My Thoughts

The stock market doesn’t makes sense…I’m going to wait for another pullback…..the stock market is too expensive…its different this time…

I’ve heard it all, and I’ve seen investors get it wrong for well over 20 years. The stock market never does make sense, if it did we would all be rich and investing would be easy; pullbacks never come when you want them to but are completely unexpected (who foretold COVID-19?); there are always “expensive” and always “cheap” stocks, the market is a collection of companies but is not a company in itself; and it’s always different, of course it is, the world evolves and so does the market.

Yet still investors remain their own worst enemies.

Stastica 2020

Wall Street and Main Street are very different animals, and it can be difficult to separate them. Fortunately capitalism always seems to prevail, with the U.S. the best proponents of this. I don’t necessarily agree with the world I work in, but I know how to play within the “biased” rules. The market is always forward looking by 6-12 months, yet in any crisis it will temporarily reprice things to reflect the world at that instant, and investors will panic. We may be experiencing economic contraction at present, but the market has long since priced this in and is now looking far past it. The U.S. economy will eventually surpass previous levels, and stocks will look cheap, even at today’s prices.

Comparing the Stock market to the housing market is a good way of looking at things. If the Vancouver housing market went down by 35% you would likely not be looking at selling your real estate, but would more likely be looking to add to it. Unfortunately when the stock market goes down everyone seems to want to do the opposite and they end up losing out.

Investors, and the mainstream media are generally terrible investors to listen to. The media reports nothing but headline seeking “sensationalist” news, which both for wall street and main street, is generally doom and gloom based. When did you last see news of a good dead making headline news? Even Warren Buffet, who owned 10% of the 4 major U.S. airlines and sold them at the very bottom of the market, at prices 50% below where they are trading today, got things very wrong. Mark Cuban likewise, said he was raising cash in the middle of March – both terrible calls.

Throughout the months of April and May, despite not knowing exactly where the bottom was, we gradually added to positions in industry leading companies, with dominant market share such as Home Depot, Starbucks, Microsoft, Amazon, Visa and Netflix, which were extremely unlikely to be going out of business, and at some point would report earnings that were far better than the significantly downwardly revised earnings that analysts were expecting. At the core of it when investing in a company you are buying individual businesses with great leadership and dominant market share, which are likely to generate significant and growing earnings over the years to come, not the stock market as a whole,

Once repricing has occurred (which is always severe) it very quickly looks forward again. Stocks like McDonalds were driving 70% of their revenue from drive through business prior to COVID – so despite the temporary economic shutdown, once restrictions were somewhat lifted, it was one of the first places that consumer returned to. The same for Starbucks. These companies, like it or not, will likely emerge from COVID stronger than before as much of their competition (both public and private companies) will have gone out of business.

COVID for the large part (excepting some retail, travel and hospitality) was catastrophic for the small business, but only a temporary glitch for billion dollar multi-national companies, and a positive boom for many others.

It is always tough to buy at the bottom, but corrections offer the best opportunities long term. Whether or not we see a pullback in the Fall I don’t know, but sentiment is still pretty negative, and we do have the U.S. election to contend with, so I wouldn’t be surprised to see things continue to move higher, especially if / when we get news of a vaccine.

My focus remains on being well diversified across industry sectors that show the best strength both near and long term, with an emphasis on multi-national, World leading, billion dollar U.S. based businesses

Canada - cannot do without type companies

Banks

Utilities

Telecom

Food companies

U.S. - more growth orientated companies for the “new” world

Consumer

Technology

Communications

Health Care

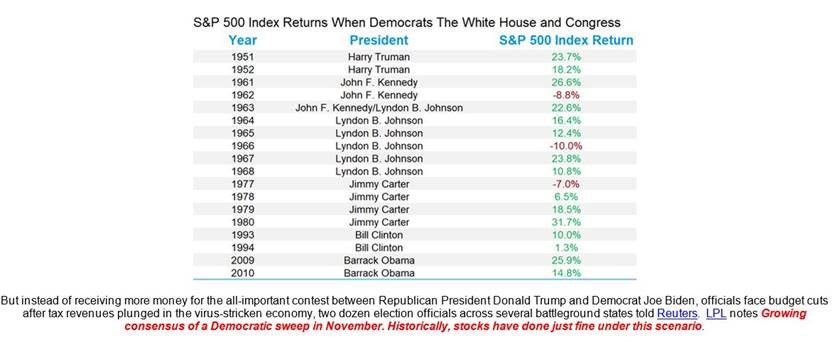

And just in case you were wondering what a democratic President may do for the markets, the below chart shows pretty much business as usual.

Stay safe, stay healthy, and stay sane.

Sincerely,

Vice-President and Portfolio Manager

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.