I came across this fantastic piece on the impact to bond portfolios in a rising interest rate environment from Sellwood Consulting in the US. I encourage you to read it in full: https://www.sellwoodconsulting.com/rise-and-shine-why-bond-investors-still-shouldnt-fear-rising-rates/

This has been a topic on my mind for the past year or two as we have begun to prepare for rising interest rates. We are now on that path in North America as both the Bank of Canada and US Federal Reserve are expected to continue to raise short term lending rates for this year and next. We don’t expect it to be huge increases but rather slow and measured over the next 18+ months and maybe beyond that.

What does this mean to you, the normal investor? Well two things. First, your bonds will decrease in price. Second (and totally related) your bonds will yield more. Yield is a fancy way of saying you will get more in interest for each dollar you have in bonds.

Now remember that we have been at HISTORIC lows in bonds yields/interest rates for quite some time and your bonds have paid peanuts. Your bank savings account has paid less than peanuts so getting a little better yield is a good thing, even if it comes at the cost of some short term price drop.

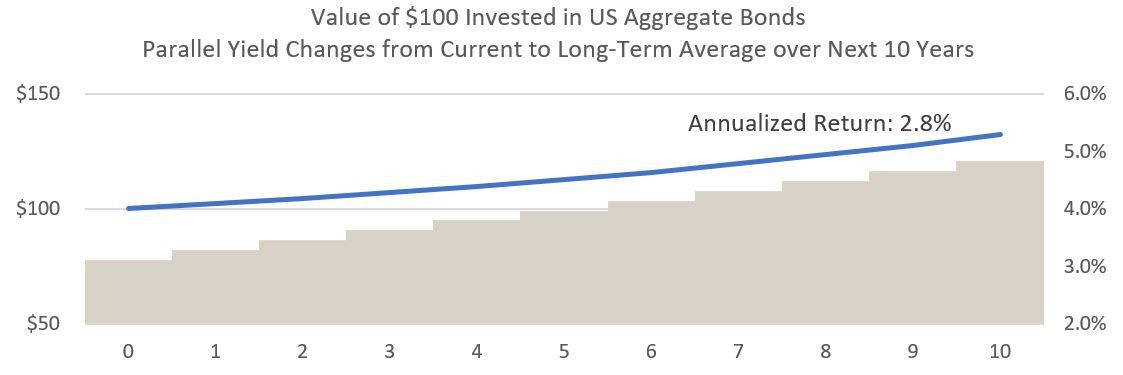

The Sellwood Consulting research does a great job at looking at a number of different scenarios with rates increasing. Our most likely course at least for the next couple of years is a gradual and slow increase in interest rates.

(Source: Sellwood Consulting LLC)

The Gradual Scenario is nothing to be afraid of at all. Sure 2% won’t get you to jump up and down but if you’re investing in bonds for growth, you might want to reconsider your investment priorities. Remember that bonds/fixed income are an important part of your Asset Allocation because they provide stability and steadiness. You don’t buy them to trade or for massive growth.

I encourage you to read the full report in the link as it covers different scenarios including at what point you will get a negative bond return after 10 years (it’s going to take A LOT higher interest rates for that to happen). It is well worth the few minutes to broaden your comfort with your bonds in a rising rate world.

If you want to chat about building a plan for you and your family, contact me today.

Sign up for notifications of new blog posts here.