As I’m sure you’re aware, interest rates have gone up. And, for the first time in over 15 years, GIC rates actually look enticing!

And because they look enticing we have been receiving questions about whether it makes sense to move more money into GIC’s now. The questions come because of one of two scenarios:

- it’s because the client thinks the rate is simply attractive and wants to lock it in, or

- it’s because they are worried the market will drop, and they want to lock in the return.

Here is why we don’t recommend either at this point.

In regards to the attractive rate, yes it is attractive, however bond rates are actually more attractive.

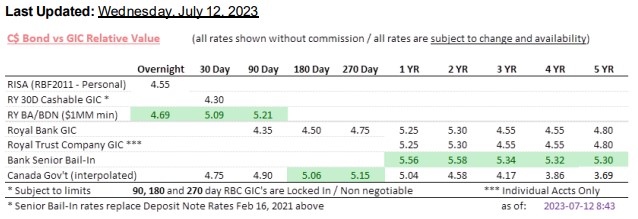

Below is a table which shows how a GIC lags bonds in the current environment. The Example here is the RBC GIC vs Banker Acceptance, RBC Senior Bail-in Bonds, and Canadas, but it applies across the industry. A bond portfolio will yield you more than the yield of a GIC. In addition, you are entering into the bond market near what we anticipate is its height in anticipated rate hikes. There is therefore potential for capital appreciation as the interest rates level off and drop in the future- meaning not only will your receive your yield, but your capital could appreciate in value.

You are better off holding a diversified bond portfolio.

The second point is the more important one. It seems very logical to just lock away a return and be ahead in a year from now. On the surface it seems like you can’t lose. The problem with this approach is that you have just put yourself in a position of trying to time the market. You’ve created a date in which you will enter back in, or even worse, it leaves you thinking that if I don’t like where the market is in a year, you’ll just hold until you’re comfortable.

Timing the market has been proven to be impossible. No one can do it consistently, and when it loses, it loses big. You also need to factor in that interest earned on a GIC is taxed at the highest rate, double that of a capital gain.

In the scenario above where you’ve locked away for a year, you should actually be hoping that you are LESS comfortable than you are today when it matures- meaning the market is worse and you are buying back in when it is lower. If you are "comfortable" when it matures, the market will probably be at a higher point than it is today, and you’ve in all likelihood lost ground.

It's possible that you can get lucky in this scenario, and come out ahead, but the problem with that is it will lead you to believe that you know what you’re doing, and you will try it again. The odds are overwhelmingly against you coming out ahead, and eventually it will catch up and you will lose.

Instead, you need to take a step back and think “yes, the market may pull back in the short term, but do I think it will eventually come back?”. The answer to that question should be “Yes”. The market has always come back, through every recession, economic crisis, and depression through the history of time. So, why try and play the game which is proven to be a loser? Instead, stay invested, rebalance the portfolio on a regular basis, make asset allocation adjustments and be patient. That is the strategy that is proven to win every time.