Despite the chilly temperatures and lingering snow, Spring 2024 officially arrived last week. With the changing of seasons comes the release of the RBC Global Asset Management spring report. This year they’ve “condensed” it to a manageable 84 pages. So for those who prefer the short version, this post will be focused on providing the Cole’s notes of the report and a few other insights over the past month. If anyone is keen on diving into the full report, just reach out to one of our team members or email us at scrimgeourgrahamwealth@rbc.com and we’ll gladly share the entire report…for the true enthusiasts.

So let's dive in...

- They are upgrading their economic outlook.

A variety of factors have motivated them to upgrade the likelihood of a soft landing for the U.S. economy to 60% from 40% last quarter and now look for modest growth in the first half of 2024 instead of recession. They also boosted the 2024 forecast for real U.S. GDP growth to 2.4% from 0.3% and project further moderate growth in 2025 that could be even stronger if central-bank rate cuts unfold.

- Rate cuts not hikes.

The period of aggressive central-bank rate hikes ended last year, with a small number of central banks, starting to ease monetary conditions. Major developed-world central banks are now in a position to do so for several reasons. Inflation has dropped significantly and most major economies have recorded uncomfortably slow growth over the past year. They forecast five 25-basis-point policy-rate cuts in the U.S. over the next year, although recognize that the timing and pace of monetary-policy adjustments will ultimately be guided by the path of the economy and inflation. Canada will need to follow suit.

- Speaking of Canada?

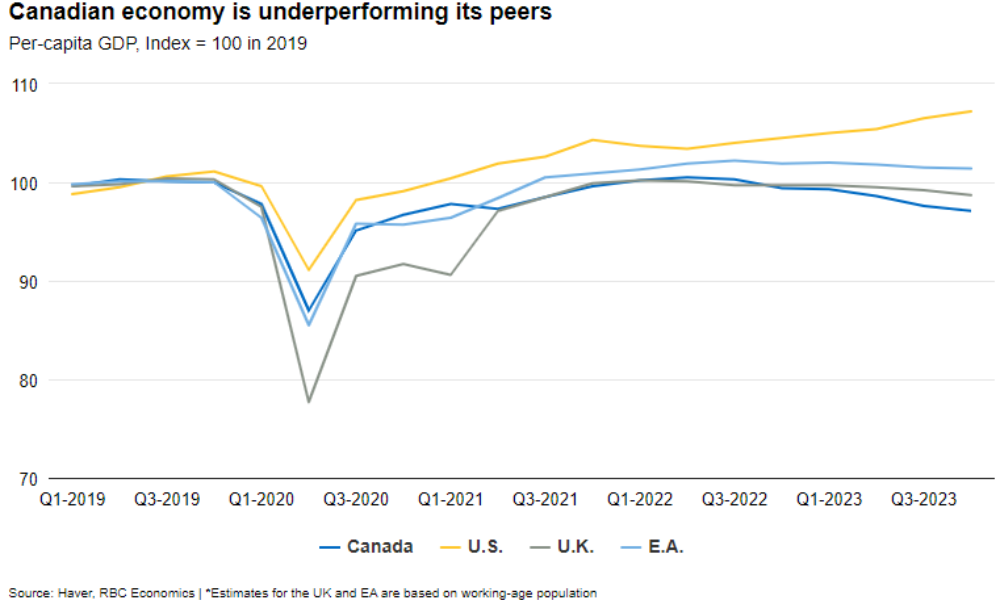

While the global economy managed to avert an economic slowdown last year, the Canadian economy has lagged major developed peers. Canada’s GDP growth gained momentum over the previous quarter but still failed to keep up with the rapid population growth and fellow developed countries. We are the dark blue line on the graph. AKA, last.

- Stocks at all-time highs? Well…some of them

It was a powerful rally last quarter, across the board. However, for the big gains it was a very narrow market. There are lots of people that believe the Magnificent 7 are in quite a bubble given the extraordinary gains. RBC notes that these stocks are benefiting from trends in artificial intelligence and are not necessarily overpriced, as long as they grow their aggregate earnings by 23% each year for the next 15 years to justify their current valuation premium versus the rest of the market. No easy task but maybe?

-

Last but not least.

This wasn’t in their report but for those that don't know Jerome Powell, he is the Chair for the Central Bank of the US and he has managed to get:

a) The US Indices back to highs

b) The US Economy growing vs the assumed recession

c) He did this all with interest rates at 40 year highs

For that, he deserves a thumbs up... the only thing he couldn't do was revive the meme stocks. He is human.

Have a great rest of the week, and enjoy the upcoming long weekend holiday with friends/family!

- The Scrimgeour & Graham Wealth Management Group