Since their introduction in 1957, Registered Retirement Savings Plans (RRSPs) have been the number one choice of Canadians to help grow their retirement savings. In fact, just under 70% of Canadian adults have an RRSP account.* And it’s not hard to see why, as these accounts provide important tax benefits, as well as long-term sheltering of investment gains that leverage the power of tax-free compounding over time.

But the RRSP is no longer alone in providing important tax-sheltering investment opportunities. First made available in 2009, the Tax Free Savings Account, or TFSA, has really caught on with Canadians: as of 2020, we had stashed over $300 billion into over 20 million of these accounts.** And, while the contribution limits may have seemed small at the beginning, the lifetime limit is now a cumulative $88,000.

RRSP or TFSA? How about both!

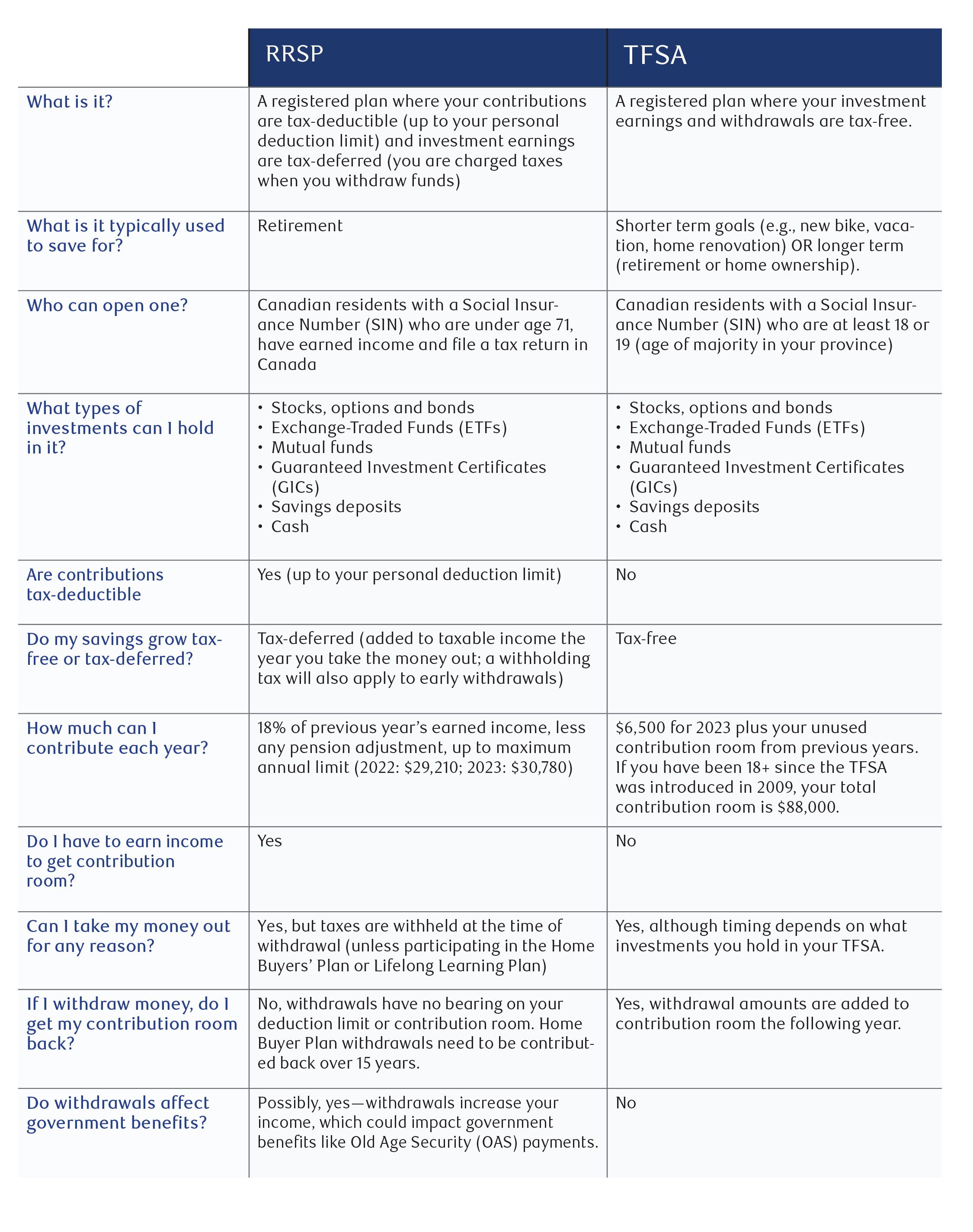

Having two great tax-sheltered choices to save can raise the question of which one is better. Fortunately, it’s not really about which is better to help saver’s achieve their unique needs, but that they provide similar but different benefits:

Source: RBC Royal Bank (as of January, 2023)

Double-up on your savings options

If you want to expand your tax-sheltered savings options to save money and help grow your investments over time, consider the complementary benefits of investing in a TFSA with the refund you receive from your RRSP contribution to get you started. More often than not, two are better than one, especially when it comes to smart solutions to help you reach your goals – talk to us to get started.

*The Daily - Registered retirement savings plan contributions, 2020. Statistics Canada (April 2022).

**Tax-Free Savings Account Statistics 2021 Edition. Government of Canada (January 2021).

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license.