Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q2 2025 edition covers Market Review for Q1 2025, the impact of tariffs on markets, and how to position your portfolio during a time of disruption. Shiuman’s Corner is about the art of retail in Japan.

Markets

Market scorecard as of close on Friday June 13, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 26,504 | 0.3% | 7.2% |

| U.S. | S&P 500 | 5,977 | -0.4% | 1.6% |

| U.S. | NASDAQ | 19,407 | -0.6% | 0.5% |

| Europe/Asia | MSCI EAFE | 2,614 | -0.2% | 15.6% |

Source: FactSet

-

TSX closed lower in Friday afternoon trading, bit off worst levels ending three consecutive daily gain streak. Most sectors softer. Energy the best performers, boosted by strong crude prices on Middle East tensions. Healthcare and materials the other strong gainers. Canadian equities eked out 0.3% weekly gain, ahead of US peers.

- US equities were lower in Friday trading as stocks ended a bit off worst levels. S&P 500 and Nasdaq both lower for first time in three weeks. Energy the sector standout on crude rally.

- Last week’s soft inflation data was well received in the Treasury market as yields declined (and prices rose) throughout the entire curve. The yield on the 10-year Treasury benchmark dropped 15 basis points since the beginning of the week, while the monetary policy-sensitive 2-year yield is down sharply as well from investors ramping up Fed rate cut expectations.

Economy

Canada

- Canadian household balance sheets remain resilient in Q1 despite escalating global trade uncertainty and market volatility, with household net worth eking out a small gain. Canada’s debt servicing ratio held steady at 14.4% in Q1 2025, remaining below the 15.1% peak in Q4 2023. Despite the stable ratio, debt payments are anticipated to rise over the year as 4- and 5-year fixed-rate mortgages, set during pandemic lows, continue to renew at elevated rates.

- As trade talks continue and tariff threats out of the White House show signs of de-escalating, the fears around the Canadian economy have modestly softened, at the very least reducing the probability of worst-case scenarios, according to RBC Economics.

U.S.

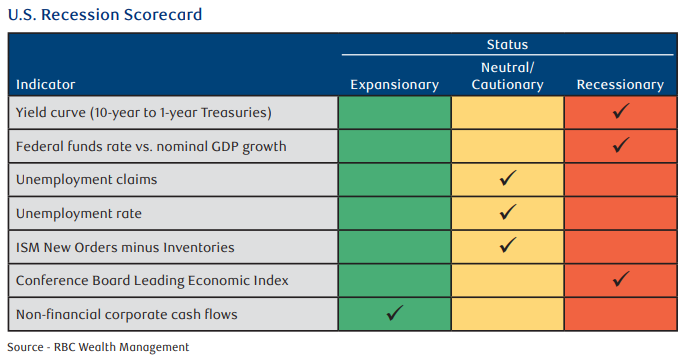

- On our Recession Scorecard (see table below) only one green indicator remains—the free cash flows generated by non-financial businesses. The rest are evenly split between cautionary yellow and recessionary red.

- Green is hard to find in today’s Scorecard. That is not necessarily sending a dire message for the U.S. economy or for global equity markets. But it does argue that a continued, uninterrupted economic expansion should not be taken for granted. Stay tuned.

- “Big and beautiful” or not? With the centerpiece of U.S. President Donald Trump’s economic agenda winding its way through Congress, we examine what’s of key interest to markets and investors, before noting why the ultimate outcome of the bill is likely to look different. Read the article here.

Further Afield

- The U.S. and China concluded two days of trade negotiations in London. Both sides agreed to address recent setbacks in implementing the Geneva agreement and to explore a path forward for stabilizing trade relations. The talks avoided escalating trade tensions and recommitted both sides to negotiations. However, few concrete details of the agreement have been disclosed thus far.

Notes About Companies in Model Portfolio

- Dollarama (DOL) reported its financial results for the first quarter ended May 4, 2025. Sales for the first quarter of fiscal 2026 increased by 8.2% to $1,521.2 million, compared to $1,405.8 million in the corresponding period of the prior fiscal year. This increase was driven by growth in the total number of stores over the past 12 months (from 1,569 on April 28, 2024 to 1,638 on May 4, 2025) and comparable store sales growth. Gross margin(1) was 44.2% of sales in the first quarter of fiscal 2026, compared to 43.2% of sales in the first quarter of fiscal 2025.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.