If you have read this space more than once, you have heard me climb on my horse and talk about the importance of “planning” or a “financial plan”. I think having a financial plan is the best thing you can do for your finances, even though it starts going out of date almost as soon as it is completed. You are probably wondering why I place so much weight behind something that goes stale so fast and to that I argue; have you ever seen how many baguettes get sold in a bakery every weekend?

The Financial Plan, as marketed in our industry, is this all-seeing, all-knowing bible-like document that is meant to show you, the client, how to use your savings towards achieving any number of goals. It is often many pages long with beautiful charts and graphs that lend a sense of permanence to “the plan” as your map towards these goals. The reality is that nothing, and I mean NOTHING, you put in a plan today is guaranteed to come true. If that is the case, what exactly is a financial plan?

Consider it a snapshot of your current finances, current goals and current assumptions that is designed to give you an outline of how to achieve your goals. More importantly, a good plan should also help to uncover the risks that could seriously impact you and your family should they come true.

A good plan is a fluid and ever-changing exercise that adjusts to your ever-changing life and/or goals. As you change, your plan should change along with it. A good plan is written in pencil not ink because life is never written in ink.

The other misconception surrounding financial plans is the appropriate target for planning. If a plan is meant to help you meet your goals throughout life, why is it mainly targeted at 60 year olds close to retirement? The benefit of having financial planning done is that it allows a person to compound the good (saving and investing) and minimize the risk of the bad (disability and illness). Each of these factors work in a push-pull system to impact your finances. You can be a great saver, but if you become permanently disabled at 30 and can no longer work, your saving and investing is going to be impacted.

This is why I a firm believer that planning is MORE important for young people because the benefit is so much greater. At 30, time is your friend. Your investments will have plenty of time to grow. Your earnings will more than likely increase. The cost to insure yourself is much lower too. Good financial planning will help improve all these areas for you, and when you compound that benefit over a person’s lifetime you can see why I think planning is so important for young people. I am not advocating against planning for people nearing retirement because I do a lot of that for my clients, but the time value of compounding investment returns is lower and the cost of risk management structures like insurance is much higher. How does paying more for things and having less of the benefit of compounding work in your favour?

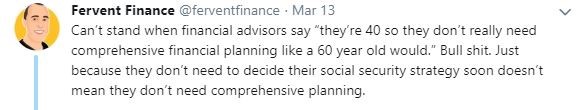

Plans don’t need to be dozens of pages long. They don’t need fancy graphs and nice covers. A good financial plan should reflect you and your wishes. It should be simple to follow, easy to replicate, quick to adapt and have just enough information to help you plan for next year. Planning should NOT be the cheapest option available, nor should it involve so much complexity that you need a team of lawyers and accountants to decipher everything. A good financial plan is worth the price because it will save you the cost in the end. That is why I think financial plans matter and matter even more for younger people. Why wait until the costs are going up and the benefits are going down to suddenly start planning? As I saw on Twitter last week:

You know you want to start planning. Reach out to me here and let’s get you started.