The term Yield Curve is one of those two-dollar words we use in the investment world that just sound hard to understand. In truth it is really simple a concept and it is something everyone should understand because it is one of the most important concepts in finance.

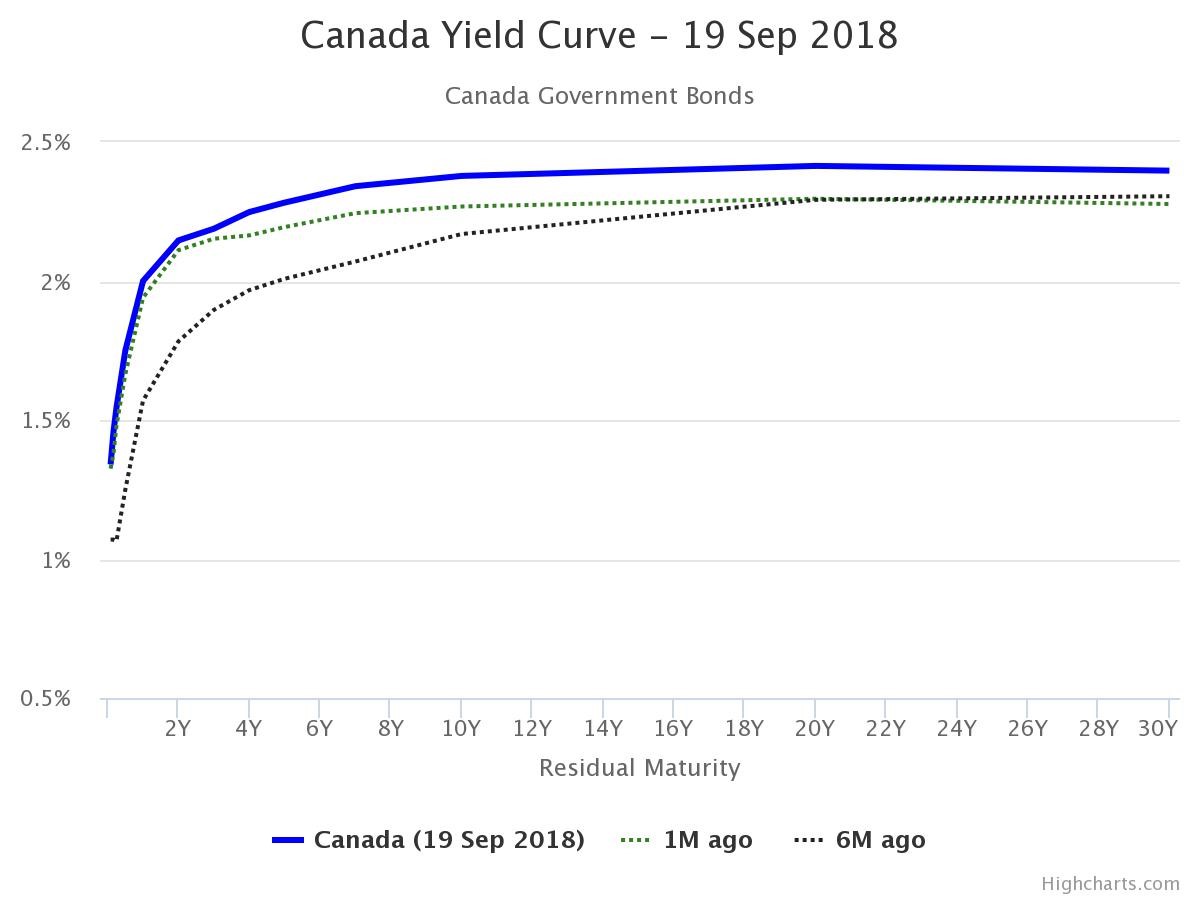

What is “The Yield Curve”? The Yield Curve is the representation of what you would get in return for a given bond over any number of years. We jazz it up in a fancy graph too! If you go to the bank and ask for the 1 year GIC rate or 5 year GIC rate, the difference in rates they offer to you is essentially an expression of the yield curve. In finance we use the Government of Canada bonds as The Yield Curve that all others are compared against.

I can already hear you asking; “What does it actually mean to me?” Well simply, it means that right now you would get the same-ish yield buying a Government of Canada bond that matures in 10, 20 or 30 years. In our world we call this a flat yield curve because if you look at this graph, it bears a striking similarity to a topo map of Saskatchewan. Having lived in Saskatchewan for 8 months [Narrator: Hi to our fans in Wilcox] I can tell you southern Saskatchewan is flatter than this yield curve…but not by much.

Here is what it actually means to you though. Bond yields are an expression of where Mrs. and/or Mr. Bond Market thinks interest rates will move throughout the next 30 years. It is a forecast but it is very important to remember that once you get beyond 1 year that forecast gets cloudy with a chance of meatballs. What the forecast is telling us is that they expect interest rates to rise a bit more from here but they will not go way higher from here - hence why a 10 year bond yields about the same as a 30 year bond.

More importantly, it is telling us that we are unsure how long this economic expansion will continue. Mrs. Bond Market is worried about a recession and she is working with Mr. Bond Market to keep long term interest rates down while the Bank of Canada pushes short term interest rates up slowly. Remember I predicted a recession here and told you to get ready in your portfolios. Don’t forget my adage, “no one knows the future!” and there are countless times where the yield curve has flattened just like this and we bypassed a recession. Let’s just say the prediction record of “flat yield curve : recession” is the same as “weather forecast of sun : actual sun”. Not good.

How do you handle a flat yield curve? Well first and foremost, stick with your asset allocation and keep on saving. If you are buying bonds, there is little reason to “go long” in this type of environment. Short (under 7 years) bonds will mature in a different environment and they will also have much less fluctuation in pricing. It also helps to not chase for a higher yield. The bond that gives you a bit more interest every year, is really that company that has to pay higher interest to attract people to buy their bonds because they are not as stable as a better company. If a recession happens, those lower quality companies feel the pain more than others. That translates to a drop in your bond‘s value. Skew towards more high quality.

Saskatchewan is a beautiful and surreal place, especially in the winter. I had always heard that it was flat but hearing that and living it are two different things. I left at the end of my internship with an appreciation for the prairies. Preparation and adjusting were the key to making my time there work and the same holds true for your portfolio in a prairie-like yield curve world.