Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q2 2024 edition covers Market Review for year-to-date 2024, featuring an article on the Role of Artificial Intelligence.

Markets

Market scorecard as of close on Friday June 28, 2024.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 21,876 | 1.5% | 4.4% |

| U.S. | S&P 500 | 5,460 | -0.1% | 14.5% |

| U.S. | NASDAQ | 17,733 | 0.2% | 18.1% |

| Europe/Asia | MSCI EAFE | 2,315 | 0.3% | 3.5% |

Source: FactSet

-

S&P/TSX Composite Index advanced 1.5% for the week.

-

US equities closed mostly lower in quiet Friday trading, with afternoon weakness possibly a function of quarter-end flows. Major indexes logged a mixed weekly performance, with equal-weight S&P a notable laggard to the official index. Big tech was broadly lower though several names were still up solidly WTD.

Economy

Canada

-

Canadian CPI growth ticked higher in May. Excluding food and energy, price growth rose to 2.9% year-over-year from 2.7% in April, with the gain led by higher travel prices (airfares, travel tours, and traveler accommodation). The increase in CPI was the first upside surprise of 2024 following a string of softer readings.

-

RBC Economics anticipates the BoC will implement three additional 25 basis point rate cuts this year, which, in our view, could help support consumer spending in the upcoming quarters as interest rates move meaningfully lower.

-

Canada’s retail sales edged higher in April, bucking a trend of declining sales over the past three months. Retail sales expanded by 0.7% m/m in April, matching an earlier advance estimate by Statistics Canada.

U.S.

-

In housing, the U.S. Census Bureau reported that new home sales fell sharply in May to just 619,000, well below the consensus expectation of 647,500 and the lowest level since November 2023. The report is just the latest sign of the continued weakness in the housing market, as would-be homebuyers continue to struggle with affordability amid record-high home prices and elevated mortgage rates.

-

The U.S. has begun to slowly refill its Strategic Petroleum Reserve. After depleting the reserve by more than 40% from its early 2022 level in response to the energy crisis caused by the Russian invasion of Ukraine, the Biden administration has reversed course and has started the process of refilling—albeit at a slow pace.

Further Afield

-

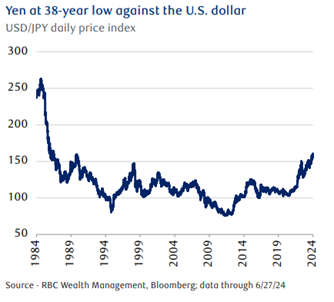

The yen fell to a 38-year low of 160.87 against the U.S. dollar, well beyond the level in April when officials intervened. Japan’s Vice Minister of Finance for International Affairs Masato Kanda reiterated that authorities are urgently watching the foreign exchange markets and would take appropriate steps as needed.

-

Economists surveyed by Bloomberg now expect China’s GDP to expand 5% in 2024, up from their 4.9% projection in May. Exports are expected to climb 4.3% y/y this year, an improvement from the 2.8% y/y forecast in the May survey.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman