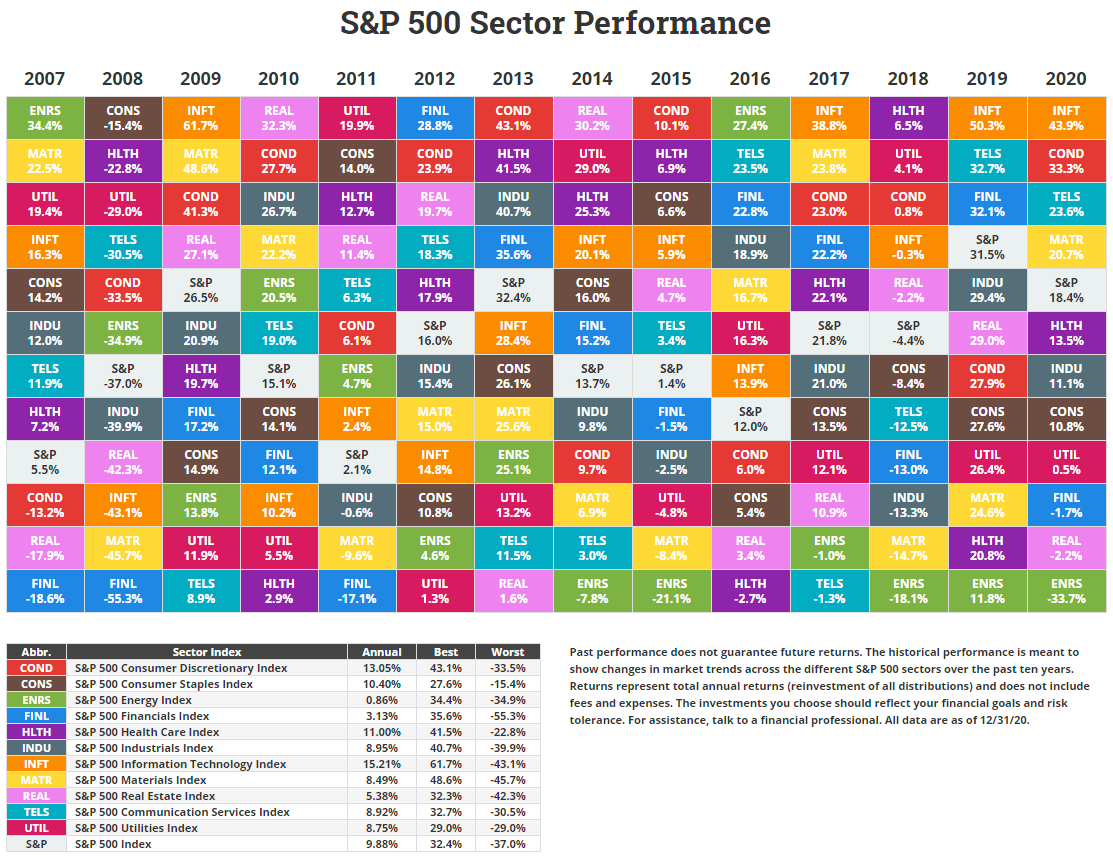

Last week I talked about how to construct a portfolio with a focus on risk management. We are all bombarded with investment choices: Royal Bank or Amazon?, Canadian Tire or McDonalds?, and it’s not easy to choose. However, if you make a conscious effort to set your initial mix of bonds and stocks based on your needs (see blog #12: Asset Allocation), and if you diversify by sector, geography, size and/or style, the importance of picking the “winning” stock will be reduced. Given the variability of sector performance each year (see diagram below) what do you think the average investor’s chances are of picking the right sector, much less stock, from year to year? Very low I suspect.

Retrieved from https://novelinvestor.com/sector-performance/

Timing the market is another dubious method I see investors use to attempt to manage risk. Here are some examples:

- The market has been steadily moving up. I will sell now, wait for the drop and then buy back in.

- The market has been steadily moving down. I will sell now, wait for it to hit bottom and then buy back in.

Seems logical and reasonable but unfortunately the market isn’t logical and reasonable! When you cash out of the market, you are making a big bet (see previous blog on gambling vs investing). If I was given a dollar for every time a client told me that he or she had a feeling the market was going to drop, I could retire now! It was going to drop if Trump got in, and when he did, it roared! It was going to drop if the Democrats got in, and when they did, it roared! While we think we know how the market will react to a macro event we really don’t!! And knowing when to buy back in is even harder! How low it will go is anyone’s guess and, when you think it is “turning,” there are typically some false starts along the way. And, when it does turn back up it typically does a significant move in 1 to 2 days. If you miss those days, then you miss the big opportunity that you were trying to capitalize on!

The good news is that there is a better way to manage risk that doesn’t rely on guesswork. It’s called regular rebalancing. Regular rebalancing enables an investor to buy low and sell high. Here’s how it works. I assign a percentage weight to each investment in my portfolio and the total sums to 100%. On the selected rebalance date (could be every quarter, every six months or once a year) I sell the portion of the position that is above the assigned weight and buy more of the position that is below the assigned weight. For example, if Shopify is a 5% weight at $5000 and grows to $7000 by my rebalance date then I take the $2000 profit and invest it in say Royal Bank which is a 10% weight and has gone from $10,000 to $8000 on the rebalance date. Of course, frequent rebalancing can be expensive if you are in a commission-based account and have to pay a fee for each trade. Much better to execute in a fee-based account with no trading fees. More on fees in the next blog.