One of the hardest things to do as an investor is to overcome your hard-wired need to avoid pain. Pain, as an investor, is a loss of capital. To be an investor requires a certain level of optimism about how things will turn out. No one buys an investment expecting to lose some of their money, even if they acknowledge that it is a possibility. Being an optimist has worked out for most people that give investing enough time, but that doesn’t mean we aren’t still hopefully searching for that investment that can give us all the fun of making money without any of the pain.

There are lots of people that know that you, the investor, are looking for an investment that “goes up but doesn’t lose money”. But every so often, one comes across my screen that just makes no sense. It’s those products that are selling “goes up but doesn’t lose money” as their primary marketing pitch that are actually the ones that cause the most trouble. I call these types of products “landmines”.

Bridging Finance was a landmine and it finally exploded recently when the Ontario Securities Commission took control of their business and the private debt funds they have operated for several years. There are lots of allegations of misappropriation of investor funds which is a polite way of saying the CEO was taking money out for his personal needs. It’s going to be doubly painful for investors in the Bridging Income Fund ($1 billion in assets) and the Bridging Mid-Market Debt Fund ($500 million in assets) because not only are they potentially now losing some of their money, they were sold the idea of “upside without the downside”. It’s a double gut-punch for many people.

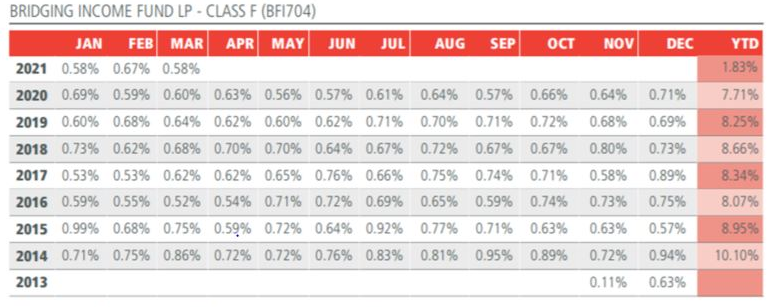

Bridging Finance does provide us with some real good lessons on how to spot a landmine. Here are their publicly reported returns for their largest fund, the Bridging Income Fund.

Do you notice anything about it? It’s almost like a metronome in how consistent their returns have been month to month, year to year. Well, of course it is going to be like that, because they told you they would earn good returns without any of the pain. Anyone would take 8% returns per year without any down months.

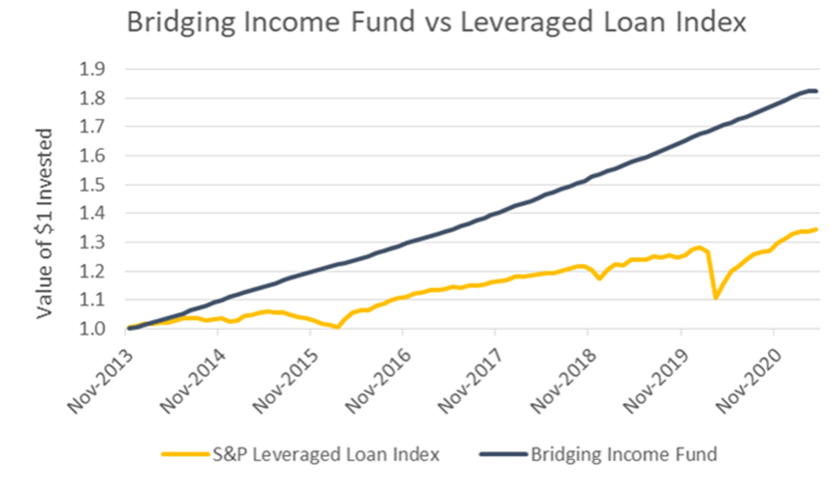

But if we take a look at how this fund performed compared to the broader leveraged loan side of the bond market, we can see its true “landmine” nature. The Bridging Income Fund was invested in these leveraged loans, which are typically the bonds that are issued by smaller companies that can’t get funding from the most conservative lenders. The bonds they issue are usually low-rated or even unrated by bond rating agencies. They are a far cry from safe bonds like treasury notes.

This is how the Bridging Income Fund performed throughout its life compared to the Leveraged Loan Index. Quite the stark contrast isn’t it? But all is not as it seems. Since 2013, between 2 and 4% of US leveraged loans have defaulted each year. When you invest in these types of bonds, you get paid a higher interest rate for that risk. You are also assuming there are going to be some bad periods along the way.

You invest in bonds expecting them to be safe and stable, but safe and stable doesn’t mean there aren’t EVER any bad months where returns are negative. For example, we had rising interest rates in 2018 which negatively impacted bonds of all kinds and yet, it doesn’t even register as a blip in the returns on this Bridging Income Fund. It was like nothing happened.

It’s entirely possible that you can outperform the index, especially in a volatile space like leveraged loans, but to do it without ANY down periods? I’d put the statistical probability of that happening somewhere between impossible and hell has frozen over.

What’s the lesson to take away from this? If something you are being presented promises you “good returns without the risk”, or if it simply looks too good to be true, you may want to think twice before putting your money there. Investing requires patience and understanding that nothing just goes straight up. Understanding this is one of the most important ways you can avoid stepping on an investment landmine.