Dealing with Market Volatility

How to insulate your portfolio from violent price movements

Market Review: First half 2025

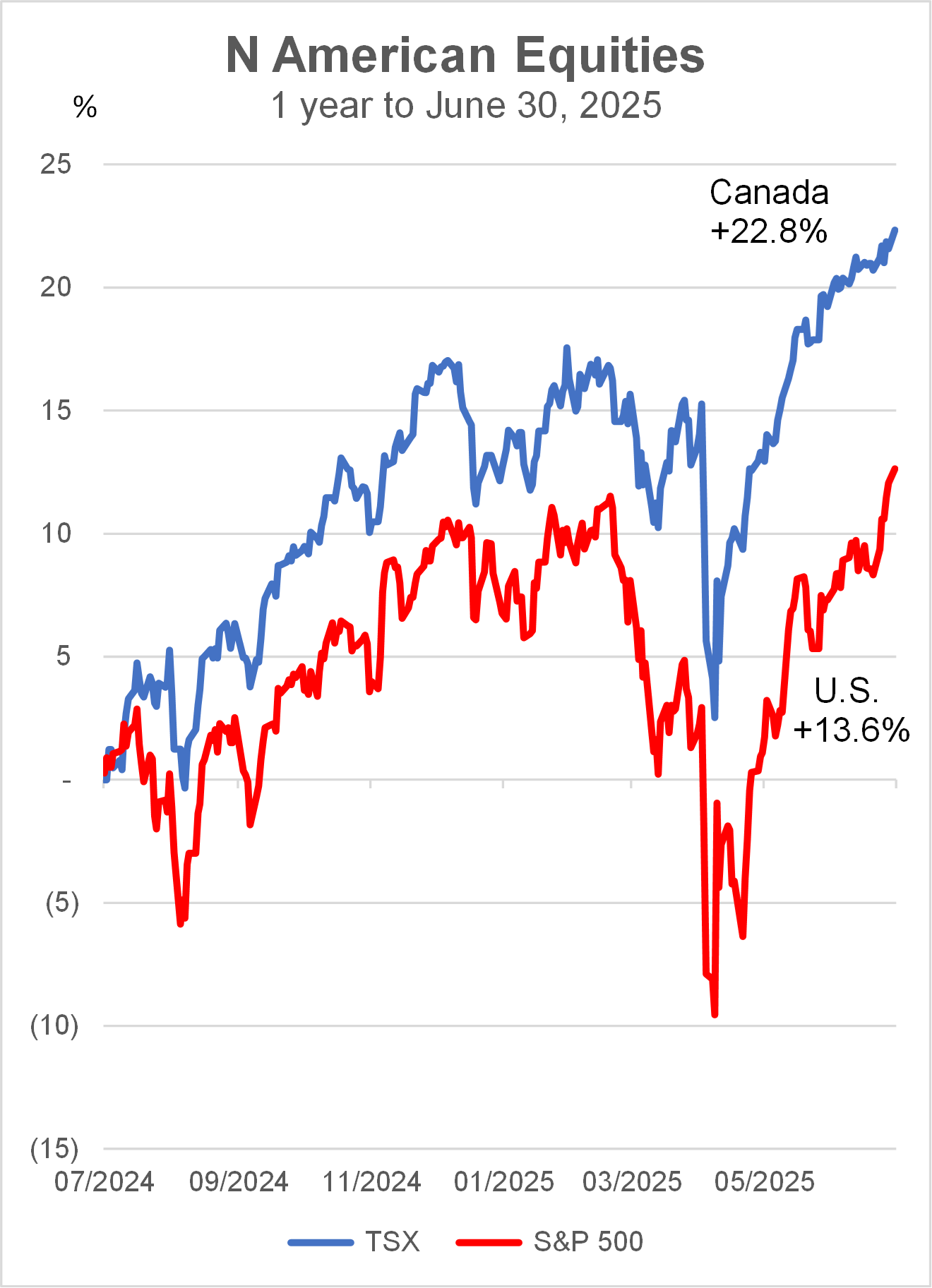

To describe the stock markets in Canada and the U.S. in the first six months of 2025 as volatile would be an understatement. The S&P/TSX Composite Index (TSX) was up 8.6% in the first half of the year, and up 22.8% in the past 12 months to June 30 (see blue line in chart below). The S&P 500 Index in the U.S. was up 5.5% in the first half of 2025, and gained 13.6% in the 12 months to June 30. In the past year the Canadian stock market has led the U.S. market, a reversal of the past decade.

Source: FactSet June 30, 2025

The positive performance appears innocuous in the light of the volatility the stock market experienced in April. That was after the U.S. had declared on the White House lawn the tariffs that would be charged on every other country. However, after the tariffs were put on hold for 90 days the stock markets recovered almost all of its losses in a matter of weeks. As of June 30, both the TSX and S&P 500 were at all time highs.

