Let's review basic terminology so that we are all on the same page. In a previous post, we briefly discussed stocks and mentioned that they represent ownership in a company. You make money when the stock goes up. But some companies offer another way to make money. They will actually pay you money each year just to keep owning the stock! Let's look at an example. It will cost you about $130 US to buy 1 share of Apple stock today and if you buy that 1 share, Apple will pay you $2.62 US every year that you hold it. Plus, if they continue to make lots of money they might even increase that amount! The amount they pay is called a dividend. So, with some companies you make money from the stock price going up (when you sell it) and the dividend which you get every year. Very similar to buying an apartment, renting it out and receiving regular rent checks from the renter and then selling it at a higher market value.

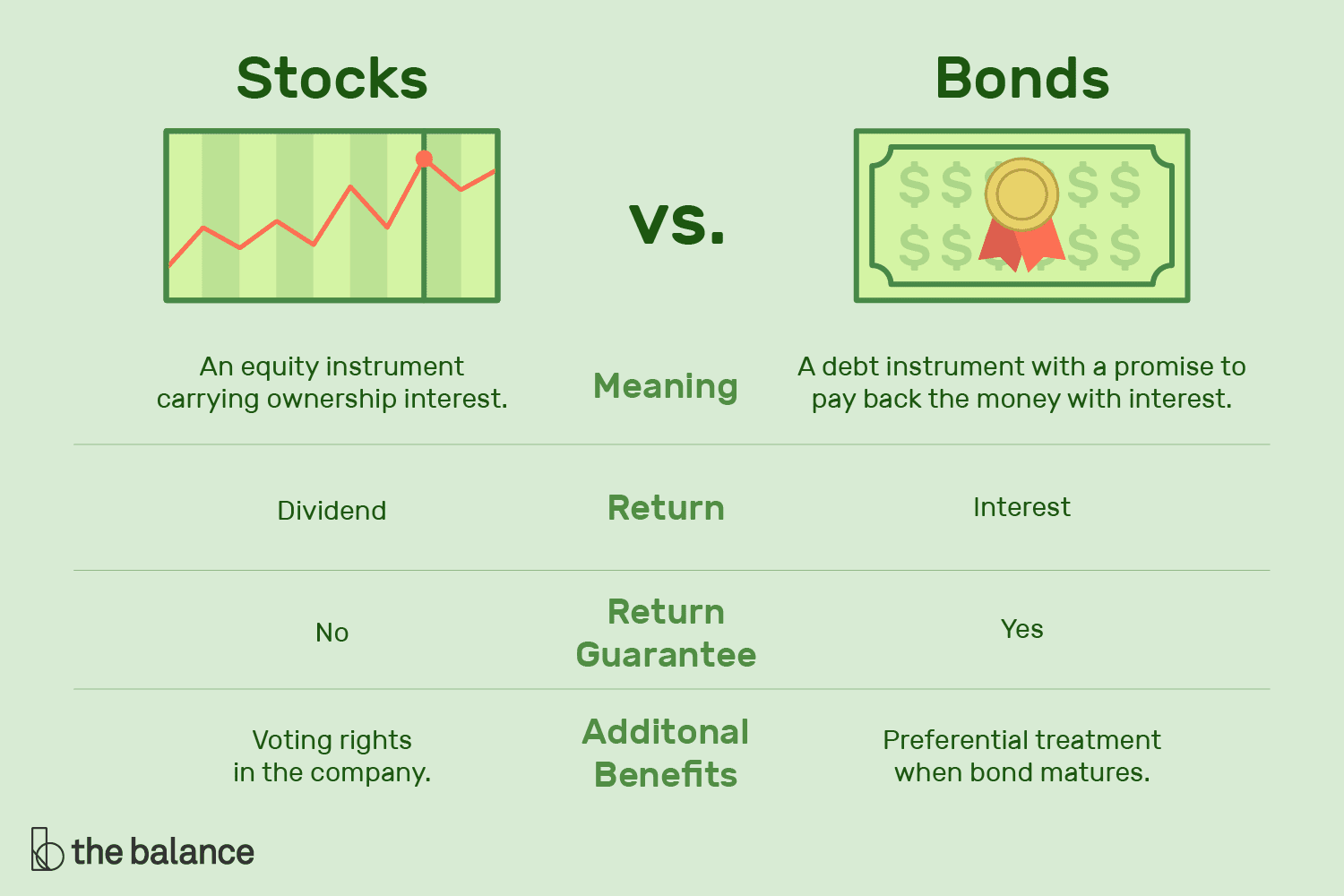

Many investors are familiar with stocks, but there is another big category that you need to know about and that’s bonds. Bonds can be a bit more confusing. Whereas with stocks you own a piece of a company, with bonds you lend money to a company and want to get your money back. You can choose how long you lend the money for and the company will pay you some money (called interest) for borrowing it from you. When I explained bonds to Natalie she said, “It doesn’t sound like I can make much money from bonds compared to stocks so why bother?”. Great question. Why do investors buy bonds?

Two main reasons. One, they really like the part about getting their money back. With stocks, there is no end date which means you don’t know when you’ll get your money back. Bonds are more secure in this way. The other reason is that, if you are really clever, you can make money trading bonds just like you can make money trading stocks. Let me explain.

Kenny, T. (29 October, 2020). How Stocks and Bonds Differ and Why it Matters. The Balance. Retrieved on 3 March, 2020 from https://www.thebalance.com/the-difference-between-stocks-and-bonds-417069

When bonds are born they are called Par. Not Fred. Not Sally. Just Par. (A little attempt at humor as discussions about bonds can be a bit dry). In the bond world Par is a fixed value, usually $1000. So, if you bought a new baby bond it would cost you $1000 and at the end of the agreed upon term (i.e. 1 year, 5 years, 30 years, etc.), whatever you choose and is available, you would get the $1000 back, plus every year you would have received some money in a fixed interest payment that doesn’t change (i.e. 2%, 5%, 3.5%). So as you can see, you know how much you are going to make when you buy it and you know you are going to get your money back (unless something goes terribly wrong with the company and they go out of business). Perfect for those that need that security.

However, most bonds aren’t bought when they are new. Most are bought when they have been trading in the market, and just like stocks when they hit the market there are buyers and sellers haggling over them so their price fluctuates based on supply and demand. OK, so how can I make money on them? Buy low, sell high just like stocks of course! If I buy a bond below Par and keep it until the end of the term (called maturity) I make money both on the price appreciation and the interest payment. Let’s say you bought a 5 year bond for $900 with a 5% interest payment (called coupon) that you hold until it matures. You would get $100 (bought for $900, matures at $1000) plus $50 for each of the 5 years you held it. That’s it? You may be thinking. Well, another option is you could watch the price because it’s going to fluctuate the whole time just like a stock and when you think it’s gone as high as it can go, you could sell it before it matures. In that case, you get to keep the coupon payment that you’ve earned since you bought it and the money you made by it going up. That is what bond traders do. They are constantly selling huge quantities of bonds and making (sometimes losing) huge amounts of money.

I warned you that bonds can be a little confusing but the good news is that most investors don’t buy individual bonds and you don’t even have to buy individual stocks. There are other great options which I’ll explain next week.