Why I will be buying Global in 2018

2017 has been a fantastic year for equity investors nearly across the board. Canada has been up (hooray banks and oil not dropping like a stone), the US has continued its strong run, led by tech darlings Amazon, Google and Facebook but helped across the board with good, growing earnings. The real stars of the year though have been the International indexes with Europe, Asia and the Emerging Markets up strongly on the year which is a bit of catch up for the past 4 years where the US has been the leader.

After a strong year, why am I buying more of what the Global markets have to offer? Well, a couple of big reasons but the biggest factor is valuation. European and Asian companies are STILL trading at material discounts to their US competitors. For example, German Industrial giant, Siemens AG is trading at 16x next year’s forecasted earnings. US competitor Honeywell is just under 22x their 2018 earnings forecast. You can see the same type of figures across nearly all sectors.

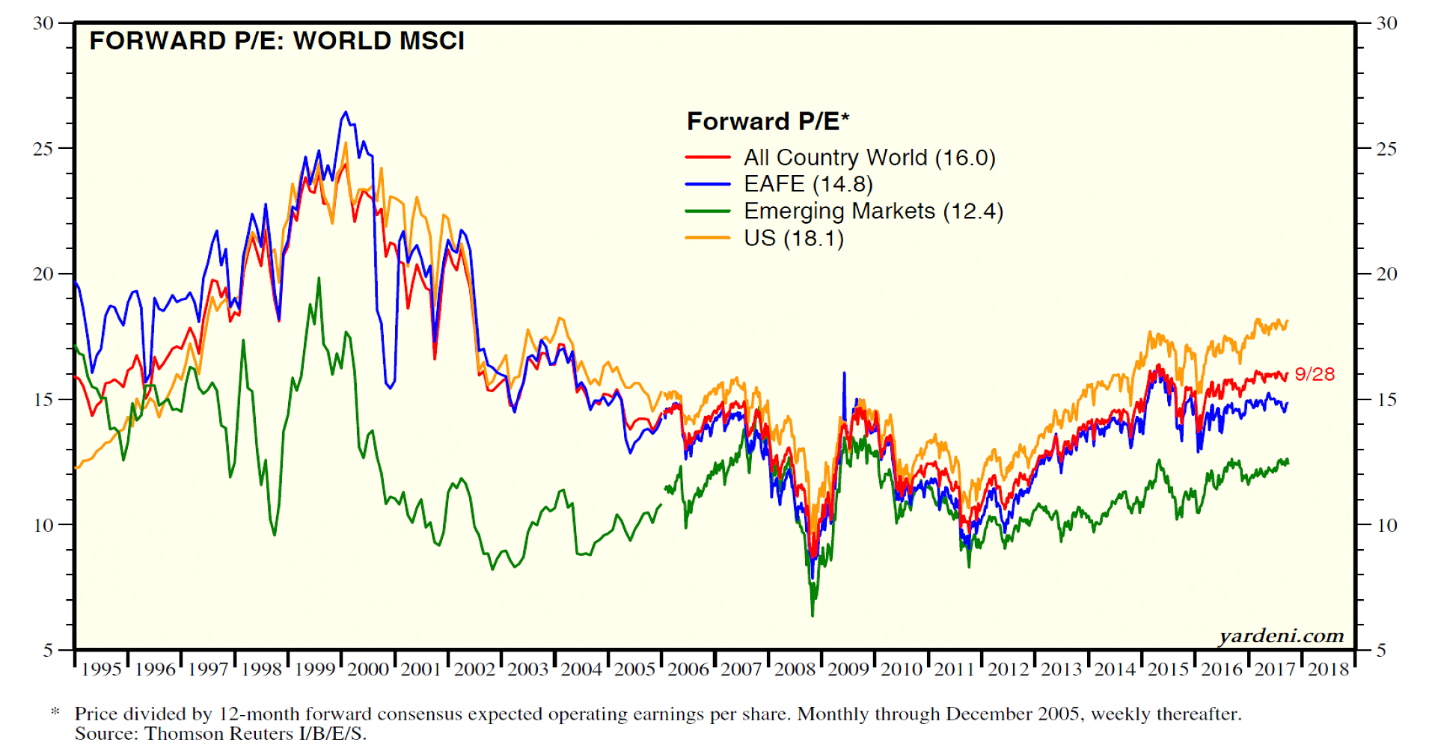

Don’t believe me, look at this chart from Thomson Reuters (h/t to Yardeni Research)

(Source: Yardeni Research https://www.yardeni.com/pub/mscipe.pdf )

The US market is trading at 18x forward earnings while EAFE is only 14.8x next year. The gap has grown since 2012 and is especially wide when comparing US valuations to Emerging Market valuations although this is often the case when you look long term.