U.S. returns lagging

The table below summarizes the returns of the major markets for year-to-date (YTD) to June 30, 2025, and the 12-month performance. The S&P 500 gained 5.5% YTD lagging the TSX and MSCI EAFE. When factoring in the recent weakness of the U.S. dollar, the U.S. market was essentially flat in Canadian dollar terms.

Source: FactSet June 30, 2025

Source: FactSet June 30, 2025

MSCI EAFE represents the major developed markets outside of North America, which outperformed Canada and the U.S. in 2025 so far.

Europe leads the way

Coming out of the Covid-19 pandemic, Europe suffered from higher inflation for longer, and slower growth than in north America. The new U.S. administration’s aggressive trade policies and pull back in defense spending in Europe has led to a new commitment by European governments to higher defense expenditures. The German government has also loosened its policy on public finances to allow the country to take on debt to fund the additional expenditures. This has raised the prospects of not just defense firms, but also those in other sectors such as industrials and finance. The new spending, partly financed by debt will be stimulative for the European economy, which is what the stock market is betting on.

Impact of Tariffs so far

What was expected

At the time of the announcement of tariffs early in April this year, many economists and analysts warned about the effect of higher cost of imports on inflation in the U.S. The June inflation figure based on Consumer Price Index was 2.7% which was a reversal of the downtrend, but not enough to cause alarm. Though it may delay rate cuts by the Federal Reserve in 2025.

Sharing the cost

Higher tariffs take time to work through the system. Some companies stocked up on inventory of imported goods trying to beat the tariffs. As they draw down inventories their costs will go up. It will be a matter of negotiation to see how the additional costs can be shared amongst the overseas supplier, the importer and the consumer. It is unlikely for the consume to bear the full brunt of paying for the tariffs.

Consumer resilience

The unemployment rate in the U.S. has been hovering just above 4% for the past year. This is at a level some economists consider as full employment. Credit card data the U.S. suggests that the consumer has not curtailed spending. Any up-tick of the unemployment rate may dampen consumers’ discretionary spending. 70% of the U.S. economy is represented by consumer spending.

Where tariffs land

The U.S. administration had promised 90 trade deals within 90 days. The deadline has passed and there are only a handful of agreements announced, notably the U.K., Japan, EU and Indonesia. These are not legally binding trade agreements, but are considered just framework for which details have yet to be worked out.

Tariffs on Canada

The U.S. has imposed 25% (set to rise to 35% on August 1st) on Canadian goods imported to the U.S. However, this only applies to goods not covered by the existing trade agreement between the U.S., Mexico and Canada (USMCA). The effective tariff rate is therefore much lower than this. Where we land eventually remains to be seen.

Alternative Universe

What are alternatives

Cash, fixed income and equities are traditional asset classes investors use. Their prices fluctuate when interest rates go up or down, or when economic factors and sentiment change. A different type of investment fund employ various techniques such as shorting (see below) or using leverage or derivatives. The goal is to earn positive return under any market condition, hence the concept of absolute return. These are known as hedge funds, which may invest in fixed income, equities and other assets including commodities. They may buy not only publicly traded securities, but also privately-held ones.

The long and short of it

Selling securities that you do not own, so you can buy them back later when prices are lower is called shorting. It is a valuable technique for sophisticated investors. It allows them to profit from a drop in price, but the strategy carries significant risks. Combined with owning stocks or bonds, this strategy can be called market neutral or long-short fund. The goal is for lower volatility than the market and to earn absolute return.

The upside of limiting downside

Warren Buffett has been credited with the saying that “the first rule of investing is not to lose money.” While never seeing your portfolio drop in value is impossible, it has been shown that by introducing alternative funds (for example 10-20%), a portfolio will generally have lower downside risk. By limiting losses, the long-term performance should be improved.

Shiuman’s Corner

Music to my ears

Pianist Tom Borrow, left [photo: S. Ho]

Some people meditate or do yoga, but I have always found music, particularly classical music to be a delightful distraction from day-to-day routines. It is at once relaxing as well as intellectually stimulating. Although I am not a believer, some expectant mothers have been known to play classical music before their child is born hoping to stimulate their brain at that early stage. I am fortunate that Vancouver has a lively classical music community. I am a long-time attendee of concerts organized by the Vancouver Recital Society, which have hosted numerous young, emerging artists including Lang Lang, the Jupiter Ensemble and Yunchan Lim. Two years ago I joined their board of directors, a volunteer position. I hope to make a small contribution to the cultural life of the city and meet other music enthusiasts. VRS was founded by the inimitable Leila Getz over 40 years ago, who remains its artistic director. The picture above shows Leila interviewing Israeli-born pianist Tom Borrow after his mesmerizing performance in February. Growing up I was not a disciplined student of music, but a few years ago I started taking piano lessons and playing classical pieces I like. Unfortunately for my family, it’s more enjoyable for me than for them when I struggle through a practice session at home. Good time for them to meditate!

|

â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. (2025). All rights reserved. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. (2025). All rights reserved.

information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.

|