It’s hard to believe that I wrote this piece only two and a half years ago. I had no idea about Covid-19 when I talked about how Debt, Divorce, Disability and Inflation can really hurt your finances. Looking back, the pandemic has kind of brought all four “horsemen” into play for many of you. The economic hit has caused debt levels to go up, many people that have survived contracting the virus are left with long-term health problems that limit their ability to work fully and then add on the stress for couples who are dealing with the financial difficulties of top of all of this….

These are all real problems for many people but their impact on the larger group is starting to peak as we inch closer to the end of lockdowns. We are now dealing with that final horseman, Inflation, and this might be the most difficult one to defeat. Inflation is hitting in all kinds of different ways but you are absolutely feeling the impact every day. From the fence at your house that cost you $1000 more to your grocery bill going up 10% in the past 6 months, inflation around much of the world has been growing at nearly 4% annually over the past 6 months.

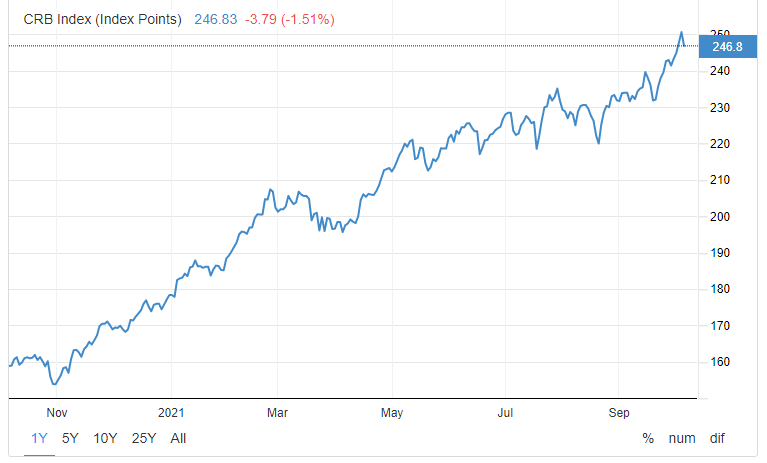

Where this is showing up most is in the raw commodities. Things like oil (check those gas prices!) and food and copper. If you don’t believe me, check out this 1 year chart of the CRB Commodities Index which I found on Trading Economics.

In 2021, the commodities index is up over 38%. Now that’s off the low levels of last summer when nearly everything was shut down across the world, but we are also sitting at an index level not seen since January of 2015. Commodities are hot and with disruptions to supply chains and the resulting delays in shipping products, I don’t expect this to change anytime soon despite our central bankers calling inflation “transitory”.

Now what can an investor do about it? I think for your bond allocation you should now be focused on shorter duration. For over 40 years, owning long term bonds (20 years and longer) has been a fantastic decision. I think inflation ultimately leads to interest rates rising earlier than expected and that means more volatile times for longer term bonds. Go short. Five years and under. Real yields (interest paid minus inflation) of almost all bonds are negative but at least with shorter time frames until maturity, you won’t have to deal with the ups and downs of your invested capital. I will have more on this and Real Return bonds soon.

For your stock allocation, I want to highlight this great breakdown by Dale Roberts of CTC Investing. Dale combed through lots of available research and found that commodities, and especially oil, outperformed during inflationary times. Now if you have some qualms about investing in oil or commodity stocks, an alternative would be to find areas with high demand that can pass on price increases to consumers without seeing a drop in consumer demand.

I think this is a time to get yourself prepared on the spending side of your life as well. Look at your unsecured debt and your discretionary spending, and try to figure out what higher prices and/or higher interest rates would do to your finances. This isn’t a call for you to do some zero-based budgeting, rather it’s a comment that it is always easier to make some tough decisions when you aren’t being forced to make them right away. You have some time to prepare now so use it wisely, lest the Four Horsemen run rampant over your wealth.