Long seen as the ultimate store of value, gold is a valued commodity with unique characteristics that make one of the most coveted assets the world over. The commodity’s sharp rise in 2024 (it recently hit an all-time high of over US$2,400 an ounce) has refocused attention upon it, prompting many investors to wonder whether it has a place in their portfolio.

Golden ages

Gold has been around for ages: pieces have been discovered in Spanish caves that date as far back as 40,000 B.C. Ancient Egyptians smelted it as far back as 3,600 B.C. Today, gold is prevalent around the world as a precious metal, rare enough to command real dollars to own, but ubiquitous enough to be enjoyed and valued by millions of people. It has at various times been used as a currency, for example, by the Roman Empire. Currencies like the U.S. dollar and the British pound were once linked to the value of gold, underpinning their value.*

“Gold is money – everything else is credit.” ~ J.P. Morgan

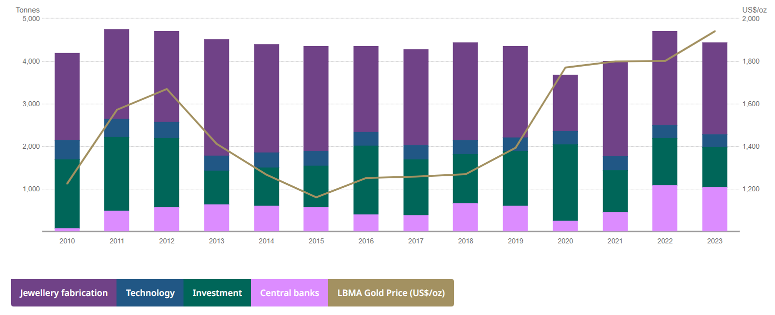

About half of the world’s annual gold production (3,644 tons in 2023) is used for jewelry, while the rest is divided up for use in technology, investment, and as reserves by central banks.*

Source: World Gold Council. December 31, 2023. Spot gold price as of December 31, 2023, was $1940.50 (US$/Oz). LBMA: London Bullion Market Association.

Gold as a tradable commodity can be purchased or sold through futures contracts or Exchange Traded Funds (ETFs) that trade on standard investment markets. Alternatively, investors can purchase the stocks of a variety of gold companies, each of which has its own unique financial and investment characteristics.

Gold standard

From an investment standpoint, gold can be a suitable investment in a properly diversified portfolio, whether as a straight commodity (gold bars) or through the ownership of gold-producing company shares directly or indirectly (e.g., ETFs or mutual funds). Gold producers fall under the Materials sector of the S&P/TSX Composite Index, which is the fourth largest sector at 11% of the total index. Gold-producers represent a significant portion of the sector, and includes Barrick Gold, the world’s second largest gold producer behind global leader and U.S.-based Newmont Corporation.**

Gold can also serve investors in specific ways, including as a:

- Portfolio diversifier: Gold has a low correlation to other commodities, and is negatively correlated to the U.S. dollar, adding diversification benefits to a portfolio.

- Inflation hedge: Gold’s scarcity and perception as a “store of value” has long made it a hedge against inflation, maintaining its value while rising prices devalue the purchasing value of money and other assets.

- Safe haven: In times of uncertainty, upheaval and volatility, gold is seen as a safe place to wait out trouble given its low volatility and perception as a store of value. Historically, gold doesn’t often decrease or increase with the same momentum as the market as a whole – but when volatility hits, this makes the shiny metal especially attractive, providing a “buffer” against falling asset values.

Wondering if gold is right for your portfolio? Please contact us to learn more.

*World Gold Council.

**S&P Dow Jones Indices LLC. All figures as of March 28, 2024.

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license.