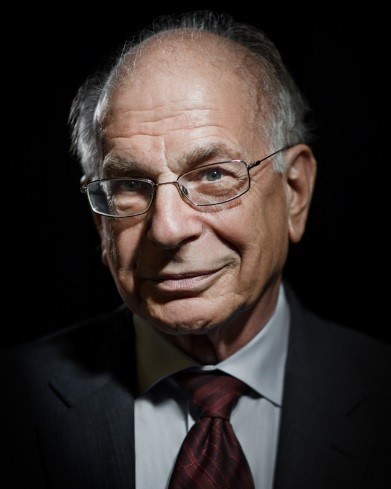

(Dr. Daniel Kahneman) (Jeremy Grantham)

Last week I travelled to Chicago to attend the 2018 Morningstar Investment Conference. I felt a need to get out of the bubble and hear some different voices and inputs plus it gave me a chance to see noted Behavioral Psychologist, Dr. Daniel Kahneman. If you are unfamiliar with Dr. Kahneman’s work (chiefly with his long time co-worker, Amos Tversky) then I suggest you start with Michael Lewis’ brilliant book, The Undoing Project and then follow it up with Kahneman’s classic; Thinking, Fast and Slow, a compilation of most of his life’s work.

Kahneman is the person that worked to understand all the biases and psychological errors we make in every day decisions. His work helped quantify the impact of recent events on our current decision making- termed, Recency Bias-and he extensively studied how our brain’s short cuts and heuristics lead to imperfect decisions and justifications for our imperfect decisions. If you read the above books you will see the world of politics, investing and family dynamics in a whole new light.

His chat was fantastic and he shared some really keen insights but the one that stuck out to me was his thoughts on training for professionals that help manage OPM (Other People’s Money). To paraphrase he suggested that Financial Advisors should receive training not only in the fundamentals of the industry but also in recognizing and handling the behavioral biases in clients as well as ourselves. The last part was the most intriguing. Here is a story to prove my point.

Dr. Kahneman’s talk was the opener on Tuesday. The closer was noted investor, Jeremy Grantham of GMO LLC, a huge and revered investment manager in the US. Mr. Grantham is a noted environmentalist and the topic of his discussion was exactly that. The Coles Notes version; we have polluted our world by addiction to fossil fuels and if we don’t stop now our food will run out, our land will wash away in super storms and we will suffer mightily. Morningstar did a great job scheduling the cocktail hour immediately following his talk!

The point of this post isn’t to discuss Climate change (a very real threat!) or to dispute anything that Grantham said, because much of what he said is backed by an avalanche of climate data and study. What I wanted to talk about was my emotional reaction to his talk. It was horrible. I began to wonder whether I should start to liquidate client’s holdings in Oil and Pipelines. I thought should all that money go into Solar Energy companies or wind turbine manufacturers. My response was entirely emotional! [Narrator: Well d’uh]

It was an entirely human response for me to see a dire consequence for my client’s portfolios and want to mitigate that risk. A 40% loss is still better than a 100% loss and Jeremy Grantham JUST told me they were all going to zero. That was the intelligent thing to do and I must do it now. I was ready to charge into that battle without logic and reason. My Captain Kirk had kicked in.

Of course, cocktail hour [Narrator: A Heineken was involved, or two] allowed me the necessary time to think more logically about that decision. Absolutely I think the cost of producing a kWh of electricity via green energy will continue to drop and make it more economical than electricity via coal or natural gas. We are almost there right now. However the biggest consumer of oil remains industry and automobiles and we are still years away before we can properly manage to make things and move things solely through battery technology. Oil and the off-shoot industries will remain viable for many more years. Mr. Spock had taken the upper hand.

I am glad that I learned many years ago about Dr. Kahneman and behavioral economics. Reading his work and improving my self-awareness allowed me to tame the emotional, charge-into-battle Captain Kirk and allow the analytical and emotionally detached Mr. Spock to eventually win more arguments. It has helped me immensely in my every day decision making and as an Investment professional, this bit of self-discovery will help me make smarter decisions for my clients and not decisions based on heuristics or biases.

I encourage everyone to read Dr. Kahneman’s book. To read Michael Lewis’ book and to find any of the other great thinkers on behavioral economics (ie. Thaler or Shiller) and work to find the biases in your own decisions. Being aware of your “hangups” and making decisions without emotion can make all the difference between success and failure.

Post Script: I loved Chicago. The Riverwalk and lakeshore alone is worth it but the Art Institute of Chicago had some incredible art, and I only saw maybe half the museum.