Given that we have just finished personal tax season, it’s a good time to review the taxation of investments in non-registered accounts. With investments in registered accounts (such as RRSPs, RIFs, LIRAs, LIFs and TFSAs), there are no tax consequences when you buy or sell and earn income. You don’t need to claim your gains or losses or the income you have earned from dividend or interest payments. All types of investments within registered accounts are treated equally by Revenue Canada. As such, the only time you are taxed on these investments is when you withdraw funds from the accounts (with the exception of the TFSA, which is truly tax free!). The amount you withdraw is considered income and will be taxed based on your marginal tax rate. See tax table. Non-registered accounts are a different story.

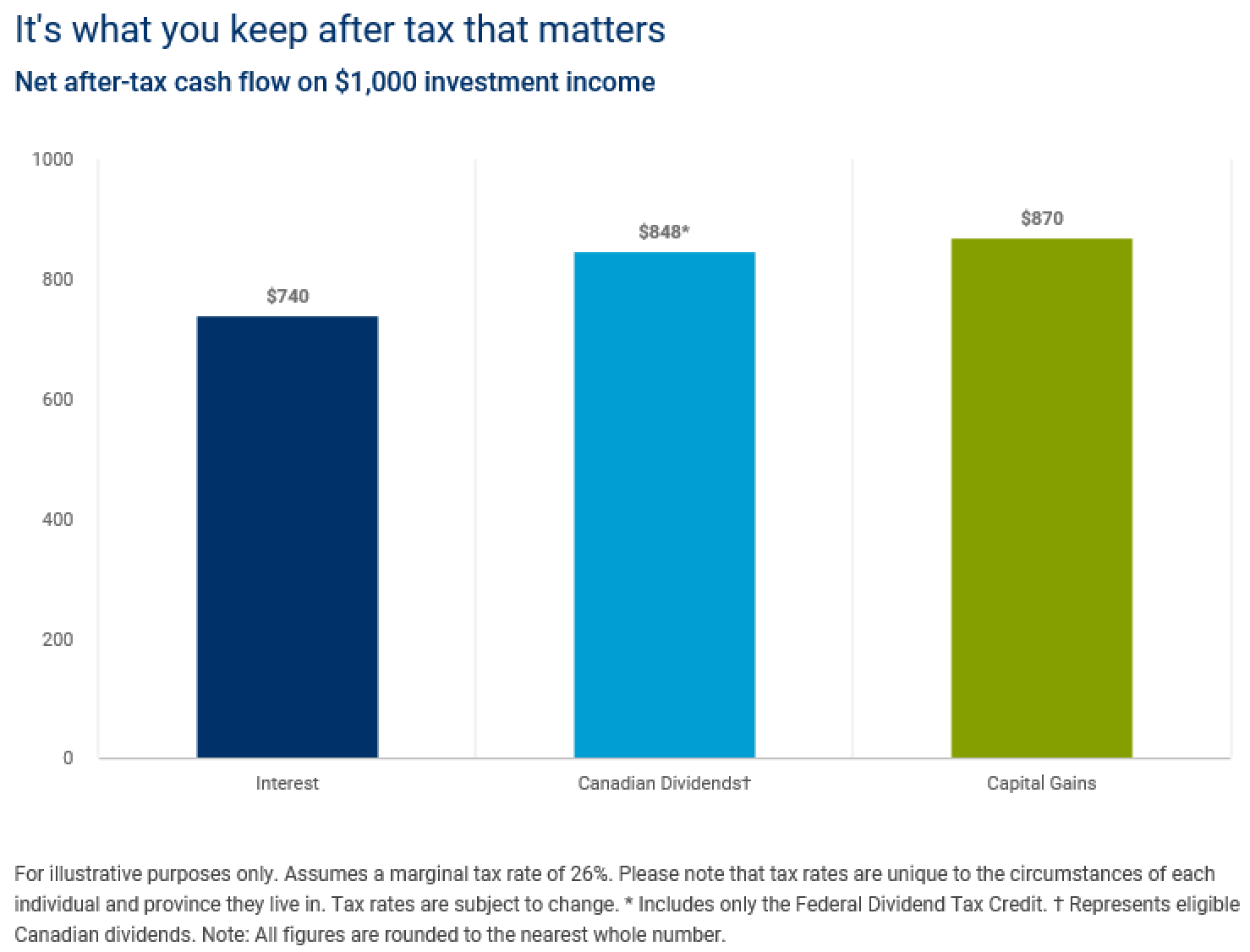

In non-registered accounts, the amount of tax you pay depends on the type of investment. If you own bonds which pay interest income, the interest income is taxed at your marginal tax rate. Therefore, interest income is the least tax efficient type of investment income. In contrast, dividends paid on stocks issued by Canadian companies receive more favourable tax treatment, since this type of income benefits from the federal dividend tax credit. Canadian dividend income is more tax-efficient than interest income, which ultimately means that investors in Canadian dividend-paying investments keep more of what they earn after taxes. Unfortunately, dividend income from US companies doesn’t receive this favourable tax treatment and is taxed the same as interest income.

Capital gains happen when you sell your investment for a higher price than what you paid for it. This difference is recognized as taxable income. Similar to Canadian dividend income, capital gains also receive relatively favourable tax treatment, since only half of the capital gain is subject to taxation. Dividends and capital gains are typically earned on equity investments. So you might be thinking, then should I have all equity investments in my non-registered account to maximize the tax efficiency? The answer is yes, that would be the most tax efficient, but there are other factors to consider. A 100% equity portfolio will fluctuate a lot more with market changes and if that makes you uncomfortable then including some fixed income to stabilize the portfolio will help. Also, if you are drawing a lot of income from your non-registered portfolio and the market is declining, then you will deplete your portfolio a lot faster than drawing the funds from fixed income.

Retrieved from: https://www.rbcgam.com/en/ca/learn-plan/investment-basics/understanding-taxes-and-your-investments/detail

A few more important points to keep in mind about the taxes on your investments:

- If you own mutual funds that hold stocks you may be subject to two rounds of capital gains or losses. The gain or loss when you sell the fund and the gain or loss when the manager sells the holdings in the fund. In other words, even if you don’t sell the fund the manager may have made changes to the fund and triggered gains. If this occurs, you should receive a tax slip reporting the amount of the gain.

- Make sure that you always report capital losses in non-registered accounts as they will offset your gains and will reduce the amount of tax owing. Losses can be carried back three years and they carry forward until you die so they are to be recognized.

- If you want to move a non-registered investment into a registered account in-kind to make for example a TFSA or RRSP contribution (in-kind means that you don’t sell the investment and move the cash, you just transfer the investment as is into the account), then you should be aware of the tax rules. If the investment has a capital gain when you move it into the registered account the capital gain will be triggered and tax will be owing. From a tax standpoint you can’t avoid paying the capital gain tax whether you move cash or the investment. However, if there is a loss on the investment and you move it in-kind into a registered account, CRA will not recognize the loss! You can only claim the loss if you sell the investment and move the cash. Fair? Absolutely not!

- Finally, be sure to deduct any investment management fees on non-registered accounts at tax time. Unfortunately, they can’t be deducted for registered accounts.