Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2025 edition covers Market Review for first half of 2025, the impact of tariffs, and alternative investments. Shiuman's Corner is about classical music as balm.

Markets

Market scorecard as of close on Friday September 26, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 29,761 | 0.0% | 20.4% |

| U.S. | S&P 500 | 6,664 | -0.3% | 13.0% |

| U.S. | NASDAQ | 22,484 | -0.6% | 16.4% |

| Europe/Asia | MSCI EAFE | 2,742 | -0.4% | 21.2% |

Source: FactSet

- TSX finished slightly higher in Friday afternoon trading, off best levels. Most sectors higher. Materials the best performer. Canadian equities ended little changed for the week.

- US equities were higher in Friday trading, as stocks ended just off best levels. S&P 500 and Nasdaq both broke three-straight declines, though capped off slight weekly losses.

- European defence stocks rose following a series of alleged airspace violations by Russia, and U.S. President Donald Trump’s comments on the sidelines of the United Nations General Assembly that NATO nations should shoot down Russian military aircraft that violate their airspace.

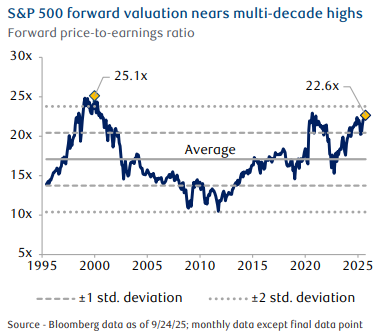

- S&P 500 forward valuation nears its highest levels in over two decades. The S&P 500’s forward price-to-earnings ratio of 22.6x is nearing two standard deviations above its long-term average of 17.1x, reaching levels not seen since the early 2000s tech bubble (excluding the brief COVID-19 pandemic distortion).

Economy

Canada

- Bank of Canada Governor Tiff Macklem said Canada needs to accelerate efforts to reduce its economic dependence on the U.S. and cautioned that tariffs have put economic growth on a lower trajectory. Better east-west transportation corridors, removing interprovincial trade barriers, and improvements to port infrastructure were among the key themes that Macklem pushed for during a speech in Saskatchewan last week.

- Meanwhile, Canadian Prime Minister Mark Carney and Mexican President Claudia Sheinbaum agreed on a new Comprehensive Strategic Partnership to deepen ties between the two countries.

U.S.

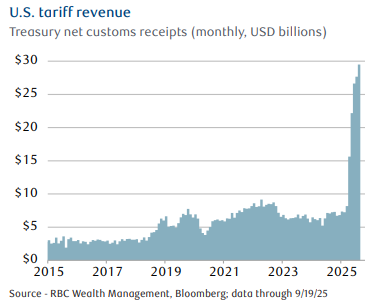

- Collections from U.S. tariffs are surging, but trade diversion and exemptions have softened the macro impact. Even at below-estimated levels, the overall cost of tariffs (import tax) is still substantial. U.S. tariff revenues are now around $30 billion per month, putting collections on an annualized pace of $354 billion—roughly $275 billion more than in 2024.

- The open question is who ultimately bears the cost. In principle, costs can be distributed amongst foreign exporters (through price cuts to remain competitive), U.S. companies (through squeezed profits by absorbing the duties), or consumers (through higher prices). Evidence thus far leans toward U.S. businesses carrying a significant portion of the burden. Over time, the burden of tariffs could shift more visibly to consumers.

Further Afield

- The Chinese government has characterized the recent phone call between President Xi Jinping and U.S. President Donald Trump as positive and pragmatic. Xi appears confident that the U.S. and China can resolve their differences, but also reminded his counterpart that the U.S. should offer a fair operating environment for Chinese businesses. After the call, Trump said he will meet with the Chinese leader during next month’s Asia-Pacific Economic Cooperation Summit and is pleased with the progress made on TikTok negotiations.

Notes About Companies in Model Portfolio

- Costco Wholesale Corporation (COST) announced Thursday its operating results for the 16-week fourth quarter and the 52-week fiscal year ended August 31, 2025. Net sales for the quarter increased 8.0 percent, to $84.4 billion, from $78.2 billion last year. Net sales for the fiscal year increased 8.1 percent, to $269.9 billion, from $249.6 billion last year. COST continued to grow its membership base from new clubs and membership upgrades, driven by executive perks. That said, both US/Canada and worldwide renewal rates sequentially decreased 40 bps from higher mix of digital sign-ups.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.