Investors that had a healthy allocation to US stocks are certainly pleased with the 23% gain in the S&P 500 in 2024, which marks the second consecutive annual gain of more than 20%. Of course, much of the gains were led by the mega-cap tech stocks, but that is not to say that the rest of the market did poorly. The equal-weighted S&P 500 index — which gives a better representation of how the average stock performed — was up a respectable 11% last year, on the back of a 12% gain in 2023. Canadian stocks have also fared well, with the TSX gaining 8% and 18% in 2023 and 2024, respectively.

After two strong years, however, we must not become complacent. To help us gauge the prospects for 2025, let’s consider the current bull and bear cases for stocks for the new year.

Reasons to be bullish

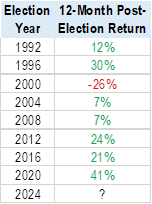

Post-election tailwinds: One of the best periods to be invested in stocks is the twelve months following a US election – regardless of which party wins. After the past 10 elections, the only time when the market declined in the subsequent 12 months was 2000 as the Internet Bubble was bursting). Thus, with only two months since election day, history remains on the side of stocks. Regarding the incoming Donald Trump administration’s philosophies, its focus on deregulation could maintain investor optimism. Another tailwind could come from the soon-to-be-formed Department of Government Efficiency (DOGE). If Elon Musk and Vivek Ramaswamy can overcome the fact that they will not have any formal power, any resulting reduction in federal spending could ease concerns in the bond market about widening government debt levels.

Tariffs may be a negotiating tactic: If Trump were to raise tariffs on incoming Chinese goods by 10% and place 25% tariffs on all Canadian and Mexican imports, as he has stated he would do, inflation would likely rise and economic growth would slow. However, some observers seem to have forgotten that he made similar threats ahead of and during his first presidential term, with the end result being less damaging targeted import duties and a re-worked North American free trade agreement. Trump has already left the door open for such an outcome, saying that Canada and Mexico could avoid new tariffs if progress is made on border security and fentanyl imports.

AI’s efficiency potential: One of the main risks to the stock market is its high price-to-earnings (P/E) valuation (more on that below). Many bearish investors argue that this ratio will revert towards a lower long-term average and thus stock prices must come down. Another path to the P/E ratio normalizing, however, is the cost-cutting that could result from corporations finding innovative uses for artificial intelligence. This would boost the ratio’s denominator (earnings), which would also result in a lower P/E multiple.

Valuations are not a good timing tool: Even if earnings growth fails to surprise to the upside, it does not mean that stocks are doomed in the near term. The last two times the S&P 500 Index’s P/E ratio rose to its current level of around 22x (in 1998 and 2020), the stock market did not peak until more than a year and a half later. Stocks rose 24% between July 1998 and September 2000 and an astounding 54% between June 2020 and January 2022. Selling stocks too early were costly on those occasions.

Risks for stocks

Elevated sentiment: One reason for caution heading into 2025 is that a lot of the above positives have already been recognized by investors, who are now fully invested. As evidence, in December, Bank of America’s Fund Manager Survey indicated that mutual fund cash balances had fallen below 4% — a rare occurrence. For stocks to move higher, it is helpful to have large investors deploying more cash into the market. Low cash positions suggest investors are more likely to be sellers than buyers from here.

Stretched valuation: The other way to gauge whether investors have become overly optimistic is to look at the P/E ratio, which, as discussed above, has risen above 22x. The bullish investor sentiment and the elevated valuation multiples are unlikely to themselves cause a stock market pullback, but they do increase the risk that one of the below triggers results in a negative investor reaction.

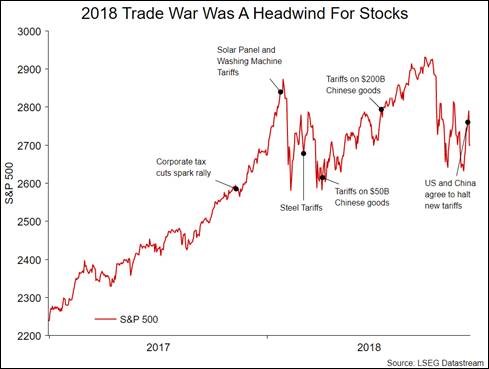

2018 redux?: By the end of 2017, Trump’s corporate tax cuts and deregulation plans boosted investor sentiment and lifted the S&P 500’s P/E ratio to its highest level since the Internet Bubble — similar to the current conditions. In 2018, when Trump began his tariff threats in earnest, the ensuing China-US trade war created a very turbulent year for stocks.

