Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2025 edition covers Market Review for first half of 2025, the impact of tariffs, and alternative investments. Shiuman's Corner is about classical music as balm.

Markets

Market scorecard as of close on Friday October 17, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 30,108 | 0.9% | 21.8% |

| U.S. | S&P 500 | 6,664 | 1.7% | 13.3% |

| U.S. | NASDAQ | 22,680 | 2.1% | 17.4% |

| Europe/Asia | MSCI EAFE | 2,776 | 0.7% | 22.7% |

Source: FactSet

- TSX finished lower on Friday, bit off worst levels. Sectors mixed. Materials, the outsized decliner, pulls back after three-day rally. TSX up 0.9% on the week, and 21.8% year-to-date.

- US equities were mostly higher in Friday trading, though ended a bit off best levels. Friday’s upside reversed some of Thursday's weakness amid worries about credit challenges for regional banks, though S&P 500 and Nasdaq finished solidly higher for the week. Big tech mostly higher.

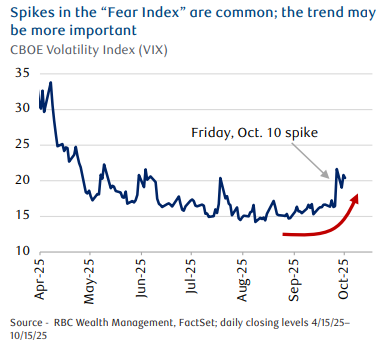

- U.S. stock indexes recovered during the week, regaining most of the losses incurred in a significant one-day selloff on Friday, Oct. 10. Investors were encouraged by an apparent Trump administration U-turn on the harsh tariff rhetoric directed at China that appeared to trigger the Friday swoon. A positive start to Q3 2025 earnings season provided a further tailwind.

Economy

Canada

- Canada’s labour market surprised to the upside in September with a net addition of 60,400 jobs, almost fully reversing the August losses, while the unemployment rate held steady at 7.1%.

- Canadian manufacturing sales and wholesale trade dropped in August. Regionally, trade-exposed provinces saw the biggest declines, with Quebec down 1.6% and Ontario falling 0.8%.

U.S.

- The government shutdown continued into its third week, preventing the release of important economic data on employment and inflation.

- RBC Economics looks for the U.S. Federal Reserve to keep gradually reducing the fed funds target range (including a cut in October), but with 50 basis points fewer reductions in 2026 than previously expected.

- Further Afield

- In France, President Emmanuel Macron reappointed Sébastien Lecornu as prime minister just five days after his resignation, which had followed the National Assembly’s rejection of his austere budget.

- On Oct. 9, China’s Ministry of Commerce announced it would implement further export controls on 12 rare earth minerals and related upstream/downstream products such as batteries and related technologies. Rare earths are critical materials for the semiconductor manufacturing supply chain. The Trump administration retaliated by announcing an additional 100% tariff on Chinese goods effective Nov. 1.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.