Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2025 edition covers Market Review for first half of 2025, the impact of tariffs, and alternative investments. Shiuman's Corner is about classical music as balm.

Markets

Market scorecard as of close on Friday September 12, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 29,284 | 0.8% | 18.4% |

| U.S. | S&P 500 | 6,584 | 1.6% | 11.9% |

| U.S. | NASDAQ | 22,141 | 2.0% | 14.7% |

| Europe/Asia | MSCI EAFE | 2,759 | 1.1% | 22.0% |

Source: FactSet

- TSX closed lower in Friday afternoon trading near worst levels. Canadian equities set fresh highs last week, finished with a 0.8% weekly advance.

- US equities were mostly lower in very quiet, rangebound Friday afternoon trading. Major indices still posted moderate weekly gains, while Nasdaq set another fresh record high.

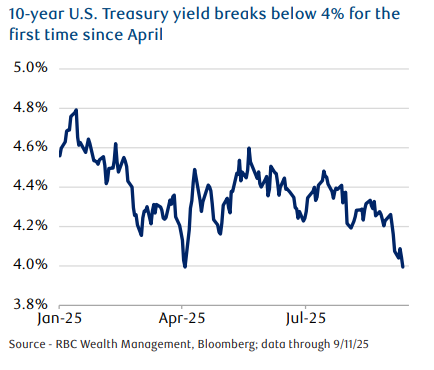

- U.S. Treasury yields have dropped sharply since the beginning of September as recent data shows further evidence of a slowing economy. As illustrated in the chart, the 10-year Treasury yield broke below 4% on Thursday, marking the lowest level since the beginning of April.

Economy

Canada

- The Canadian labour market weakened again in August amid trade-related pressures. The Canadian economy shed 66,500 jobs in the month, on top of July’s contraction of 41,000. Meanwhile, the unemployment rate rose to 7.1% in August—the highest level in four years—from 6.9% in July.

- The weaker-than-expected employment report increases the likelihood of a rate cut by the Bank of Canada (BoC) at its Sept. 17 meeting, but markets will be attentive to upcoming Consumer Price Index data a day prior for more clarity on inflation pressures. Elevated prices may entice the BoC to hold rates steady, while easing inflation could reaffirm current market expectations for a cut.

U.S.

- Markets shifted their attention to inflation following Friday’s release of the Producer Price Index. On the wholesale side, producer prices unexpectedly declined in August for the first time in four months, coming in 0.1% lower than in July. In our view, despite tariffs likely driving up costs for producers, the report suggests companies refrained from outsized price increases during August.

- Nonetheless, although the report followed a sizable advance in July data, it appears many businesses are concerned that steep markups could push customers away at a time when economic uncertainty further weighs on spending.

Further Afield

- In line with the market’s and our expectations, the European Central Bank (ECB) Governing Council voted “unanimously” to hold rates at 2%. The central bank policy statement maintained its “meeting-by-meeting” approach for future policy decisions.

- Japanese Prime Minister Shigeru Ishiba announced he will resign and step down as head of the conservative Liberal Democratic Party (LDP). He will continue his duties until a successor is selected. Currently, the market widely sees former Economic Security Minister Sanae Takaichi and current Agriculture Minister Shinjiro Koizumi as frontrunners to be the next LDP leader.

Notes About Companies in Model Portfolio

- Canada has now completed another earnings season, with all eyes on management commentary as investors look to uncover how Canadian businesses have been operating amid the evolving tariff landscape. Constituents of the S&P/TSX 60, an index that tracks the 60 largest companies in Canada, produced robust results, with 80% reporting earnings that beat consensus estimates.

- Furthermore, 17% of those companies have brought future estimates higher as they see less impactful tariff headwinds than originally feared. While a small number of companies reduced estimates, rationales were largely tied to company-specific headwinds.

- Last quarter, management commentary was largely concerned with uncertainty and planning difficulties in the evolving business environment. This quarter, commentary has shifted to an acceptance of the “new normal” with management teams now focused on assessing the true tariff impact on their businesses.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.