Investor concerns surrounding the coronavirus, and to a lesser extent American politics, have lead to recent bouts of volatility in financial markets, most notably across stock markets in recent days. The swift gains that investors enjoyed in early 2020 have been erased, owing to uncertainty and the aversion to risk that comes with it.

The common denominator in all market pull-backs is such uncertainty. The lasting economic impact of coronavirus, and the US political situation (election) remain vague, but will eventually pass from headlines. In the absence of a decline in infection rates, coronavirus and its ability to hamper economic growth, is undoubtedly cause for some concern. However, in periods of heightened fear, warranted or not, it is quite common to see investors "sell first and ask questions later".

As a client, you'll note that in past periods of volatility, the team at Randall-Roberts Wealth Management often preaches patience, while encouraging long-term thinking. We know that panic selling in periods of heightened fear is simply not a winning investment strategy.

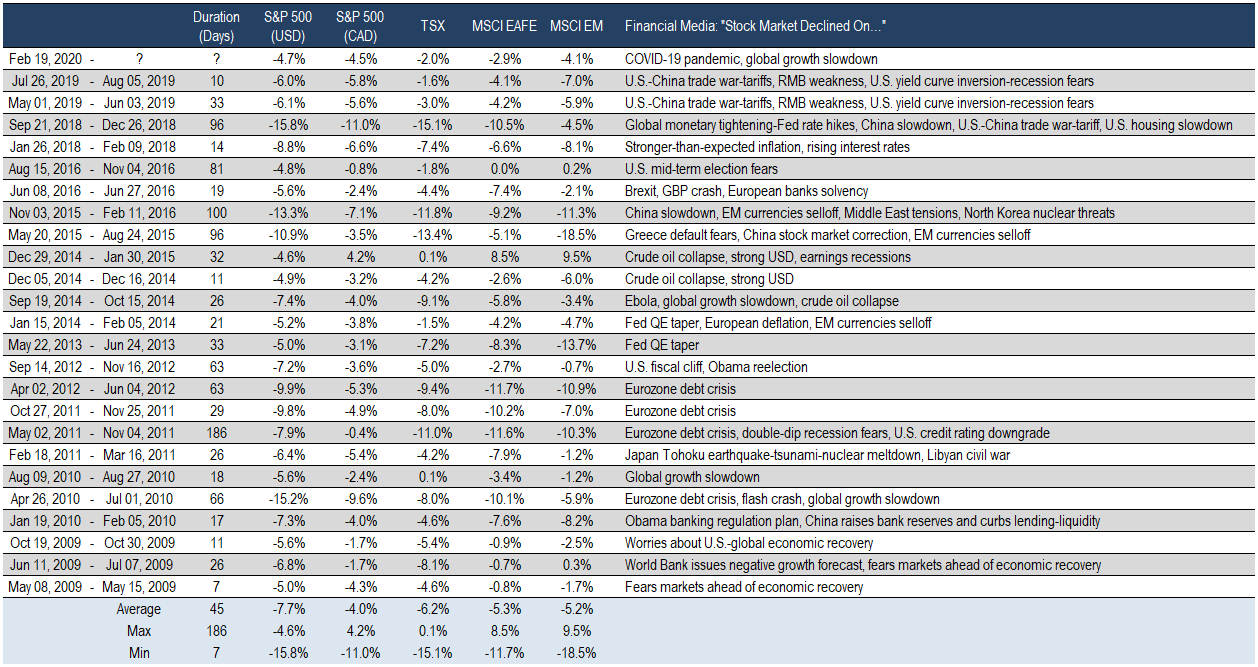

Further, history teaches us that market corrections can be quite common, and that in hindsight, they are often looked back upon as attractive rebalancing opportunities for long-term investors. The below history of S&P 500 corrections tells this story. It is not uncommon for markets to face some form of negative headwind each year. Yet even in the face of these types of events, markets tend to move higher over time.

More volatility cannot be ruled out. However, if the U.S. economy avoids a recession in 2020, by year end, our firm's view is that most stock markets could advance meaningfully from here. We have seen valuations normalize from prior elevated levels. It is now widely expected that central banks will intervene with interest rate cuts and/or fiscal stimulus to buffer potential economic risks. As of writing, the bond market is now pricing-in multiple interest rate cuts by the US Federal Reserve for 2020. The Canadian bond market is placing certain odds of interest rate cuts, on the part of the Bank of Canada, at upcoming meetings. RBC Economics anticipates that a 0.25% rate cut will occur at next week's Bank of Canada meeting (March 4th).

In terms of the containment of coronavirus, interestingly, the rate of infection growth in mainland China appears to be slowing, despite new cases being confirmed in several countries. From a research perspective, our firm is of the view that infections are likely to be better contained throughout North America, owing to greater awareness and vigilance, improved healthcare infrastructure and screening, and reduced levels of international travel to China compared to other regions.

The solutions to investing comfortably during difficult times are to invest prudently, maintain a focus on quality holdings/companies, diversify portfolios for multiple outcomes, and to keep emotions in-check, taking the long-term view. While not complex, these are key tenets to investment success, and we preach them to clients and implement them in our practice. It can be helpful to remind ourselves of them during uncertain times.

If you are concerned, please do not hesitate to contact our team. As the situation evolves, and new details emerge, we will be sure to communicate the facts with you. For additional insight, we're providing two timely research notes, also on the subject of coronavirus, which can be viewed by clicking the links below.

Global Insight Weekly - Special Report on Coronavirus

Equity Market Brief - Coronavirus Comments

Thank you,

Trevor, Mark, Tyler, Rob, Julie, Genesis