The debate rages on

The question on everyone’s mind is whether the U.S. economy will enjoy a soft landing in 2024 or succumb to a recession—with each piece of data dissected and interpreted according to market participants’ biases. Such scrutiny stems from the U.S. Federal Reserve’s reliance on “data dependency,” which leaves markets at the mercy of each data release.

Take the recent data, for example. After U.S. nonfarm payrolls rose by 199,000 in November (consensus expectation: 185,000), most on the Street agreed that it suggests a very healthy labour market, and hence a strong economy with a soft landing in sight. Those concerned an economic contraction may be in the offing focused instead on average hourly earnings rising at an annual rate of four percent, a level inconsistent with the Fed’s two percent inflation target. In this line of thinking, such high wage growth indicates interest rates will have to be maintained at current levels for longer, which may eventually propel the economy into recession.

In the feature article from our Global Insight 2024 Outlook, RBC Dominion Securities Inc. Investment Strategist Jim Allworth points out the debate will not be settled definitively for a while. In fact, it is the Business Cycle Dating Committee at the National Bureau of Economic Research which determines the official start date of any recession that arrives. And that announcement usually comes about a year after a recession has begun.

A useful framework

With economic data volatile—offering contradicting clues at best or being of poor quality at worst—using a framework to assess the macroeconomic backdrop can be a useful tool.

We are in the camp of those expecting a mild recession in the U.S. next year. The combination of high interest rates and restrictive bank lending standards that is in place today has historically resulted in recessions. Soft landings, on the other hand, have featured rising interest rates but no overt tightening of lending standards.

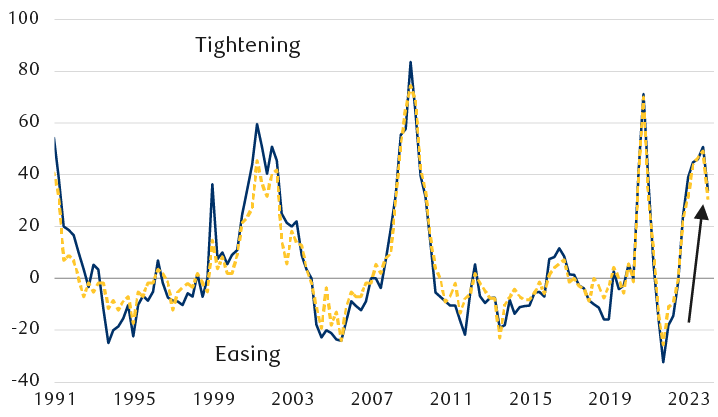

U.S. business lending standards have tightened

Net percent of banks tightening credit standards for commercial & industrial loans

Line chart showing the net percentage of banks which are tightening credit standards for commercial and industrial loans to large and small firms using data from the U.S. Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices. A positive percentage indicates business lending standards are tightening, while the converse holds true. Since Q3 2022, lending standards have markedly tightened, peaking in Q3 2023, with some 50 percent of the banks tightening standards. The percentage has fallen somewhat since, but more than 33 percent of the banks still have tightened credit standards.

Note: October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

Source - Federal Reserve Board, Macrobond, RBC Global Asset Management, RBC Wealth Management

RBC Global Asset Management Inc. Chief Economist Eric Lascelles concurs, estimating the probability of a recession at 70 percent over the next 12 months.

Still, that leaves the probability of a soft landing at 30 percent, not an insignificant level. For our part, we acknowledge that shifts in monetary and fiscal policy over recent years could mean merely lower growth, as opposed to a recession.

So, it’s worth looking at episodes of soft landings and observe how the S&P 500 reacted.

Soft influence

Since the mid-1950s, there have only been three soft landings, admittedly a small sample: in the 1960s, mid-1980s, and mid-1990s. In each of these episodes the S&P 500 performed very well, gaining on average more than 30 percent.

Paul Danis, head of asset allocation at RBC Brewin Dolphin, points out that specific or idiosyncratic circumstances contributed to each of these rallies. In the 1966 soft landing, the Fed loosened monetary policy very quickly, fuelling the rally. That resurgence proved short-lived, however, because the Fed was forced to resume its monetary policy tightening to rein in inflation which had flared up again, and the stock market duly corrected.

Heading into the 1984 episode, the real fed funds rate was over six percent. The steep decline, to one percent, was instrumental in driving robust equity returns.

The third soft landing occurred in the mid-1990s, a time of rapid globalization that both contained inflation and boosted profit margins. These factors fuelled the longest and strongest rally of all three.

Continuing to be constructive

To our mind, the recent rise in nonfarm payrolls suggests a lower chance of an imminent recession. This opens the road to new highs in equity markets, in our opinion. The S&P 500 has rallied 14 percent since the end of October as the Fed paused its rate hikes and the soft landing narrative gained traction. The rally suggests to us some discounting of the soft landing scenario, but we think stock markets may have more room to run.

It seems to us the U.S. economy is poised to start the new year on a strong enough footing to keep S&P 500 earnings growing, although probably not by as much as the current consensus estimate for 2024 ($245 per share, up 11.4 percent from 2023’s expected $220) would suggest. In our opinion, any growth in earnings would leave room for share prices to advance between now and the end of 2024, even if the path for getting there remains in debate.

We continue to recommend a Market Weight position in global equities as well as U.S. equities. Our stance takes into account the wide range of possible outcomes for the U.S. economy: soft landing, average growth, mild recession, or otherwise.

We believe, however, that investors should consider limiting individual stock selections to high-quality businesses, or those they would be content holding through the economic cycle. This means companies with solid business models, quality management teams, robust cash flow generation, and strong balance sheets.

In our view, portfolios that have held their value to a better-than-average degree will be best-equipped to take advantage of the opportunities that are bound to present themselves when a stronger pace of economic growth reasserts itself.