Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2024 edition covers Market Review for 2023, a Turning Point on interest rates, and advantages of Bonds. Plus my Book List for 2023.

Markets

Market scorecard as of close on Friday March 15, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 21,849 | 0.5% | 4.2% |

| U.S. | S&P 500 | 5,117 | -0.1% | 7.3% |

| U.S. | NASDAQ | 15,973 | -0.7% | 6.4% |

| Europe/Asia | MSCI EAFE | 2,325 | -1.4% | 4.0% |

Source: FactSet

-

The TSX finished up 0.5% for the week.

-

U.S. markets were down on the week, but the S&P 500 is still up 7.3% year-to-date.

Economy

Canada

-

The Canadian economy added 41,000 jobs in February, doubling consensus expectations. However, the labour force grew by 83,000, and thus the unemployment rate increased by 0.1% to 5.8%. In our view, high interest rates and tepid economic growth could remain headwinds to hiring trends in the near term.

-

According to RBC Economics, home sales picked up in February, notably in Vancouver, Edmonton, Hamilton, and Montreal, driven in part by softening recessionary risks and improved optimism surrounding the Canadian economy. Overall, RBC Economics thinks a substantial recovery in activity is unlikely to take place until interest rates fall more meaningfully, potentially in the second half of 2024.

U.S.

-

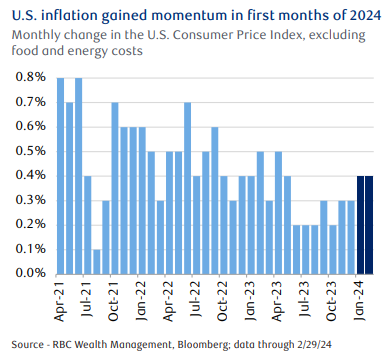

Inflation in the U.S. gained momentum in February for the second month in a row, reinforcing the Federal Reserve’s cautious stance on rate cuts this year. Headline inflation rose 0.4% in February, mostly led by higher gasoline prices, whereas food prices came in flat.

-

The U.S. Federal Reserve is widely expected to stand pat on the fed funds range for a fifth consecutive meeting on Wednesday. But any shift in the monetary policy statement language will be closely watched after two straight months of upside surprises on inflation.

Further Afield

-

Eurozone industrial production slumped by 3.2% m/m in January and largely reversed December’s 2.6% m/m expansion, thus exerting pressure on Q1 GDP and increasing risks of stagnation.

-

UK GDP rebounded following two consecutive quarters of negative growth in H2 2023. GDP expanded by 0.2% y/y in January, in line with economist consensus expectations.

Notes About Companies in Model Portfolio

-

Apple (AAPL) People familiar with the situation say that Apple and Google are actively negotiating a deal that would allow Apple to license Gemini to power certain new iPhone software features coming this year, although no decision has been made yet over the terms or branding.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman