Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q2 2024 edition covers Market Review for year-to-date 2024, featuring an article on the Role of Artificial Intelligence.

Markets

Market scorecard as of close on Friday June 14, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 21,639 | -1.7% | 3.2% |

| U.S. | S&P 500 | 5,432 | 1.6% | 13.9% |

| U.S. | NASDAQ | 17,689 | 3.2% | 17.8% |

| Europe/Asia | MSCI EAFE | 2,306 | -2.6% | 3.1% |

Source: FactSet

-

TSX closed lower in Friday afternoon trading, way off worst levels. Most sectors lower. Canadian equities fell 1.7% for the week, the fourth-straight weekly decline.

-

US equities finished mostly lower in Friday afternoon trading, though ended near best levels. S&P and Nasdaq both logged solid weekly gains. Big tech was mixed on another day of equal-weight S&P underperformance.

-

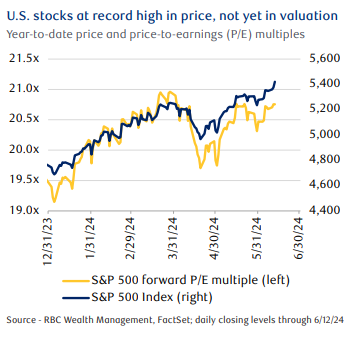

The major U.S. stock indexes set new record highs during the week and interest rates fell as the Federal Reserve appeared to be turning the tide in its battle against inflation. The release of the May Consumer Price Index (CPI) report coincided with updated economic projections from the Fed at the conclusion of its June meeting. These highly anticipated data points were better than market expectations, with some caveats.

Economy

Canada

-

May was a particularly quiet month for housing activity as many awaited the prospects of an interest rate cut, which materialized at the beginning of June when the Bank of Canada (BoC) trimmed the overnight interest rate by 25 basis points to 4.75%.

-

Signals of cooling persist in the Canadian labour market as recent employment data showed significant gains in part-time work, propping up a 27,000 increase in absolute employment, but a decline in full-time employment by 36,000 marks the largest fall in full-time positions in nearly two years, reversing the 40,000 gain seen in April.

U.S.

-

The headline CPI for May came in at an annualized rate of 3.3% versus the consensus forecast of 3.4%, and the core rate excluding food and energy showed the lowest monthly growth since August 2021.

-

The Fed’s June meeting concluded with no change in interest rates, as we expected. But the policy statement noting “modest” further progress toward inflation goals (instead of a “lack of” further progress in the prior statement) raised investors’ hopes of imminent cuts.

Further Afield

-

China’s consumer prices rose 0.3% y/y in May, according to the country’s National Bureau of Statistics, as inflation hovered above zero for the fourth consecutive month but missed the Bloomberg consensus forecast of 0.4%; economists believe the risk of disinflation remains.

Notes About Companies in Model Portfolio

-

Dollarama Inc. (DOL) reported on Wednesday its financial results for the first quarter ended April 28, 2024. Comparable store sales grew 5.6%, over and above 17.1% growth in the corresponding period of the previous year. Diluted net earnings per common share increased 22.2% to $0.77, compared to $0.63.

-

-

Dollarama also announced today that it has acquired an additional 10.0% equity interest in Latin American value retailer Dollarcity, increasing its total equity interest to 60.1%, and that it has expanded its partnership countries to include Mexico

-

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman