Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q2 2025 edition covers Market Review for Q1 2025, the impact of tariffs on markets, and how to position your portfolio during a time of disruption. Shiuman’s Corner is about the art of retail in Japan.

Markets

Market scorecard as of close on Friday July 25, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 27,494 | 0.7% | 11.2% |

| U.S. | S&P 500 | 6,389 | 1.5% | 8.6% |

| U.S. | NASDAQ | 21,108 | 1.0% | 9.3% |

| Europe/Asia | MSCI EAFE | 2,691 | 1.9% | 19.0% |

Source: FactSet

- TSX finished higher in Friday afternoon trading, near best levels and all-time high. Most sectors were higher. Canadian equities posted 0.5% weekly gains, lifted by materials.

- US equities were higher in Friday trading as stocks ended just a bit off best levels. S&P 500, Nasdaq posted fresh record close, up over 1% for the week.

- European equity markets close softer, but off worst levels. Asian equities were lower Friday. Japan benchmarks pulled back after two days of sharp gains fueled by US trade deal. Greater China dropped as Hang Seng snapped five-day winning streak.

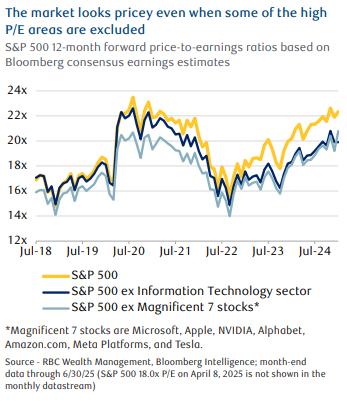

- With the S&P 500 marching higher since the spring tariff scare, the market’s valuation has risen nearly in tandem, pushing the price-to-earnings (P/E) ratio back up to a level that we view as pricey.The S&P 500 has rallied 27.6 percent since the April 8 low and 8.1 percent year to date, as of yesterday’s close.

- Market valuation has historically been a poor market-timing barometer. P/E ratios and other valuation metrics can stay elevated for longer than one might think is reasonable.

Economy

Canada

- The Bank of Canada’s (BoC) latest Business Outlook and Consumer Expectations Surveys reflect a cautious tone among both households and businesses. While fears of the worst-case trade outcomes have eased, uncertainty related to tariffs and global spillovers continues to weigh on business sentiment.

- Canada’s retail sales contracted by 1.1% m/m in May, in line with advance estimates. Sales were down in three of nine subsectors, with the pullback led by auto sales, which fell by 3.6% m/m, suggesting to us that the tariff-driven front loading seen in the prior two months has reversed.

U.S.

- The U.S. dollar continues to perform poorly, with the U.S. Dollar Index (DXY)—a roughly trade-weighted measure of the greenback’s value against major currencies—hovering near its lowest level in over three years. While the S&P 500 is up over 8% year to date in dollars, it’s nearly 5% lower when measured in euros and essentially flat in yen terms.

- Dollar weakness and recent economic data—most notably June’s elevated retail sales numbers—have contributed to continued market concerns on future inflation.

Further Afield

- In line with the market and our expectations, the European Central Bank (ECB) “unanimously” decided to leave interest rates unchanged at 2%. ECB President Christine Lagarde described rates as being “on hold,” but a September cut is still possible, albeit less likely than we previously estimated.

- The trade framework between the U.S. and Japan sets U.S. tariffs on Japanese products, including automobiles, at 15%. Investors viewed the auto tariff as a relief; although it represents a large increase from the 2.5% rate of last year, it is substantially less than the 25% previously announced by the White House.

Notes About Companies in Model Portfolio

- Alphabet (GOOG) released Q2 results showing revenues of $81.723 million and EPS of $2.61. “Google delivered what we believe is a defining quarter with 32% Google Cloud revenue growth, increasing scale of AI search products, and greater benefits from AI across every part of the business” according to a report by JP Morgan. “Google Cloud is nearly half the size of Amazon Web Services (AWS) and ⅔ the size of Azure, while growing ~twice as fast as AWS and nearly on par with Azure.

- CN (CNR) reported Tuesday its financial and operating results for the second quarter ended June 30, 2025. Revenue for Q2/25 of $4,272MM came in below consensus $4,329MM (RBC estimate: $4,349MM), down -1% year-over-year mainly due to lower volume. Volume was negatively affected by tariffs and trade uncertainty. Year-to-date EPS growth of +4% was tracking notably below management prior guidance of 10% to 15%, and together with the uncertain outlook from a trade policy perspective.

- Waste Connections (WCN) announced Wednesday its results for the second quarter of 2025 and updated its outlook for the full year. Revenue in the second quarter totaled $2.407 billion, up from $2.248 billion in the year ago period. Operating income was $459.5 million, compared to operating income of $424.7 million in the second quarter of 2024. Adjusted net income for the six months ended June 30, 2025 was $626.2 million, or $2.42 per diluted share, compared to $588.7 million, or $2.28 per diluted share, in the year ago period.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.