Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2024 edition covers Market Review for 2023, a Turning Point on interest rates, and advantages of Bonds. Plus my Book List for 2023.

Markets

Market scorecard as of close on Friday May 3rd, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 21,947 | -0.1% | 4.7% |

| U.S. | S&P 500 | 5,128 | 0.5% | 7.5% |

| U.S. | NASDAQ | 16,156 | 1.4% | 7.6% |

| Europe/Asia | MSCI EAFE | 2,284 | 0.8% | 2.1% |

Source: FactSet

-

Canadian equities finished higher Friday, near best levels. Most sectors higher. TSX edged down 0.1% on the week as a big Tuesday selloff outweighed modest gains in other four sessions.

-

US equities finished higher in Friday trading, with major indices ending the week higher. Big tech was broadly higher, with AAPL-US the notable gainer on its report. Risk-on session with further rate reprieve (and pull forward of easing expectations to September from November) was driven by “bad-news-is-good-news” theme following softer April non-farm payrolls and unexpected contraction in ISM services.

-

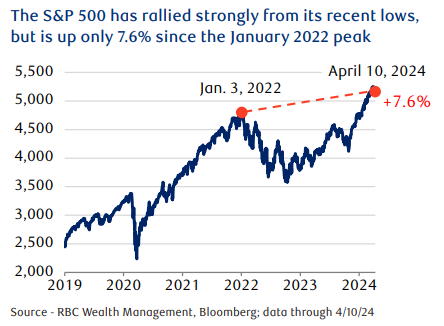

The S&P 500 has surged 25.3 percent since the October 2023 low. The 22.5 percent rally in Q4 of 2023 and Q1 of this year ranks among the top five percent of the strongest six-month moves in the last 75 years, according to data compiled by Bloomberg Intelligence. But in the context of the last couple years, the picture is less buoyant, as the chart below shows. The S&P 500 is up only 7.6 percent since the January 2022 peak.

Economy

Canada

-

After a 0.5% upside surprise in January (led largely by teachers in Quebec returning to work after being on strike), Canadian GDP growth slowed to 0.2% in February, well below the 0.4% advance estimate from Statistics Canada a month ago. The softening in growth over February and March leaves output for Q1 as a whole tracking (by our count) a 7th consecutive per-capita decline. That together with an increasingly soft labour market (unemployment rate was up 1.1% from end of 2022) and substantially slower inflation pressures are consistent with the Bank of Canada to start easing the monetary tap on the economy soon.

U.S.

-

The U.S. Fed held the fed funds target rate unchanged (as widely expected) in its May policy announcement, but acknowledged that progress in slowing inflation has stalled in recent months. Chair Powell continued to point to lower job openings as a sign that labour demand is softening, and said it is "unlikely that the next policy move will be a hike. RBC Economics’ own base case assumption is that the Fed won't cut the fed funds target until December, with that expected cut still contingent on economic growth and inflation pressures slowing.

-

Payroll employment growth slowed at the start of Q2, to 175k in April from an average pace of 270k in the first quarter. That pace itself can still be considered as solid, but was below consensus forecast of 245k. Contingent on inflation in the U.S. slowing back down throughout the year, RBC Economics expects a first rate cut to come later in December.

Further Afield

-

As we expected, the European Central Bank (ECB) held interest rates at 4% for the fifth consecutive meeting. The monetary policy statement highlighted that inflation is moving broadly in line with the central bank’s expectations and noted that if policymakers continue to observe this trend, “it would be appropriate to reduce the current level of monetary policy restriction.”

-

Some economists have started to revise China’s 2024 gross domestic product (GDP) growth forecast higher as Q1 2024 data surprised to the upside. The Bloomberg GDP consensus estimate now stands at 4.7%, up from 4.6% previously.

Notes About Companies in Model Portfolio

-

Apple (AAPL) announced Thursday financial results for its fiscal 2024 second quarter ended March 30, 2024. The Company posted quarterly revenue of $90.8 billion, down 4 percent year over year, and quarterly earnings per diluted share of $1.53. . IPhone revenue is Apple’s primary driver, and it fell 10% year over year. The year-over-year comparison was affected by $5 billion in revenue last year, pushed into the March quarter due to supply constraints in the December quarter. Adjusting for this, iPhone and total Apple revenue was closer to flat year over year.

-

Berkshire Hathaway Inc.’s (BRK.A/BRK.B) first quarter earnings release and its quarterly report on Form 10-Q were posted on the Internet on Saturday, May 4, 2024. Adjusted pretax operating earnings of $12.5 billion were up 30.9% year over year. Berkshire was once again a net seller of stocks during the first quarter, with sales of $20.0 billion offset by purchases of $2.7 billion. CEO Warren Buffett confirmed in the annual meeting that Berkshire sold about 13% of its stake in Apple for around $20 billion during the March quarter. Buffett stated that his views of the Apple business have not changed since original purchase, that he expects AAPL to remain its largest common stock holding at year-end, while acknowledging that they have sold shares. For those interested to read Warren Buffett’s letter to shareholders, it can be found here.

-

Brookfield Infrastructure Partners L.P (BIP.UN) announced on Wednesday its results for the first quarter ended March 31, 2024. Brookfield Infrastructure reported net income of $170 million for the three-month period ended March 31, 2024 compared to $23 million in the prior year. Current quarter results benefited from strong operational performance and the contribution from recent acquisitions. Funds from operations (FFO) of $615 million increased by 11% compared with the same period last year. This increase reflects organic growth of 7%, as well as strong contributions associated with over $2 billion of new investments.

-

Fortis Inc. (FTS), a well-diversified leader in the North American regulated electric and gas utility industry, released its first quarter results on Wednesday. First quarter net earnings of $459 million or $0.93 per common share, up from $437 million or $0.90 per common share in 2023. Growth in earnings was due to the timing of recognition of new cost of capital parameters approved for the FortisBC utilities in September 2023, retroactive to January 1, 2023, as well as rate base growth across utilities.

-

Johnson & Johnson (JNJ) announced on Wednesday a proposed Plan of Reorganization by its subsidiary, LLT Management LLC, for the comprehensive and final resolution of all current and future claims related to ovarian cancer arising from cosmetic talc litigation against it and its affiliates in the United States.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman