Late last year, we expressed a relatively sanguine view on U.S. debt levels . Since then, the U.S. fiscal position has undeniably deteriorated: debt-to-GDP has moved higher, debt servicing costs increased, and the Congressional Budget Office’s projected fiscal balances shifted deeper into deficits. In short, the U.S. has more debt, more expensive debt, and is adding to the burden at a faster pace. Rating agencies have taken note, with fiscal policy and government dysfunction causing the U.S. to lose its AAA status.

At least for now, however, markets are shrugging off the news. As of Dec. 6, equity and bond markets were higher on the year, and the dollar had appreciated against trading partner currencies—a strange result if investors were worried about rising U.S. government credit risk.

We expect this behavior to continue and for asset prices to ignore U.S. debt levels. Longer-term, we continue to believe that investment plans built around any potential U.S. debt crisis are likely to underperform a balanced portfolio by significant amounts.

What gets (mis)measured gets (mis)managed?

The federal government has an astonishing $33 trillion in debt. Even after eliminating borrowing between various government agencies and adjusting for the growth of the economy, the only comparable debt in modern U.S. history was after World War II.

But that particular measurement—debt owed directly by the U.S. government to investors—is not the only measure of financial leverage in the overall economy. Households, banks, local governments, and non-financial corporations all rely on borrowed money to varying extents. And in these other areas, the U.S. doesn’t look so bad.

In a broader sense, the U.S. is not so different after all

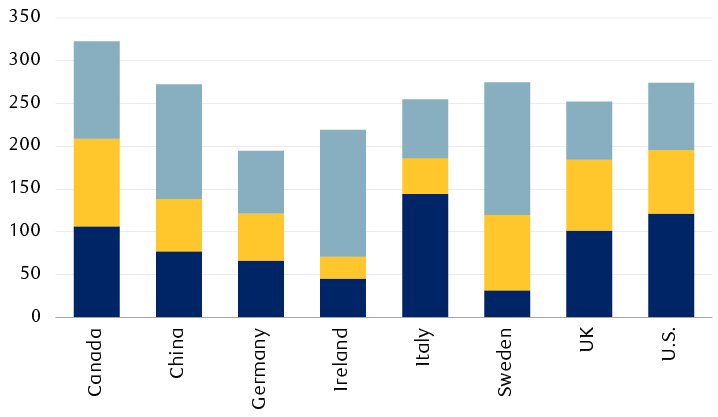

Debt including bonds, loans, and debt securities as percentage of 2022 GDP

The column chart shows debt including bonds, loans, and debt securities as a percentage of 2022 gross domestic product (GDP) for Canada (322%), China (272%), Germany (194%), Ireland (219%), Italy (254%), Sweden (274%), the UK (252%), and the United States (273%). Total debt for each country is made up of non-financial corporate debt, household debt, and general government debt.

Source - International Monetary Fund

This borrowing by lower-level entities has two impacts on a nation’s financial balance.

One is the direct impact. Borrowing by households, for instance, tends to reduce future consumption as resources are diverted to debt servicing. At a macro level, there is little difference if GDP growth is under pressure from debt-laden governments or over-leveraged households—the economic risk and pain are substantially the same.

The other concern is that in a crisis this non-government debt will ultimately have to be backed by the entire nation and, as such, should be viewed as contingent obligations of the central government. The quintessential example, in our view, is the global financial crisis, when bank and household mortgage debt was effectively backstopped by an alphabet soup of government programs.

While we don’t see a repeat of 2008 in the offing, we do think it’s important to contextualize debt data between countries. Germany’s federal debt is extremely low by international standards, but its banking system liabilities relative to GDP nearly triples that of the U.S. China is a net creditor at the national level, but the picture shifts when including substantial municipal and local government debt—a factor in Moody’s recent decision to shift to a negative outlook on the world’s second-largest economy. Closer to the U.S., Canada’s federal debt is low, but households have built up a substantial debt burden—nearly 50 percent larger than the U.S. numbers adjusted for GDP.

Ignoring these liabilities and focusing only on central government debt ignores the similarities in the day-to-day impact of leverage on the broader economy, and also ignores the potential for a rapid and unforeseen increase in national debt in a crisis.

What you see is what you get

Say what you will about the U.S. appropriations process, it’s an open book . This transparency is another underappreciated strength of the U.S. in terms of debt crisis risk.

Financial crises tend to arise when there is a rapid, unforeseen event. Problems with a long lead time tend to get resolved with adjustments instead of shocks. And this is what we see as likely: a gradual shift toward fiscal balance as the cost of debt funding erodes the value of tax cuts and higher spending.

Better before it gets worse

Even though we think a gradual adjustment is likely, we don’t expect it to be anytime soon.

To begin with, not many people really care about fixing the problem. Surveys of even self-described fiscal hawks show that when it comes to ranking policy choices, debt reduction falls below tax cuts and identifiable spending priorities. In short, everyone wants debt reduction if someone else makes the sacrifice. That’s a political non-starter.

The overarching problem with pushing for lower debt levels is the near-total lack of evidence on what debt level creates problems for countries that issue bonds in their own currency. The best evidence we have is negative: Japan shows us that debt-to-GDP over 200 percent is not incompatible with low interest rates and low perceived default risk. Beyond that, we are in terra incognita.

The healthiest canary in the flock

This lack of empirical data cuts both ways. It makes it perfectly plausible to argue that the U.S. is on the cusp of losing investor confidence because of its large stock of outstanding debt.

For investors who remain convinced that a U.S. debt crisis is inevitable, we think bond financing markets are one clear indicator that there is no imminent concern.

Most bonds are financed using repurchase agreements, more commonly known as repos. A repo is essentially a short-term loan with bonds offered as collateral. Most repo loans are repaid within a day, meaning that lenders typically risk millions of dollars of cash to earn mere hundreds of dollars in interest. Odds like that tend to focus the mind on collateral quality, to say the least.

In repo markets, across all the different bond issuers, U.S. Treasuries are the preferred asset type for most lenders. Borrowers with Treasury collateral, broadly speaking, can borrow more and pay less than investors who offer other bonds as security. We see repo lenders as having the best claim to “canary in the coal mine” status for U.S. credit risk, and they are chirping happily as far as we can see.

No there, there

For at least 40 years, we have been hearing how U.S. fiscal imbalances are unsustainable. And for all that time those imbalances have been sustained, the U.S. economy has grown, and financial markets have generated positive returns.

Given this outcome, we find it somewhat surprising that the press continues to attach so much importance to U.S. debt levels. People generally focus on strategies that have worked, and this input has been an unmitigated failure for decades. We think that history is likely to continue and that positioning for a U.S. debt crisis is likely to lead to subpar returns.