Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2025 edition covers Market Review for first half of 2025, the impact of tariffs, and alternative investments. Shiuman's Corner is about classical music as balm.

Markets

Market scorecard as of close on Friday August 15, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 27,905 | 0.5% | 12.9% |

| U.S. | S&P 500 | 6,450 | 0.9% | 9.7% |

| U.S. | NASDAQ | 21,623 | 0.8% | 12.0% |

| Europe/Asia | MSCI EAFE | 2,741 | 2.3% | 21.2% |

Source: FactSet

- TSX ended slightly lower on Friday, off worst levels. Most sectors lower. Canadian equities finished up 0.5% this week.

- US equities were mostly lower in very quiet Friday trading. Downside in S&P 500, Nasdaq limited but still posted solid weekly gains.

-

Excerpt of update from Robert Sluymer, Technical Strategist, RBC Wealth Management

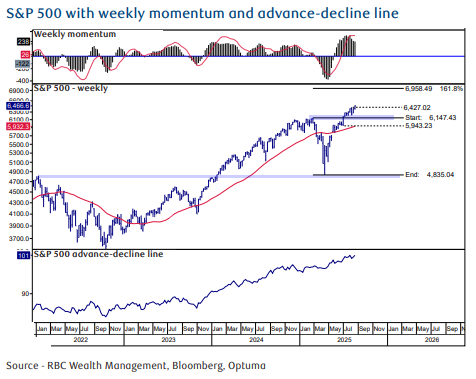

Excerpt of update from Robert Sluymer, Technical Strategist, RBC Wealth Management - Although the S&P 500’s uptrend remains intact notching all-time highs this week, we expect the balance of Q3 moving into Q4 to be more challenging.

- Market capitalization is increasingly concentrated in a handful of stocks with the largest two stocks accounting for 15% of the S&P 500, the highest since 1980, and the largest four stocks accounting for 25% of the index.

- While valuation is not a focus for us technically, our fundamental colleagues are increasingly concerned that valuations appear to be stretched for many growth stocks.

Economy

Canada

- The Canadian economy shed 41,000 jobs in July, partly reversing June’s outsized 83,000 gain. The unemployment rate held steady at 6.9%, below May’s 7%. Surprisingly, trade-exposed sectors did not account for employment loss in July.

- The Bank of Canada’s summary of deliberations from its July 30 meeting revealed a notable division among policymakers over the effectiveness of monetary policy in the face of U.S. tariffs and an uncertain domestic outlook. The central bank is continuing to navigate a delicate balance between a recent pickup in core inflation measures and signs of softening economic activity, all against a backdrop of persistent global trade uncertainty.

U.S.

- Inflation data presented a mixed picture, complicating future Fed decision-making. The combination of growing supply chain price pressure and what we see as a more nuanced reading of the CPI numbers led investors to re-evaluate their optimism for bonds and for rate cuts.

- Tariff revenues generated by the U.S. reached a fresh monthly record in July, climbing to $28 billion, representing a 273% surge from July of last year as the Trump administration aims to reduce the deficit through levies on imported goods.

Further Afield

- UK Q2 GDP growth surprised to the upside coming in at 0.3% q/q against a 0.1% q/q consensus expectation. However, the largest contributor to growth was government spending, while business investment and consumer spending surprised to the downside.

- New loans in China decreased in July, the first drop in two decades. According to the People’s Bank of China, financial institutions recorded a CNY49.9 billion (US$7 billion) decline, driven by net repayments.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.