Rising bond yields: When the US 10-year bond yield has breached 4.5% in recent years, as it has done once again in the past few weeks, it has created a headwind for stocks. The past few occurrences of such interest rate levels (October 2022, October 2023 and April 2024) were relatively short lived, so stocks were able to rebound when bond yields retreated. The current rally in bond yields was sparked by the US central bank’s rate-setting committee that said higher inflation expectations would result in fewer interest rate cuts in 2025. If inflation returns and/or if bond investors lose faith in Musk and Ramaswamy’s ability to cut the federal deficit, interest rates are at risk of rising further. A move towards 5% would most certainly hurt stock prices.

Strategy in this environment

Given the tailwinds for stocks, we want to maintain exposure to equities, which could continue to rise in a post-election rally and as companies benefit from any artificial intelligence-driven productivity enhancements. But we also recognize the risk that the elevated S&P 500 valuation multiple could contract in a trade war or if interest rates rise further.

The portfolios we manage for clients have benefited greatly in recent years by our focus on US large cap stocks. However, given the risks in that segment of the market, we have begun to seek out opportunities in small capitalization stocks and international equities – both of which have much more attractive valuations. Small cap companies also tend to import less, and thus should have better protection from rising tariffs.

We have only taken small steps in these directions as we recognize the long-term advantage of US exceptionalism and the quality and stability benefits that large cap stocks provide. However, we believe that over the medium term, small cap and international equities mitigate some of the risks posed by the US large caps that we traditionally focus upon.

Rising bond yields: When the US 10-year bond yield has breached 4.5% in recent years, as it has done once again in the past few weeks, it has created a headwind for stocks. The past few occurrences of such interest rate levels (October 2022, October 2023 and April 2024) were relatively short lived, so stocks were able to rebound when bond yields retreated. The current rally in bond yields was sparked by the US central bank’s rate-setting committee that said higher inflation expectations would result in fewer interest rate cuts in 2025. If inflation returns and/or if bond investors lose faith in Musk and Ramaswamy’s ability to cut the federal deficit, interest rates are at risk of rising further. A move towards 5% would most certainly hurt stock prices.

Strategy in this environment

Given the tailwinds for stocks, we want to maintain exposure to equities, which could continue to rise in a post-election rally and as companies benefit from any artificial intelligence-driven productivity enhancements. But we also recognize the risk that the elevated S&P 500 valuation multiple could contract in a trade war or if interest rates rise further.

The portfolios we manage for clients have benefited greatly in recent years by our focus on US large cap stocks. However, given the risks in that segment of the market, we have begun to seek out opportunities in small capitalization stocks and international equities – both of which have much more attractive valuations. Small cap companies also tend to import less, and thus should have better protection from rising tariffs.

We have only taken small steps in these directions as we recognize the long-term advantage of US exceptionalism and the quality and stability benefits that large cap stocks provide. However, we believe that over the medium term, small cap and international equities mitigate some of the risks posed by the US large caps that we traditionally focus upon.

Rising bond yields: When the US 10-year bond yield has breached 4.5% in recent years, as it has done once again in the past few weeks, it has created a headwind for stocks. The past few occurrences of such interest rate levels (October 2022, October 2023 and April 2024) were relatively short lived, so stocks were able to rebound when bond yields retreated. The current rally in bond yields was sparked by the US central bank’s rate-setting committee that said higher inflation expectations would result in fewer interest rate cuts in 2025. If inflation returns and/or if bond investors lose faith in Musk and Ramaswamy’s ability to cut the federal deficit, interest rates are at risk of rising further. A move towards 5% would most certainly hurt stock prices.

Strategy in this environment

Given the tailwinds for stocks, we want to maintain exposure to equities, which could continue to rise in a post-election rally and as companies benefit from any artificial intelligence-driven productivity enhancements. But we also recognize the risk that the elevated S&P 500 valuation multiple could contract in a trade war or if interest rates rise further.

The portfolios we manage for clients have benefited greatly in recent years by our focus on US large cap stocks. However, given the risks in that segment of the market, we have begun to seek out opportunities in small capitalization stocks and international equities – both of which have much more attractive valuations. Small cap companies also tend to import less, and thus should have better protection from rising tariffs.

We have only taken small steps in these directions as we recognize the long-term advantage of US exceptionalism and the quality and stability benefits that large cap stocks provide. However, we believe that over the medium term, small cap and international equities mitigate some of the risks posed by the US large caps that we traditionally focus upon.

If you have any questions, please do not hesitate to Contact us!