchange and acquisitions and divestitures, increased two percent versus the prior year. Diluted net earnings per share were $1.95, an increase of 21% versus the prior year primarily due to higher non-core restructuring charges in the prior year.

- Waste Connections, Inc. (WCN) announced Tuesday its results for the third quarter of 2025. Revenue in the third quarter totaled $2.458 billion, up from $2.338 billion in the year ago period. Adjusted net income in the third quarter was $372.0 million, or $1.44 per diluted share, versus $350.0 million, or $1.35 per diluted share, in the prior year period.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.