Before we discuss the recent events that have triggered financial market turbulence, it is important that we remind investors of a few points. First, while there are always unique aspects to every stock market pullback, having invested in and studied the market through many market cycles like we have in the Strauss Rom Strategic Wealth Management Group, we believe in the adage, “There is nothing new under the sun”. Whether stocks rise or fall and whether they do so slowly or rapidly, we have managed through all such episodes. Secondly, we believe investors that have remained steadfast and patient through past ups and downs – perhaps with some reassuring guidance from us along the way – have achieved superior returns than those that tried to time the market’s phases.

A Little Perspective Goes a Long Way

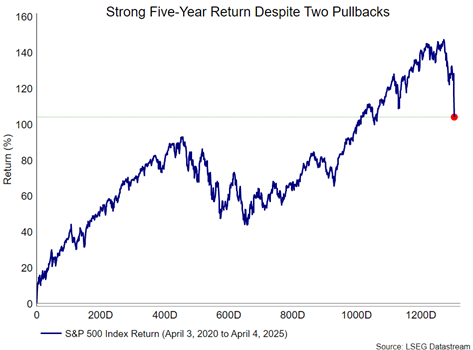

One successful strategy that builds confidence in the process and tempers the urge to act rashly during such periods of volatility is maintaining some perspective. In this case, it is helpful to remember that even after its recent 17% decline (through Friday April 4), the S&P 500 Index has more than doubled over the past five years. Once dividends are included, this equates to an annualized return of more than 15%! That five-year timeframe includes 2022 when the S&P 500 experienced a 25% decline. Recognizing that attractive returns are possible even with periods of meaningful retracements should help one realize that we need to take the good with the bad if we are to reap the long-term returns that stocks have generated.

But even with knowledge of the market’s longer-term track record, it is useful to monitor ongoing developments. Let’s take a closer look at recent events and consider some possible near-term scenarios.

Tariff Uncertainty

The primary reason for the stock market pullback, of course, has been concerns over the economic impact of President Trump’s ever-changing tariff policies. Before last week, stocks had already slid from record-highs in anticipation of the tariffs that were to be announced on Trump’s self-proclaimed “Liberation Day”. However, with the exceptions of Canada and Mexico, the actual levies turned out to be higher than anyone had expected, sparking fears of a broad economic slowdown. (Canada and Mexico were not spared; tariffs on their products, however, were comparatively better off.) While there may be some long-term social and economic rationale to the Trump administration’s policy, in the near term there will be some combination of higher prices, lower corporate margins and less economic activity, depending on how the pain of the new import taxes are shared across the supply chain.

To add to the unknowns, there is uncertainty about how other nations will respond, how the Trump Administration may alter the announced tariff levels, and their ultimate impact. Instead of trying to predict how each of these interconnected variables will play out, a better approach is to consider a range of scenarios.

Base Case:

Most people expect that the tariffs will be lowered, although the timing is up in the air. The supporting evidence for tariff reductions is in Trump’s Executive Order, which states “should any trading partner take significant steps to remedy non-reciprocal trade arrangements and align sufficiently with the United States on economic and national security matters” he might “decrease or limit in scope” the new levies. Ahead of Trump’s announcement, Israel removed its US tariffs and after the announcement, Trump said that Vietnam’s leader is willing to negotiate. China, on the other hand – a much bigger US trading partner than Israel or Vietnam – retaliated by increasing its tariffs on US imports.

But even if tariff levels are eased, we expect such reductions to take time, which will have an economic impact on an economy that was already showing signs of slowing due to consumer belt-tightening. Already, for example, some auto plants are pausing production and laying off workers.

Amidst this economic headwind, one must also factor in that even with the recent pullback, the stock market’s valuation is far from cheap. As we warned in January, the price-to-earnings ratio on the S&P 500 was elevated at 22x. Since then, it has fallen to just under 20x but remains high when compared to the 30-year average of 17x.

While we stand by our belief in the stock market’s long-term ability to produce attractive returns, our base case is that with a slowing economy and tariff uncertainty, there could be another 7-10% downside in the S&P 500 as earnings estimates slip and the market’s valuation multiple contracts further. That assumes we avoid a series of ever-increasing retaliatory tariff hikes between the US and its major trading partners and that there are meaningful tariff reductions from last week’s announced levels.

How things could be worse than our base case:

If other countries take China’s approach and enact retaliatory tariffs, it could trigger Trump to make good on his threat of further increases as he has done with the Middle Kingdom. The resulting trade war escalation could deepen any economic slowdown, pushing corporate earnings and the market’s valuation multiple even lower.

Reasons why the market could soon find a bottom:

While unlikely, it is possible that countries respond less like China (retaliation) and more like Vietnam (negotiation). Should they move to reduce tariff rates, the US could follow suit. Any positive news on this front could cause stocks to bounce from oversold levels. (Note that even in our best-case scenario we believe the floor in tariffs is 10%, which is still well-above prior levels.)

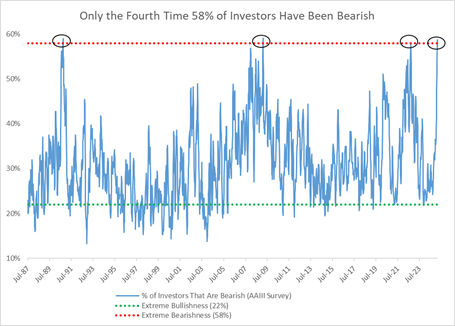

Another key consideration is investor sentiment. At the beginning of the year, many investors were very bullish on the prospects of the stock market, which left them more vulnerable to a pullback. Conversely, when investor bearishness rises to an extreme level, it tends to be a contrarian signal that stocks may be nearing a bottom. We gauge these sentiment swings by looking at a four-week moving average of the weekly survey conducted by the American Association of Individual Investors (AAII).

For only the fourth time in the survey’s 28-year history, more than 58% of respondents recently said they had a bearish view on the stock market. Each of the prior three times we had such a reading were within days of the bottom of major bear markets: October 1990 (recession), March 2009 (financial crisis/recession), October 2022 (interest rate spike/recession fears). The subsequent 12-month returns on the S&P 500 from those extreme bearish readings were +26%, +59% and +16%. It is certainly possible that investors are right to fear an escalating trade war that sends the global economy and stock market into a further tailspin, but history suggests that a lot of the fears are now priced into the stock market.

Current Strategy

In our view, the near-term risks are skewed slightly more to the downside as the economy bears the weight of the US’ new tariffs. As such, we recently reduced some exposure to cyclically sensitive stocks in our portfolios in favour of ones with greater economic resilience. But these were marginal, tactical changes as opposed to a significant overhaul. We recognize that the deeply negative sentiment increases the probability of a sharp upward reaction should any positive developments surprise investors. We are balancing the desire for capital preservation with the knowledge that the market can begin a recovery when investors least expect it.

Cyclical Renewal

As challenging as volatility can be, we know that periodic episodes of stock market declines are a healthy part of the long-term dynamic. This is analogous to moderate forest fires that burn unhealthy overgrowth, weight-lifting that damages muscles only to have them become stronger through the rebuilding process, or autophagy in the human body (the breaking down and recycling of a cell’s damaged components). Periods of economic weakness can help expunge inefficiencies and correct overvaluations to maintain sustainable, long-term growth. Consider this a period of healthy “cyclical renewal”.

If you have any questions, please do not hesitate to Contact us!