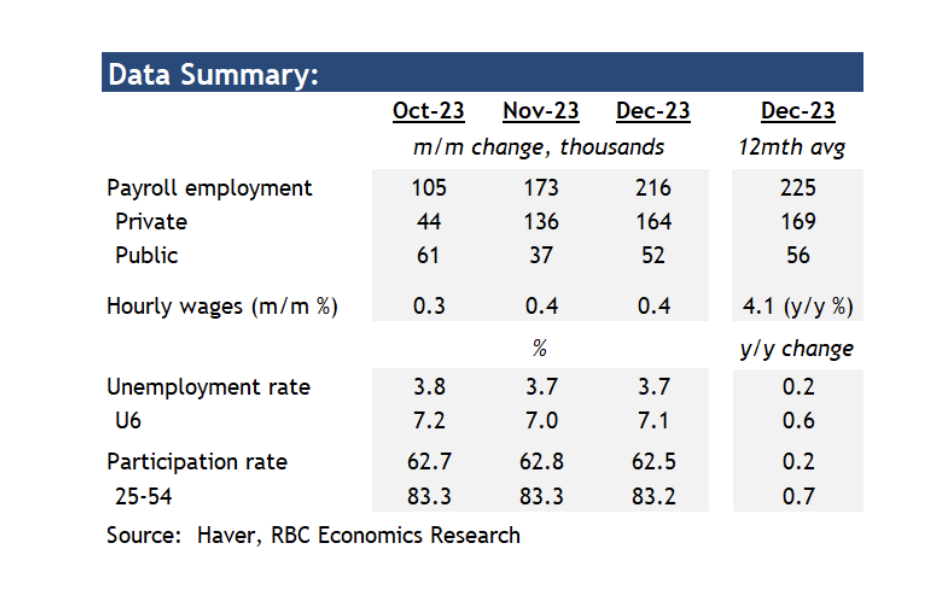

- US labour market data ended 2023 with strength. Payroll employment was up 216k in December while the unemployment rate held at 3.7% after declining to that level the prior month.

- As was the case for much of the year, the employment gain in December was led by increases in government jobs (+52k), leisure and hospitality (+40k) and health care (+38k). These three sectors combined also accounted for 65% of the overall payroll employment increase in 2023. Transportation and warehousing (-23k) in comparison shed jobs for the third month in a row, or the eighth month in the year. The sector lost 63k jobs in total in 2023.

- Participation rate in the U.S. dropped slightly lower in December to 62.5% but was little changed from where it was when the year started. On balance it was still about a percentage point below the level in early 2020 immediately before the pandemic.

- The unemployment rate at 3.7% in December was up from 3.4% in January 2023, suggesting some unwinding in tight conditions throughout the year. Much of the increase among the unemployed workers has come from those that are less educated - the unemployment rate among those above 25 but without a high school diploma was up by an especially large 1.5% from January to December.

- Wage growth after having picked up slightly in November did it again in December, rising by another 0.4% month-over-month. At 4.1% year over year in December the pace of growth itself was still elevated, and not significantly lower comparing to 4.4% at the beginning of the year.

- Hours worked among private sectors were down slightly in December but up by an annualized 0.8% in Q4, in line with our tracking for a deceleration in GDP growth to around 1% in the same quarter.

- Bottom line: Despite a solid December employment report the year has ended with a softer labour market backdrop on balance than it started with. The unemployment rate is still low but has ticked higher. The deceleration in wage gains earlier in the year had lost some momentum over the last two months, but that alone is unlikely to be a huge cause of concern as long as inflation readings in the U.S. continue to ease persistently (headline CPI was at 3.1% in November), and output growth to slow. We expect the Fed to continue to observe payroll and inflation data closely, but ultimately expect a softer economic growth backdrop and slowing price pressures to result in rate cuts starting later in the second quarter of this year.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.