However, EAFE and World Indices have not been at this wide a gap to the US indices for this extended a period in a generation. Of course there are reasons for that. Europe’s glacial reaction to the Credit Crisis led to a prolonged Government bond crisis- γεια, Greece!- for which the EU and European Central Bank found religion about 4 years late.

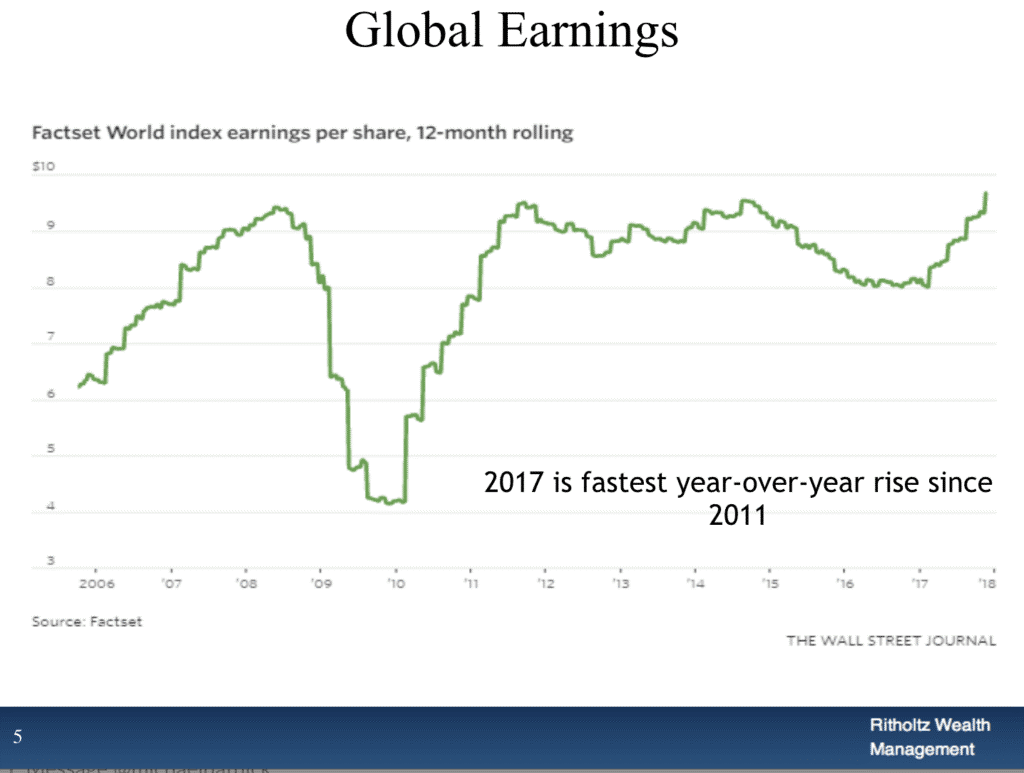

Secondly, the global economy is pushing along at a nice pace of growth and central banks are either holding rates at historic lows or raising rates at the pace of molasses. Good economic growth coupled with cheap debt is so far helping companies continue to grow their earnings year over year. Borrowing from Josh Brown of Ritholtz WM in the US, you can see that World Index earnings are at the fastest growth since 2011

(Source: Josh Brown http://thereformedbroker.com/2017/12/15/sometimes-its-not-complicated/ )

So for 2018 I will continue to recommend to my clients that we “Go see the world”. There are great companies in other parts of the world that are just as efficient, profitable and growth-focused as their US counterparts but trading at a good valuation discount in an improving earnings environment.

If you want more from me, sign up for notifications of new blog posts here.