Connecting with you Virtually – We look forward to seeing your smile on our computer screens!

As our new normal emerges, we are enjoying the opportunity to connect with clients in virtual meetings. Even though we continue to work from home, for the time being, we are using Webex technology which allows us to connect with you virtually, where we can now see each other on our computer screens. It is wonderful to see some smiling faces and feel a bit more connected. Through this technology, we can share our screen with you as we walk you through a review of your portfolio and the market updates. Please click here for a step by step tutorial for you on how to connect to us during these virtual meetings. Pia is also pleased to personally walk you through the step by step set up. Conducting a test run with Pia is a wonderful way to ensure you have it set up correctly, with the bonus being the opportunity to see her smiling face.

Friendly Reminders

Financial Literacy – Knowledge is Power – If you were interested in participating in the Financial Literacy Course offered by McGill University & RBC, but did not get the chance, it has been relaunched today. I had all three kids complete the course, and even my mom did it! My mom was surprised by how much she learned and has since been recommending it to many of her friends and especially young adults. Click here for information and to register.

Tax-Free Savings Account (TFSA) Contributions for 2020 - If you have not yet made your 2020 TFSA contribution, this may be a great time to have it completed. Markets are still down from their highs, with several companies offering attractive long term potential. Please give us a call to discuss.

Registered Retirement Income Fund withdrawals for 2020 – Given the COVID19 pandemic, the government is allowing individuals with RRIFs to reduce their minimum payments in 2020 by 25%. If you do not need your RIF income to supplement your cash flow needs, this may provide an attractive opportunity to lower your 2020 tax bill.

Market update

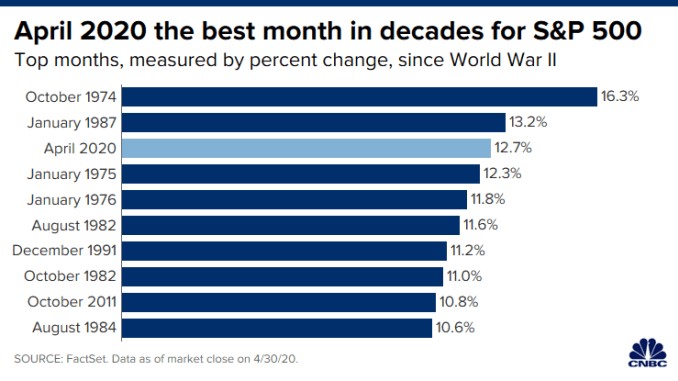

With April now in the rearview mirror, we also take a step back and look at how the markets recovered so sharply over the month. But, just as we did at the market lows in March, we remind investors not to let emotions get in the way after such a rebound. Instead, staying disciplined in the investment process, staying diversified in one’s holdings, and sticking with the investment plan is just as crucial in an upswing as it is during the depths of a crisis.

The month of April was one of the best on record for global equity markets, standing in contrast to March, which was one of the worst. The S&P 500 posted a gain of 12.7% for April. Equity markets are still down from their highs earlier this year, but the recent upswing has been nearly as staggering as the decline. How can this be? Unemployment has soared by millions, and activity has ground to a halt. Yet, investors appear willing to look beyond the dire economic headlines, believing that central banks and governments have provided sufficient stimulus to help bring the economy back to its feet once we are eventually past stay-at-home orders

Lessons learned and managing emotions

There are valuable lessons to be learned through this experience, some of which we have discussed in previous notes. First, markets are forward-looking, and reflect the anticipation of what is expected to come, not what is necessarily happening right now. And second, when investor sentiment reaches an extreme, both negative and positive, it may not take much to change the trend. More specifically, there’s a point at which bad news no longer drives market prices lower. Moreover, news that is only “less bad,” not necessarily “good,” can lead to affirmative price action as investors who have become accustomed to negativity have to shift their mindset.

Just as we did after the meaningful decline in March, we want to emphasize the need to keep your goals at the forefront of your investment strategy, and stay disciplined and remain focused on long-term outcomes. While there is still work to be done, we are hopeful that we are past the peak of this health care crisis and can now transition our attention to the economic and earnings recovery. We don’t expect it to be an easy path forward, but remain confident in the quality of the companies we own. We expect some ups and downs along the way as uncertainty likely persists in the near term, risks of additional outbreaks remain, and some measures of social distancing are still required. Furthermore, it remains difficult to forecast the behavioral changes that some may experience, holding us back from a complete return to normal.

We remain steadfast in our commitment to quality businesses, dividend yields and a disciplined approach as we manage your portfolio through this tumultuous time.

Should you have any questions, please feel free to reach out.

Rhonda Hymers

Produced by RBC Global Asset Management's Chief Economist Eric Lascelles

April 27- May 1, 2020

In this week’s #MacroMemo, we share recent good and bad COVID-19 developments, further thinking on exit strategies, and our updated economic growth forecasts. We also take a look at the oil market and more.

GLOBAL INSIGHT

APR 30, 2020

Global Insight Weekly - April 30

Global Insight Weekly - April 30

Speak loudly and carry a big stick – The Fed has fashioned its monetary policy response to the COVID-19 pandemic after foreign policy of old, with massive pledges of quantitative easing and liquidity facilities. And as is usually the goal, the simple promise to act may reduce the need to actually do so. (pg 1)

The 10-Minute Take podcasts provides insights from RBC economists and market experts on events unfolding around the globe. Topics this week include:

“Our job is to connect to people, to interact with them in a way that leaves them better than we found them, more able to get where they’d like to go.” ~ Seth Godin