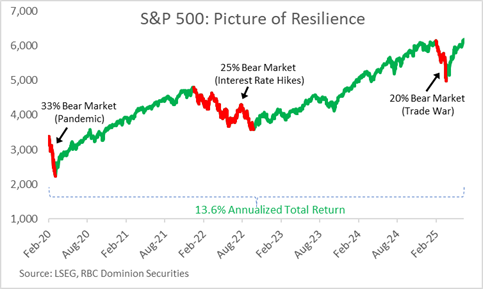

Resilience. It is a quality we try to instill in our children at a young age, so they develop the ability to rebound and persevere after setbacks in their life. The Merriam-Webster dictionary defines it as “an ability to recover from or adjust easily to misfortune or change”. If one needs a visualization to better understand that definition, look no further than a chart of the US stock market over the past five-and-a-half years.

Immediately before the pandemic, the S&P 500 reached a record high on February 19, 2020 (the first data point in the chart below). The world then endured a serious recession brought on by unprecedented global lockdowns, sending the stock market down 33%. Once financial markets recovered from that, in 2022 the sharpest interest rate hiking cycle in decades induced another bear market that saw US stocks fall 25%.

Stocks once again recovered over the subsequent two years, with the S&P 500 reaching a new high on February 19, 2025 (exactly five years after the pre-pandemic peak). US President Trump then launched his global trade war, sparking a bear market in which the benchmark stock index fell 20% on an intraday basis to its low on April 8. Since then, while he has scaled back some of his tariffs, other major events – particularly the conflict between Israel and Iran – kept many observers on edge. And yet the S&P 500 fully recovered, ending the second quarter at a new all-time high.

Thus, we have experienced three bear markets (and three recoveries) in less than 6 years – a very rare occurrence. How have investors fared with all that turbulence? If an investor had the misfortune of investing all their money into US stocks at the peak of the market before the pandemic and had the perseverance to hold on – with white knuckles for sure – through the rollercoaster of the past five-and-a-half years, they would have nearly doubled their investment — that’s an average annual return of 13.6%, including dividends. That is an impressive feat, especially when compared to the long-term average total return of 8-9% on US stocks.

Lessons

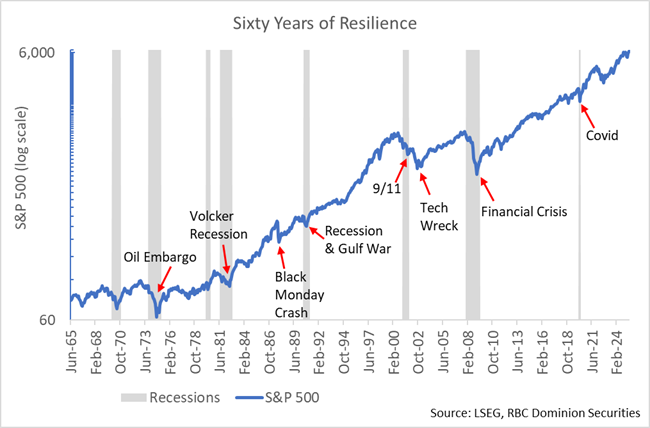

One should not extrapolate the market’s recent performance ad finitum. It would be a mistake to dismiss the potential of a major, more enduring downturn on the scale of the 2008-09 financial crisis occurring at some future date. But even after that dire 2008-09 bear market, the stock market recovered its losses within five years. As mentioned, over the long term — through wars, recessions, pandemics and political leaders of all stripes — US stocks have returned 8-9% for investors that have been able to hold their ground through any near-term volatility. Those that have pulled their money out of the market during periods of turmoil, with the aim of getting back in when there was less uncertainty, have generally discovered that markets recover well before the uncertainty has abated, leaving market timers worse off than if they had stayed the course.

Events To Monitor

Having said that, we do like to forewarn our clients of any potential sources of volatility that may present themselves. Not for the purpose of trying to time entry and exit points, but just as a reminder that there are persistent sources of uncertainty and risk in the macroeconomy that could develop into pain points for investors. Here are a couple current hurdles for stocks to clear over the coming weeks and months:

- Trade deals: After setting very high initial tariff rates on Liberation Day, Trump temporarily lowered many of them until July 9 (August 12 in the case of China), giving time for countries to sign trade deals with the US. With no meaningful deals announced, at least some rates are likely to move higher.

- Economic data and corporate earnings: A lot of consumers and corporations pulled forward demand in anticipation of the Liberation Day tariff announcements. That distorted some of the economic data and corporate earnings reports. Also, many companies were still working down inventories of pre-tariff goods, allowing them to hold off on raising prices. That may come to an end soon. In the coming weeks we may get a better picture of what the impact has been on demand and tariff-related inflation.

Conclusion

With stocks sitting at elevated valuation levels, they are somewhat more vulnerable to any negative macroeconomic developments that could develop. However, with central banks more likely to cut interest rates than raise them and with a relatively healthy overall economy, we would not expect any downturn to be deep nor lengthy. If there is anything that the past six (or even sixty) years have taught us, it is that declines in the stock market have historically been just noise in its long-term upward trajectory.

So the next time a child needs a reminder of what it means to be resilient, simply put a chart of the S&P 500 index on their wall.

If you have any questions, please do not hesitate to Contact us!