I took a much needed break last week because being a fan of a team in their first NBA Finals is pretty draining (Let’s go Raptors!!!). Seriously though, I just needed that time to not see/hear/read anything about investing, or markets, or politics, and boy was it a nice break. Stepping away allows my brain time to turn down the noise and just ponder. I highly encourage it. This post is about one of the ideas I spent a lot of time pondering.

What rate of return on your invested savings do you need to match your retirement needs? This one question is the fuel for a world with over 100,000 open-end investment funds (AKA mutual funds). Did you catch that number? Yes, worldwide there are around 119,000 open-end investment funds, and each of those funds has a marketing department selling its fund to investors like you and advisors like me. Mind. Blown.

Marketing for open-end investments funds takes a bunch of different forms. Here is US giant, Fidelity Investments with a basic play on their “contrarian-ness”.

In this next example is RBC Global Asset Management using a different tactic, highlighting their expertise. They showcase their expertise in emerging markets by featuring the large amount of money they manage in this specific area. I mean, wow, $22 Billion!

The purpose of this post isn’t to rail about these specific marketing efforts. I have no problem with a corporation trying to increase their sales and grow their business in a fair and truthful manner. Fidelity and RBC are both doing this in their marketing, and if companies never marketed their “expertise” or their “uniqueness” then we wouldn’t have much of an economy.

Here is the rub with trying to market 119,000 open-end investment funds around the world. Every single fund’s marketing department is selling you on some characteristic of outperformance, but how important is that in reality?

Do you remember the question I started this post with? What rate of return on your invested savings do you need to match your retirement needs? That is the key question for almost anyone reading this today. I am willing to bet that most readers focused on the rate of return portion and missed the key variable within the question - your savings.

How much you SAVE makes a world of difference in answering what rate of return you need on those savings. In every single financial plan we have done for clients, how much they save is the biggest contributor to their future goals. If you can save a lot of money now, it changes the math for you in each year that follows. Saving now is a form of compounding that is often ignored. Saving helps you build good habits in managing your expenses. That habit helps you avoid lifestyle creep, which helps you save even more money as your income grows. Those good habits transfer over to retirement as you will feel the need to spend less of your savings when the time comes. As you can see, the benefits of saving compound to your advantage.

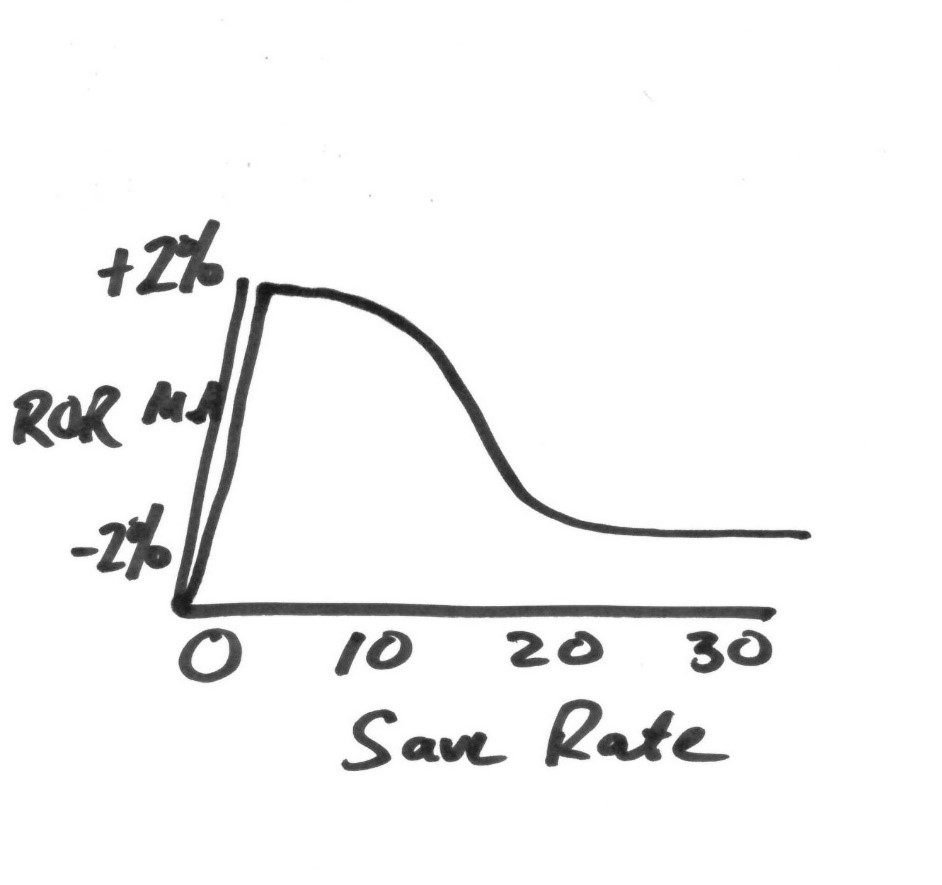

Which brings me back to our question - what rate of return on my invested savings do I need to match my retirement needs? While not exact, I think this graph I drew (hat tip to Carl Richards of Behavior Gap for the inspiration) is a pretty good way to answer that question for most people.

(Property of Samuel Rook. I take full credit for its awesomeness.)

If you save very little (x-axis), you absolutely need to beat the market average (y-axis), but as your Save Rate goes higher, the rate of return you need lowers. You no longer need to beat the market average. The simple decision to save more, changes a lot of other inputs in your favour. The more you save, the less you need to be bothered chasing “market beating returns”, and the less you need Fidelity’s “great minds” and RBC’s “emerging market expertise” to reach your retirement goals. Not needing to outperform a market comes with an added benefit as well. You sleep better at night when you’re not worrying about whether your portfolio has gone up or down in the last month.

Instead of focusing on whether your portfolio is beating an arbitrary average, look at a much more important factor to your success - your savings rate. If you can improve that, you won’t need to worry about outperforming the market and you will be a lot closer to meeting your retirement needs. Market-beating savings beats market-beating returns every time.