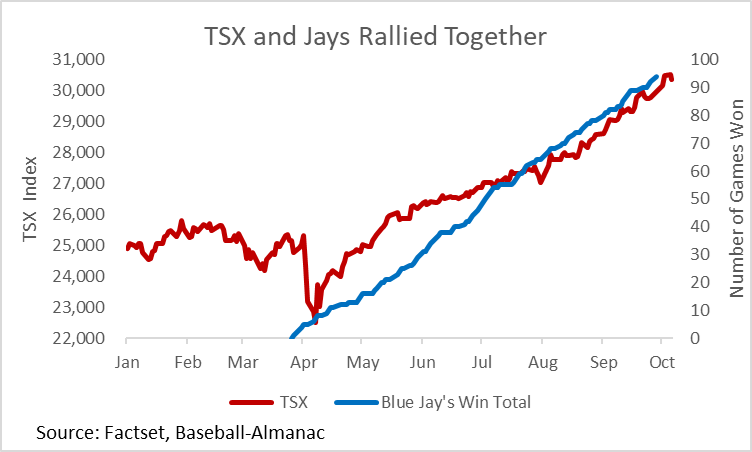

Baseball fan or not, it’s hard to ignore the buzz across Canada this fall. The Toronto Blue Jays are back in the playoffs after a long absence and are one of the favourites to bring home the championship. Back in April, few Jays fans dared to dream of October baseball. After a disappointing 12th-place finish in 2024, expectations were modest – hope tempered by realism. Ironically, investors felt much the same way about the stock market in early April. Trade tensions had triggered a sharp correction, and optimism was in short supply.

But just as the Jays quietly found their rhythm, so too did the markets. (We will let readers decide if this was causation or spurious correlation). As spring turned to summer, both delivered far more than most expected. From the tariff-induced lows, the S&P 500 and TSX indices have each risen about 35%, with the rally broadening beyond the usual handful of mega-cap tech names. What looked like a shaky lineup in April turned out to be a contender by September.

AI and the Data Center Boom

The defining theme of 2025 remains artificial intelligence (AI) and the infrastructure being built to power it. Hardly a week passes without another announcement of new data center investments, as companies race to meet the enormous computing demand AI requires.

We have long held a position in Nvidia, one of the clear leaders in this space, and added ASML Holding last year – a company with a near monopoly on the advanced lithography equipment essential for producing cutting-edge semiconductors.

Meta Platforms, which we also own for clients, continues to benefit from AI in a different way. The technology has boosted its ability to target advertisements to its more than three billion users, and advertisers are willing to pay a premium for that precision. Microsoft, one of our core holdings, also remains well positioned – both through its Azure cloud business and the growing use of its Co-Pilot AI tools across its software suite.

For diversification, we also have exposure to select Chinese technology firms through an exchange-traded fund that includes leaders such as Alibaba – companies poised to play meaningful roles in that region’s AI ecosystem.

Powering the Future

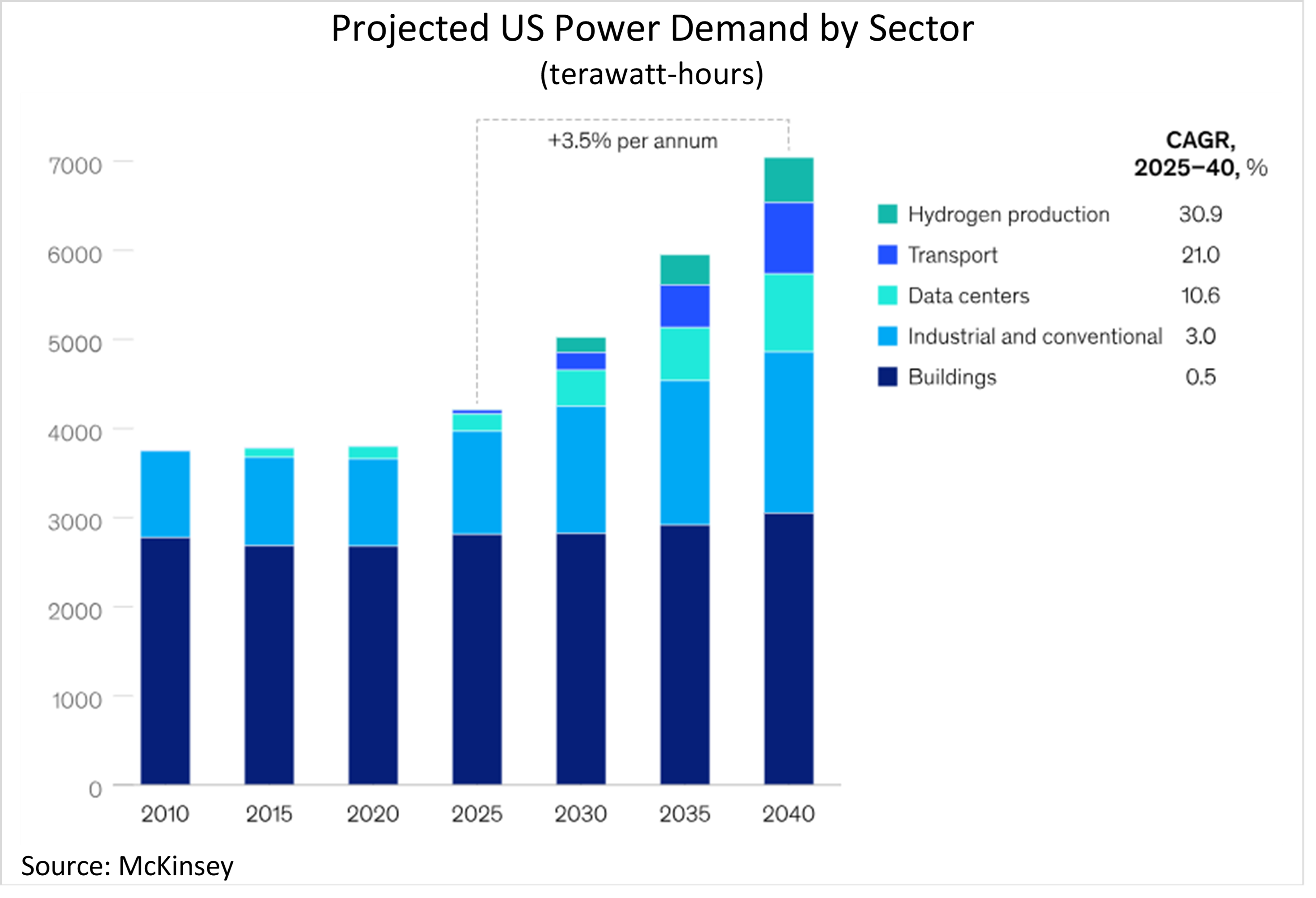

Data centers, electric vehicles, and climate commitments all share one thing in common: they demand vast amounts of power. As a result, after years of relatively stagnant growth, US power consumption is expected to increase significantly in the coming decades. That reality has renewed interest in multiple parts of the energy complex – from natural gas to nuclear to renewables.

We recently added AtkinsRéalis, a Canadian engineering and construction firm with the exclusive license to market and develop CANDU nuclear reactors. While new nuclear capacity will take years to come online, AtkinsRéalis is currently extending the life of existing reactors through refurbishments at Ontario’s nuclear stations.

In the near term, natural gas remains a critical bridge fuel. Rising demand should benefit ARC Resources, a Canadian producer we purchased earlier this year. Meanwhile, renewables will continue to play an increasing role in the global mix. Two recent additions to our portfolios – First Solar and Northland Power – provide exposure to utility-scale solar and wind farms, respectively.

Precious Metals: A Golden Comeback

Beyond AI and power, another standout theme this year has been the resurgence of precious metals. Gold and silver producers, which make up roughly 12% of the TSX Index, have rallied sharply since the lows following April’s “Liberation Day.” The combination of expected interest rate cuts, uncertainty about the outcome of new tariffs, continued central bank buying, concerns about government debt levels and a weaker U.S. dollar has lifted sentiment – and prices – across the sector.

Historically, we’ve treated gold miners cautiously given their poor track record of generating shareholder value. But with improving fundamentals and momentum on their side, we increased our exposure twice since June and have been rewarded for doing so.

Banks: A Solid Inning

The rebound in capital markets, combined with falling short-term interest rates and better-than-feared loan performance, has fueled a strong comeback for banks. Equity markets have reopened to new issuance, IPO activity has improved, and credit conditions have stabilized. Because banks represent a much larger share of the TSX than of the S&P 500, this has been a notable tailwind for the Canadian benchmark.

What Hasn’t Worked

Not every sector has participated equally. Consumer staples and health care stocks – often viewed as defensive havens – have lagged as investor attention shifted toward growth-oriented and cyclical areas.

Lingering inflation continues to pressure lower-income consumers, making it harder for companies selling everyday essentials such as diapers, soup and cleaning products. U.S. pharmaceutical firms have also faced renewed scrutiny over pricing, weighing on share prices earlier in the year. (Although the group saw some reprieve last week after the Trump administration struck a deal with a major U.S. drug maker.)

Our portfolios remain underweight in these sectors, though we continue to watch for opportunities among high-quality companies trading at attractive valuations.

Conclusion: Staying in the Game

Whether on the field or in the markets, success often shows up when expectations are low and patience runs thin. Despite April’s turmoil, it has been another strong year for investors, with gains extending well beyond the technology sector. Our portfolios remain positioned to benefit from durable long-term themes – from AI and data infrastructure to rising global power demand and the renewed strength of precious metals and financials. With the portfolios positioned for the long game, we look forward to what the next innings – and the next opportunities – may bring.

If you have any questions, please do not hesitate to Contact us!