Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website.

Markets

Market scorecard as of close on Friday January 10, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 24,768 | -1.2% | 0.2% |

| U.S. | S&P 500 | 5,827 | -1.9% | -0.9% |

| U.S. | NASDAQ | 19,162 | -2.3% | -0.8% |

| Europe/Asia | MSCI EAFE | 2,271 | 0.7% | 0.4% |

Source: FactSet

-

TSX closed sharply lower on Friday, near worst levels. Most sectors lower. Despite two prior positive sessions, Canadian equities ended down 1.2% for the week.

-

US equities ended lower Friday, a bit off worst levels, registering another weekly decline. Small caps were under pressure on rate backup. Treasuries were under pressure with yields higher across the curve.

-

Treasury bond prices faced strong selling pressure earlier in the week due to escalating concerns about faster inflation and the budget deficit. The major stock indexes also retreated as bond yields rose, continuing the pullback that began in early December following the Federal Reserve’s hawkish comments.

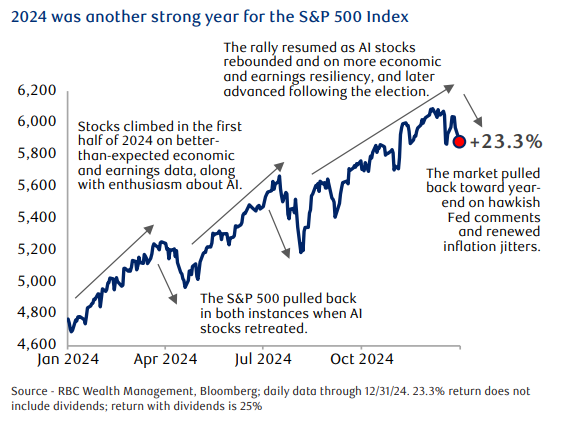

For the year 2024:

| Equity Indices | Level | 2024 |

| S&P/TSX Composite | 24,728 | 18.0% |

| S&P 500 | 5,882 | 23.3% |

| NASDAQ | 19,311 | 28.6% |

| MSCI EAFE | 2,262 | 1.1% |

-

2024 was a positive year for Canada and U.S. stock markets with the TSX up 18% and the S&P 500 up 23%. The technology heavy Nasdaq advanced 28.6%.

-

The rest of the world, represented by MSCI EAFE was up a meagre 1.1%.

Economy

Canada

-

Canadian employment jumped 91k in December - the largest increase in almost 2 years and with relatively firm underlying details including a tick lower in the unemployment rate to 6.7%

-

Canadian Prime Minister Justin Trudeau announced last Monday that he will step down as leader of the ruling Liberal Party after nine years in office, bowing out to slumping approval numbers.

-

Canadian manufacturing grew modestly in December, driven by increases in output, new customer orders, and employment. In contrast, business activity in the services sector, which accounts for roughly two-thirds of the Canadian economy, contracted in December.

U.S.

-

U.S. labour market data continue to show strength towards the end of last year, in line with job openings data that turned around to rise consecutively in October and November. We think the odds of an additional rate cut this month are low, and the central bank will more likely be holding rates steady at the current 4.25% - 4.5% range throughout 2025.

Further Afield

-

Borrowing costs have risen sharply in the UK on the back of the rise in U.S. Treasury yields, fears of the inflationary implications of the incoming Trump administration’s proposed tariffs, and the paring back of the Bank of England’s rate-cut expectations.

-

Japanese workers’ base salaries rose 2.7% y/y in November, marking the largest rise in 32 years. However, when adjusted for inflation, the average real wage decreased by 0.3% from a year earlier.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman