Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2025 edition covers Market Review for 2024, a discussion about the main themes for 2025, and some long-term multi-decade trends. In Shiuman’s Corner find out what my favourite books were from last year.

Markets

Market scorecard as of close on Friday February 28, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 25,393 | 1.0% | 2.7% |

| U.S. | S&P 500 | 5,955 | -1.0% | 1.2% |

| U.S. | NASDAQ | 18,847 | -3.5% | -2.4% |

| Europe/Asia | MSCI EAFE | 2,423 | -0.8% | 7.1% |

Source: FactSet

-

TSX finished higher in Friday afternoon trading, near best levels. Most sectors higher. TSX recorded a 1.0% weekly gain but late surge not enough to offset monthly 0.6% decline.

-

US equities were higher in choppy Friday trading, though stocks ended near best levels after big rally in final hour of trading. However, today's gains only erased some of Thursday session that saw S&P down over 1.5% and the Nasdaq off more than 2.5%, while S&P 500 and Nasdaq capped off worst week since September. Big tech higher after Mag 7 suffered worst pullback of 2025 on Thursday, while group broke six-straight declines.

-

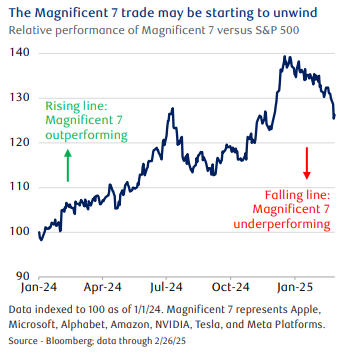

From the beginning of 2024 through mid-December 2024, the Magnificent 7 (Apple, Microsoft, Amazon, Alphabet, Meta, NVIDIA, and Tesla) outperformed the S&P 500 by nearly 40%, propelled by robust earnings growth and the intense enthusiasm surrounding artificial intelligence. However, since mid-December, the S&P 500 has outperformed the Magnificent 7 by nearly 10%, suggesting the trade’s momentum may be waning.

-

We believe these recent developments highlight the importance of diversification when it comes to managing portfolios, as shifting earnings growth dynamics could breathe new life into areas of the market that have been overlooked by investors the past 24 months.

Economy

Canada

-

Canadian GDP jumped by an annualized 2.6% in Q4, almost a full percentage point above market consensus, well above our own forecast for a 1.5% increase, and reflecting broadly based increases in spending across households and businesses.

-

Amidst trade policy uncertainty with the United States, interprovincial trade barriers within Canada have increasingly become a topic of discussion. While reducing these barriers may aid in economic efficiencies and provide a productivity boost, a solution is not so straightforward, according to RBC Economics.

U.S.

-

U.S. consumer confidence dropped sharply in February, with the Consumer Confidence Index falling to just 98.3 from 105.3 in January, the steepest decline since August 2021, according to The Conference Board.

-

January core Personal Consumer Expenditure price index (PCE) of 0.3% in line with estimates, while annual core PCE also in line with expectations, the lowest since June.

Further Afield

-

In the German federal elections, the CDU/CSU (the traditional Christian Democrat centre-right party) and SPD (the centre-left Social Democratic Party) won enough votes to form a two-party coalition government. Friedrich Merz, leader of the CDU, is set to become chancellor. Merz’s campaign promises included pro-growth supply-side reforms, some easing of regulatory and tax burdens on businesses.

-

China will begin to re-capitalize three of its largest banks by injecting at least US$55 billion of fresh capital in the coming months, according to a Bloomberg report. The objectives being to strengthen the capability of the banks to fend off risks and to spur lending.

Notes About Companies in Model Portfolio

-

Element (EFN) Reported Q4 and 2024 financial results. Element grew 2024 net revenue 13% over 2023 ("year-over-year") to $1.1 billion led largely by double-digit services revenue growth and higher net financing revenue. This resulted in adjusted EPS of $1.12 in 2024, which is a 14% increase year-over-year. 2024 adjusted operating margin was 55.3%.

-

Pembina Pipeline Corporation (PPL) announced its financial and operating results for the fourth quarter and full year of 2024. PPL reported 2024 full year earnings of $1,874 million, record full year adjusted EBITDA of $4,408 million, and record full year adjusted cash flow from operating activities of $3,265 million ($5.70 per share).

-

Royal Bank of Canada (RY) reported record net income of $5.1 billion for the quarter ended January 31, 2025, up $1.5 billion or 43% from the prior year. The inclusion of HSBC Bank Canada (HSBC Canada) results increased net income by $214 million.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman