A client asked me the other day what may be one of the most important and confounding questions of investing; “How do you know when to sell a position?”

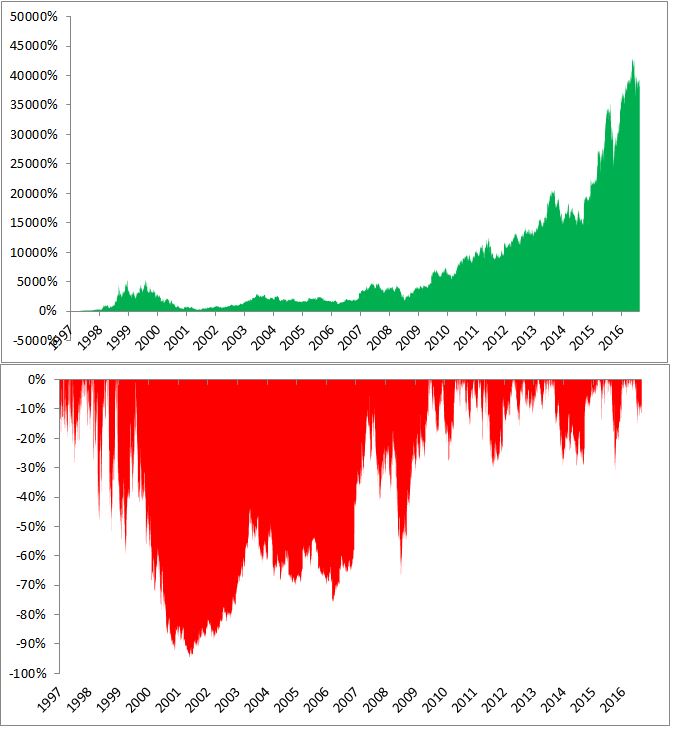

Simple axioms such as ‘Buy Low/Sell High’ do not actually work, except to trick you into thinking someone/anyone can pick the top and/or bottom on anything. Another favourite is Buy and Hold, but if you bought Nortel in 1999 and held you would definitely question that logic. If you bought Amazon in 2000 and held you would be way, way up; if you could stomach the numerous drops in the stock of over 30%. Not many people have the cast iron stomach to withstand the wild ride of Amazon over the last 20 years. Check this chart from Michael Batnick and tell me you held through that 90% drop in the tech crash.

(source: http://theirrelevantinvestor.com/2017/01/04/looking-for-the-next-amazon/ )

Expecting that your equity portfolio is going to constantly go up glosses over the fact that on average we have a 10% correction about once a year, a 20%+ “Bear Market” (poor bears, what did they ever do to get this stigma?) about every 5 years. Which leads me back to that all important question; when do you Sell?

The K.I.S.S. Principle is often the best policy. So Keep It Simple and set a plan to rebalance your asset weights back to their targets semi-annually/annually. Not only does it take a lot of the emotion out of your investment decisions, rebalancing helps reduce your portfolio’s volatility over the long term. Don’t believe me? Check the chart from Forbes here:

(source: https://www.forbes.com/sites/investor/2011/11/16/does-portfolio-rebalancing-work/#4c1ed6b88393 )

You will never have the highs during a strong up market but you also will not have the lows during a grumbling down market. It’s during those times that rebalancing works out over time because you start the next up market from a higher base. Seems simple but it’s a concept too few of us grasp.

More in Part 2 where I look at an option to sell a position that is too big and has a huge gain! (The horror! You made too much money!!!)