While bear markets are tough to sit through, missing the post-bear market bounce by standing on the sidelines is an avoidable – and often costly – mistake. Playing the long game isn’t easy at times, but history shows that it pays off for investors.

"Patience is bitter, but its fruit is sweet." ― Aristotle

The recent market gyrations have no doubt tested investors’ resolve. History, however, has shown that sticking to your investment plan, staying invested through all market conditions, and maintaining investment discipline is particularly important during all stages of the market cycle – and especially so when markets appear ready to return to more normal conditions.

2022: Annus horribilis

The past year has not been an easy one for investors, with most major equity markets posting losses that ranged from meaningful corrections (a drop of 10% or greater from an index’s peak) for indexes like Canada’s S&P/TSX Composite, or outright bear markets (a drop of 20% or greater from an index’s peak) for U.S. indices such as the S&P 500 and Nasdaq. Combine this with a sharp drop in bond prices as yields rose in response to key central banks’ about-face from historically stimulative monetary policies to historically restrictive ones, and even long-term investors’ patience has been tested.

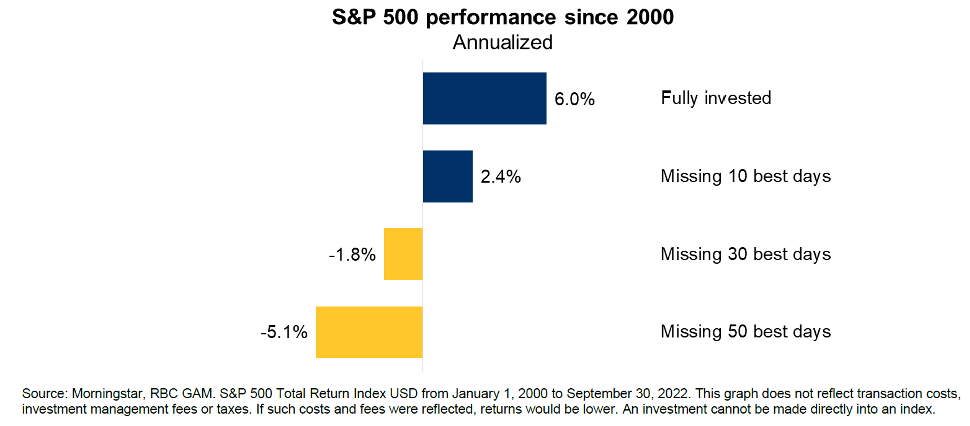

Unfortunately, market conditions like 2022’s often prompt investors to do the exact opposite from what investment wisdom suggests, abandoning their plans, selling their investments and holding cash. This is often referred to as “moving to the sidelines.” Over 2022, Canadian investors sold a massive $44 billion in mutual funds, the investment vehicle most often used by retail investors, versus 2021, when they bought $113 billion in funds.* But as history shows, moving to the sidelines and trying to time markets hurts long-term investment returns, while patience pays over time:

2023: Annus transitus

While the new year has carried-over many of the worries of the year before, expectations continue to rise that the months ahead will bring a gradual transition to moderating inflation and an end to monetary policy tightening by key central banks, including the Bank of Canada. While there are worries that a recession is in the offing, most economists are calling for a relatively short and mild economic downturn, if it happens at all. Therefore, the negative affect of a slowing economy on corporate profits, a key driver of equity market performance, will also be moderate.

The turn will come – just don’t try to guess when

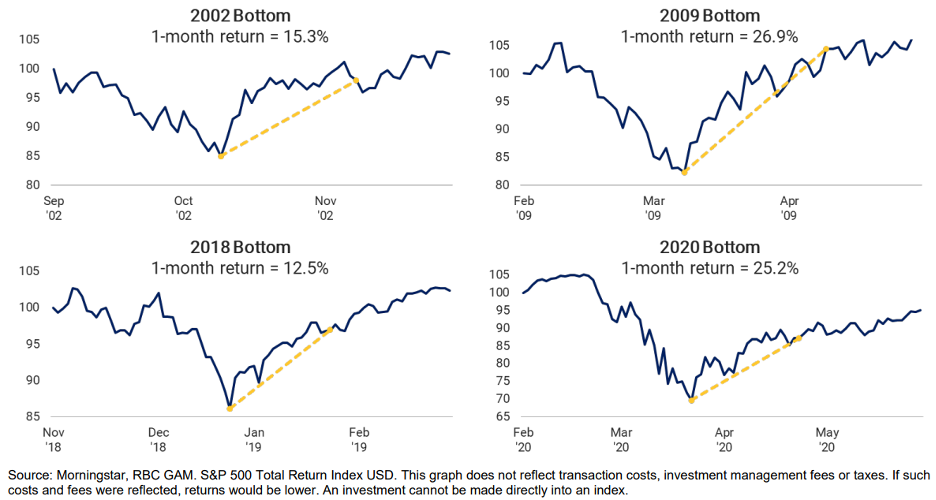

Whether the bounce back in stocks comes sooner or later, based on historical market performance, it’s important to note that much of that bounce happens quickly and often more forcefully than most investors anticipate. In fact, much of it comes in the first 30 days:

Getting back on track

Having and sticking to an investment plan that properly reflects your risk profile and goals is an important part of long-term investment success. If you find yourself on the sidelines, there is often no better time than the present to get back on track to your plan and into the market – and ready to enjoy the bounce that history shows patient, long-term investors so often benefit from.

*IFIC Monthly Investment Fund Statistics – December 2022. Investment Funds Institute of Canada (January 2023).

**Statistiques mensuelles de l’IFIC sur les fonds d’investissement – Décembre 2022. L’Institut des fonds d’investissement du Canada

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license.