Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2025 edition covers Market Review for 2024, a discussion about the main themes for 2025, and some long-term multi-decade trends. Shiuman’s Corner is a list of books I read last year.

Markets

Market scorecard as of close on Friday January 31, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 25,533 | 0.3% | 3.3% |

| U.S. | S&P 500 | 6,041 | -1.0% | 2.7% |

| U.S. | NASDAQ | 19,627 | -1.6% | 1.6% |

| Europe/Asia | MSCI EAFE | 2,383 | 0.9% | 5.4% |

Source: FactSet

-

TSX closed lower on a Friday afternoon session, near worst levels. Most sectors lower. Canadian equities posted their best intraday performance on Thursday since November, TSX up 0.3% for the week.

-

US equities finished down in Friday trading, ending near worst levels after early strength. S&P, Nasdaq, and Russell closed down for the week.

-

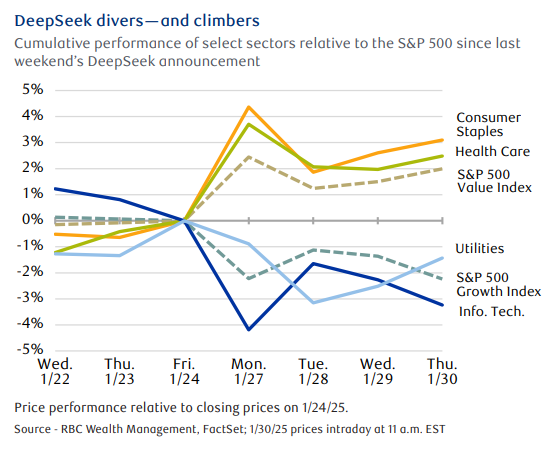

U.S. stock indexes gave back most of the gains made after the record highs achieved the prior week. Investors were caught off guard by last weekend’s announcement of a new Chinese artificial intelligence (AI) chatbot called DeepSeek that appears to use a simpler model than the leading U.S. chatbots, at a fraction of the cost.

-

The threat of a slowdown in the AI “growth trade” prompted investment flows into traditionally defensive sectors such as Consumer Staples and Health Care, although utility companies were also hit by concerns about potentially lower electricity demand.

Economy

Canada

-

Canada has been hit with its largest trade shock in nearly 100 years. As the landscape continues to evolve, RBC Economics will provide updates to our outlook, helping to build a deeper understanding of this major economic event. Read “A U.S.-Canada trade shock now in play: first economic takeaways” by RBC Economics by clicking here.

-

The Bank of Canada (BoC) cut its overnight rate by 25 basis points (bps) to 3.00% and dropped guidance of any further adjustments to borrowing costs as the threat of potential tariffs from U.S. President Donald Trump looms. The move was widely expected by both markets and economists, according to a Bloomberg survey.

-

The BoC is forecasting GDP growth to average 1.8% in both 2025 and 2026, up from 1.3% in 2024, driven by monetary easing effects, stronger household spending, and increased oil and gas export capacity.

U.S.

-

The U.S. Federal Reserve kept its policy rates unchanged and makes almost no adjustments to its recent narrative that inflation and the labour market are back to appropriate levels. Unlike the Bank of Canada’s rate cut just mere hours earlier, which was almost uniquely focused on trade conflicts, the U.S. central bank seemed to almost go out of its way to avoid mentioning any potential (however probable) policy changes from Washington D.C.

-

The Commerce Department’s initial read on Q4 2024 economic growth showed a 2.3% annualized increase in GDP, a marked slowdown from the 3.1% achieved in Q3 2024.

Further Afield

-

The European Central Bank’s (ECB) Governing Council unanimously voted to lower the deposit rate by 25 bps to 2.75%, which is in line with the market’s and our expectations. Eurozone GDP growth stalled at 0% q/q in Q4, with the two largest economies, Germany and France, showing negative growth, whereas Spain and Portugal had strong growth.

Notes About Companies in Model Portfolio

-

Apple (AAPL) announced financial results for its fiscal 2025 first quarter ended December 28, 2024. The Company posted quarterly revenue of $124.3 billion, up 4 percent year over year, and quarterly diluted earnings per share of $2.40, up 10 percent year over year.

-

CN (CNR) reported its financial and operating results for the fourth quarter and year ended December 31, 2024. Revenues of C$17,046 million, an increase of C$218 million, or 1% over the previous year. Diluted EPS of C$7.01, a decrease of 18% and adjusted diluted EPS of C$7.10, a decrease of 2%.

-

Visa (V) Reported 2025 Q1 results with net income of $5.1 billion or $2.58 per share. Net revenues were $9.5 billion, up 10% from a year ago. Payment volumes were up 9%.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman